Answered step by step

Verified Expert Solution

Question

1 Approved Answer

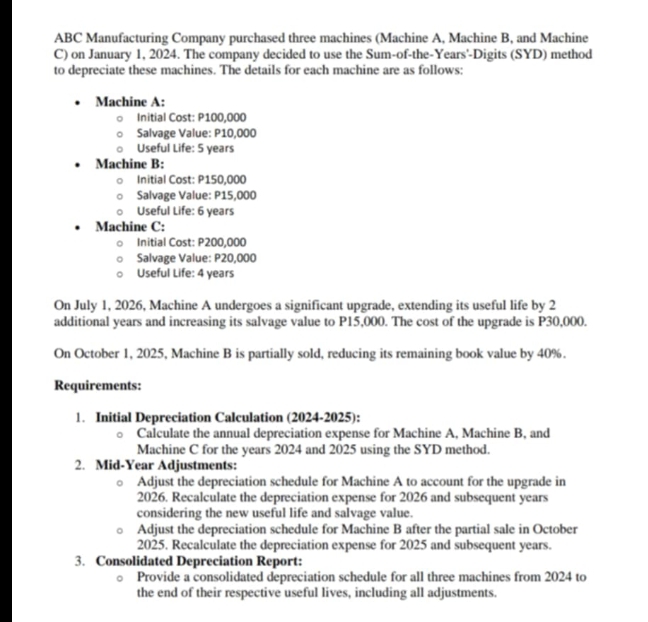

ABC Manufacturing Company purchased three machines ( Machine A , Machine B , and Machine C ) on January 1 , 2 0 2 4

ABC Manufacturing Company purchased three machines Machine A Machine B and Machine C on January The company decided to use the SumoftheYears'Digits SYD method to depreciate these machines. The details for each machine are as follows:

Machine A:

Initial Cost:

Salvage Value:

Useful Life: years

Machine B:

Initial Cost:

Salvage Value: P

Useful Life: years

Machine C:

Initial Cost:

Salvage Value: P

Useful Life: years

On July Machine A undergoes a significant upgrade, extending its useful life by additional years and increasing its salvage value to P The cost of the upgrade is P

On October Machine B is partially sold, reducing its remaining book value by

Requirements:

Initial Depreciation Calculation :

Calculate the annual depreciation expense for Machine A Machine B and Machine C for the years and using the SYD method.

MidYear Adjustments:

Adjust the depreciation schedule for Machine A to account for the upgrade in Recalculate the depreciation expense for and subsequent years considering the new useful life and salvage value.

Adjust the depreciation schedule for Machine B after the partial sale in October Recalculate the depreciation expense for and subsequent years.

Consolidated Depreciation Report:

Provide a consolidated depreciation schedule for all three machines from to the end of their respective useful lives, including all adjustments. solve the problem please complete solution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started