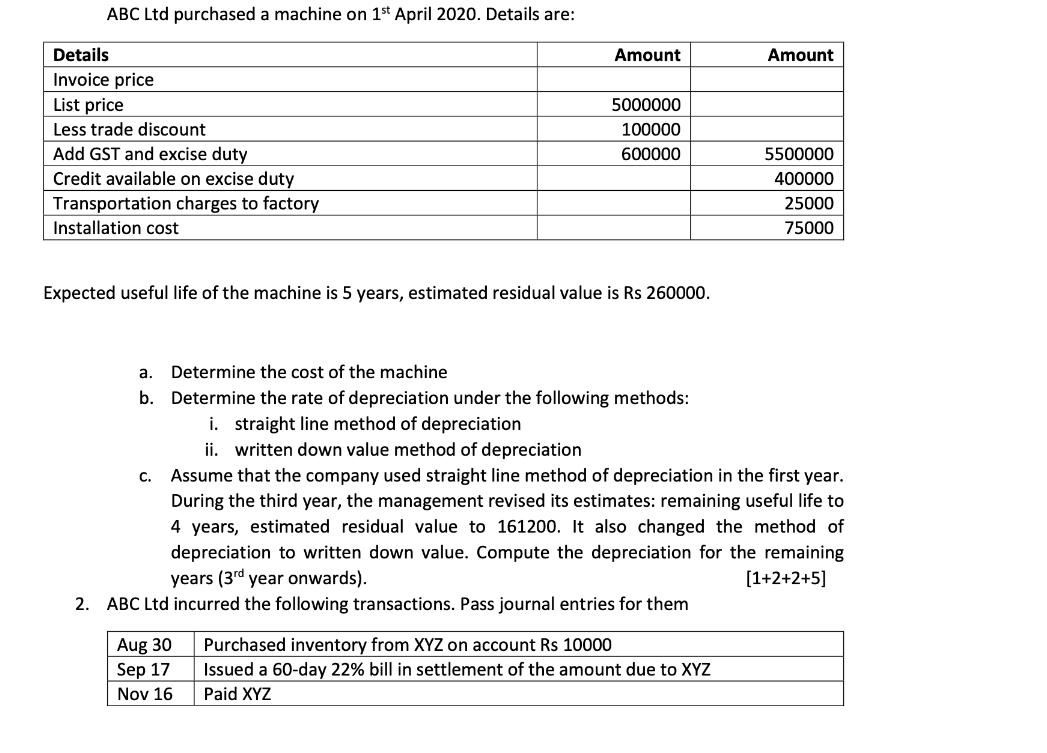

ABC Ltd purchased a machine on 1st April 2020. Details are: Details Amount Amount Invoice price List price 5000000 Less trade discount 100000 Add

ABC Ltd purchased a machine on 1st April 2020. Details are: Details Amount Amount Invoice price List price 5000000 Less trade discount 100000 Add GST and excise duty 600000 5500000 Credit available on excise duty 400000 Transportation charges to factory 25000 Installation cost 75000 Expected useful life of the machine is 5 years, estimated residual value is Rs 260000. a. Determine the cost of the machine b. Determine the rate of depreciation under the following methods: i. straight line method of depreciation ii. written down value method of depreciation Assume that the company used straight line method of depreciation in the first year. During the third year, the management revised its estimates: remaining useful life to . 4 years, estimated residual value to 161200. It also changed the method of depreciation to written down value. Compute the depreciation for the remaining years (3rd year onwards). [1+2+2+5] 2. ABC Ltd incurred the following transactions. Pass journal entries for them Aug 30 Sep 17 Purchased inventory from XYZ on account Rs 10000 Issued a 60-day 22% bill in settlement of the amount due to XYZ Nov 16 Paid XYZ

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

2 Part a Calculatlon of Cost of Machlne Particulars Amount Invoice Price ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started