Answered step by step

Verified Expert Solution

Question

1 Approved Answer

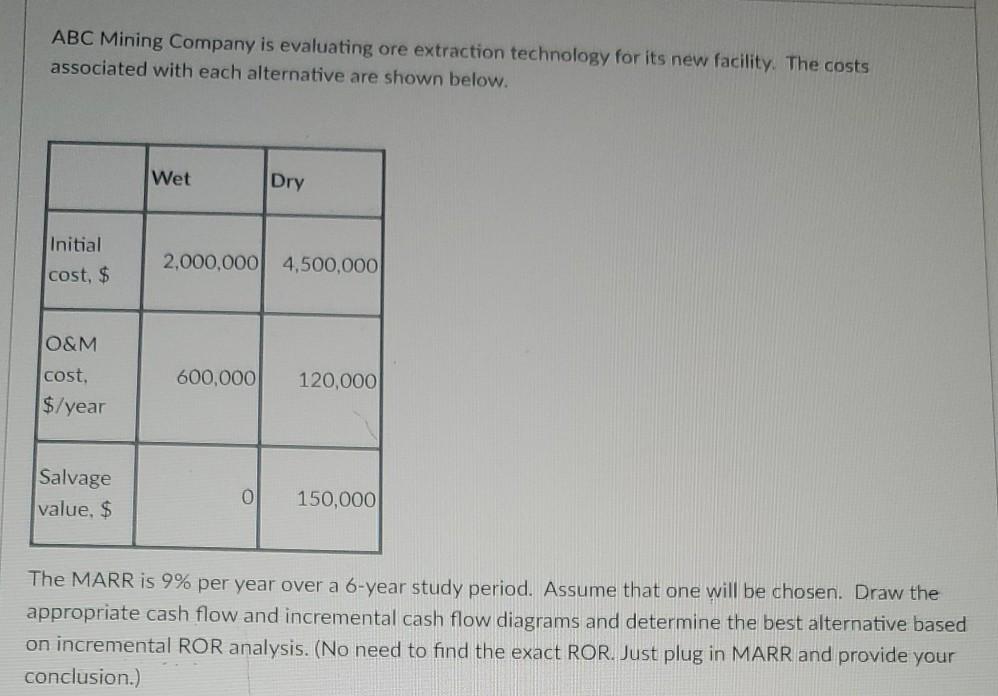

ABC Mining Company is evaluating ore extraction technology for its new facility. The costs associated with each alternative are shown below. Wet Dry Initial cost,

ABC Mining Company is evaluating ore extraction technology for its new facility. The costs associated with each alternative are shown below. Wet Dry Initial cost, $ 2,000,000 4,500,000 O&M cost, 600,000 120,000 $/year Salvage value, $ 0 150,000 The MARR is 9% per year over a 6-year study period. Assume that one will be chosen. Draw the appropriate cash flow and incremental cash flow diagrams and determine the best alternative based on incremental ROR analysis. (No need to find the exact ROR. Just plug in MARR and provide your conclusion.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started