Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a,b,c On January 20, Metropolitan Inc. sold 9 million shares of stock in an SEO. The market price of Metropolitan at the time was $41.25

a,b,c

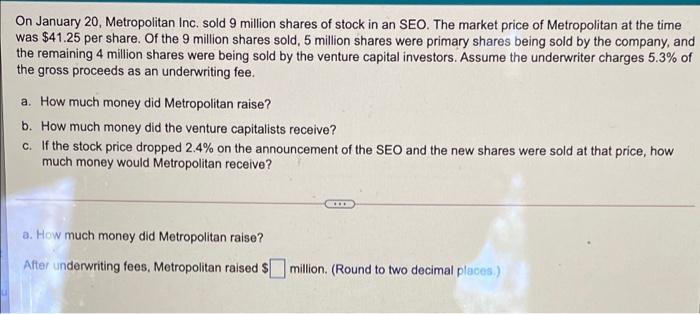

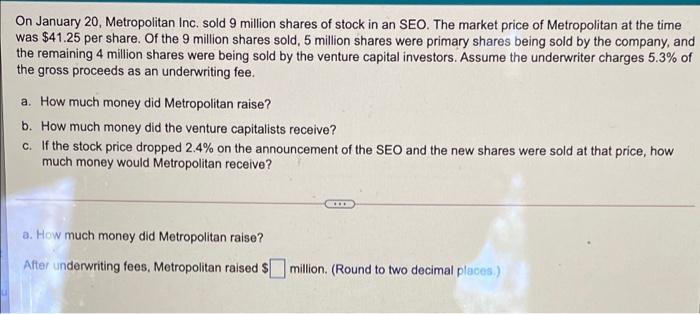

On January 20, Metropolitan Inc. sold 9 million shares of stock in an SEO. The market price of Metropolitan at the time was $41.25 per share. Of the 9 million shares sold, 5 million shares were primary shares being sold by the company, and the remaining 4 million shares were being sold by the venture capital investors. Assume the underwriter charges 5.3% of the gross proceeds as an underwriting fee. a. How much money did Metropolitan raise? b. How much money did the venture capitalists receive? c. If the stock price dropped 2.4% on the announcement of the SEO and the new shares were sold at that price, how much money would Metropolitan receive? a. How much money did Metropolitan raise? After underwriting tees, Metropolitan raised $ million. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started