Answered step by step

Verified Expert Solution

Question

1 Approved Answer

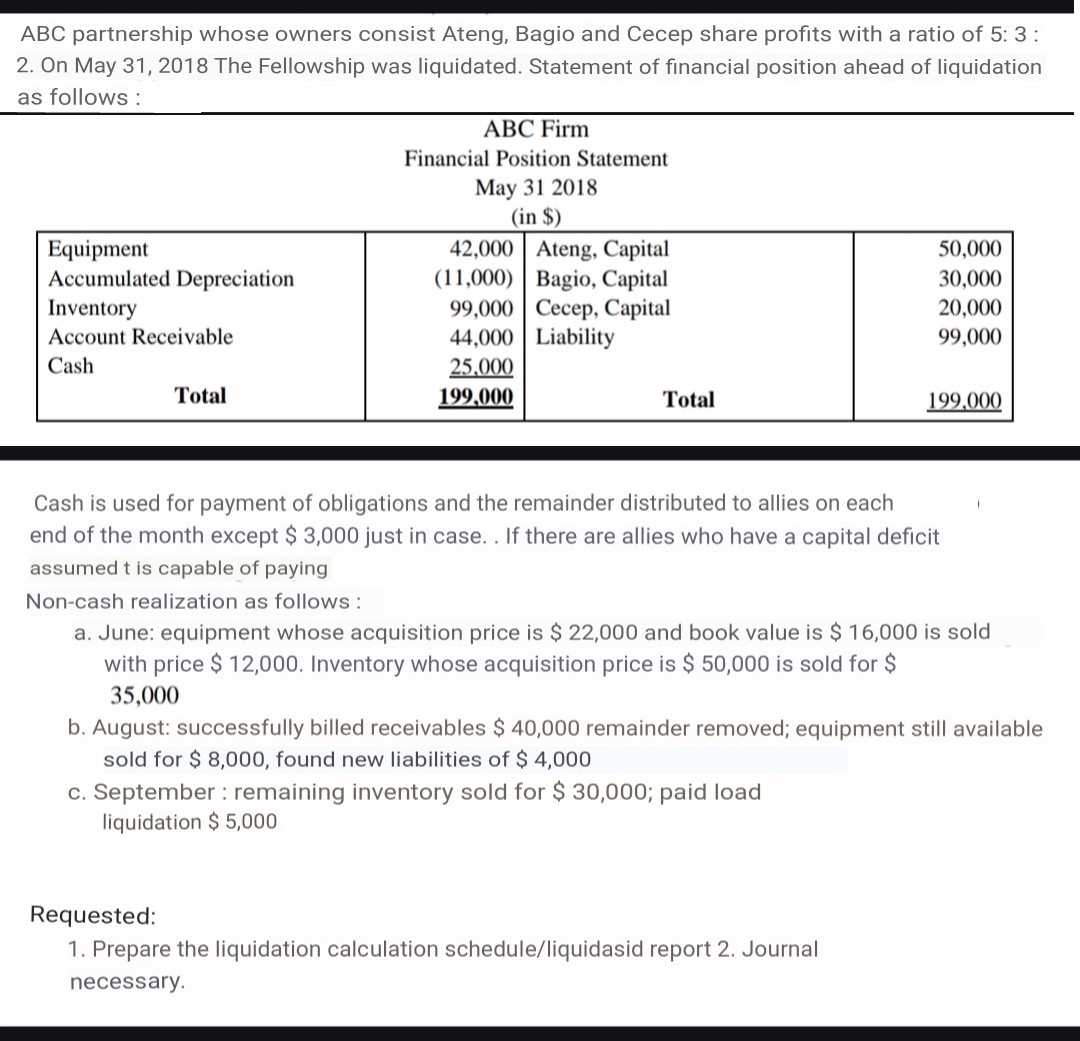

ABC partnership whose owners consist Ateng, Bagio and Cecep share profits with a ratio of 5: 3: 2. On May 31, 2018 The Fellowship

ABC partnership whose owners consist Ateng, Bagio and Cecep share profits with a ratio of 5: 3: 2. On May 31, 2018 The Fellowship was liquidated. Statement of financial position ahead of liquidation as follows: Equipment Accumulated Depreciation Inventory Account Receivable Cash Total ABC Firm Financial Position Statement May 31 2018 (in $) 42,000 Ateng, Capital (11,000) Bagio, Capital 99,000 Cecep, Capital 44,000 Liability 25,000 199,000 Total 50,000 30,000 20,000 99,000 Cash is used for payment of obligations and the remainder distributed to allies on each end of the month except $3,000 just in case. . If there are allies who have a capital deficit assumed t is capable of paying Non-cash realization as follows: a. June: equipment whose acquisition price is $ 22,000 and book value is $ 16,000 is sold with price $ 12,000. Inventory whose acquisition price is $ 50,000 is sold for $ 35,000 c. September: remaining inventory sold for $ 30,000; paid load liquidation $5,000 199,000 b. August: successfully billed receivables $ 40,000 remainder removed; equipment still available sold for $8,000, found new liabilities of $ 4,000 Requested: 1. Prepare the liquidation calculation schedule/liquidasid report 2. Journal necessary.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The image provided displays a scenario involving the liquidation of a partnership called ABC Firm The partnership consists of three partners Ateng Bag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started