Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC PEST CONTROL ABC Pest Control is in the business of providing services for all aspects of pest management in residential, commercial, industrial and institutional

ABC PEST CONTROL

ABC Pest Control is in the business of providing services for all aspects of pest management in residential, commercial, industrial and institutional settings.

ABC Pest Control provides general pest management, termite control, rodent control and real estate inspections. ABC Pest Control owns and utilizes service vehicles.

On June YR one of ABC Pest Control's service vehicles was involved in an automobile accident. The service vehicle was out of service from the date of the accident through the date that it was placed back in service, July YR

During the downtime the service vehicle was being repaired. The two other vehicles remained in service and the business continued to operate at a lesser capacity. There is an office staff and three driversservicemen

The loss period is from YR to YR Month; calculate the lost income and the continuing expenses during the downtime. Please note the following assumptions and guidance:

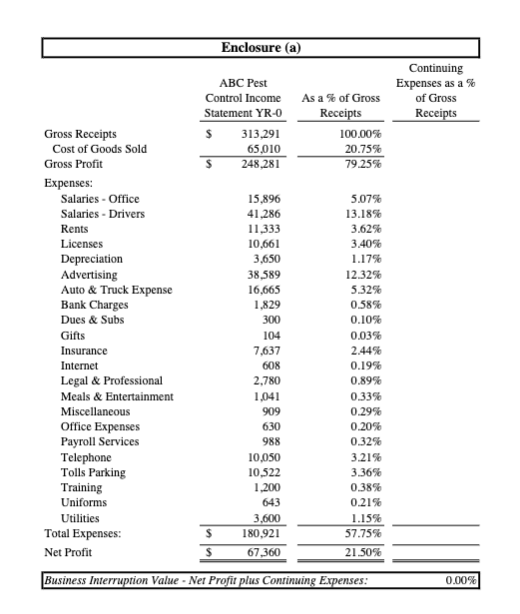

Calculate the Business Interruption value Enclosure a Note that

those expenses that are "fixed" continue. Those expenses that are

"variable" must be examined. Use your judgment for each expense

line item deeming it either "fixed" or "variable"; for variable

expenses you can either disallow completely or prorate the

expense. Provide justification for all expenses continueddiscontinued See additional assumptions on Enclosure

dCalculate the gross receipts lost during the period of interruption to

the business utilizing the information provided on enclosure b

Remember, projected income during the period of interruption has

to be reduced by actual income earned; provide justification for all the assumptions and calculations. Calculate the loss due to the business interruption based on the formula provided on enclosure cABC PEST CONTROL

Facts:

Business

Interruption:

Enclosures:

Enclosures:

Assignment: The loss period is from YR to YR Month; calculate the lost

income and the continuing expenses during the downtime. Please note the

following assumptions and guidance:

Calculate the Business Interruption value Enclosure a Note that

those expenses that are "fixed" continue. Those expenses that are

"variable" must be examined. Use your judgment for each expense

line item deeming it either "fixed" or "variable"; for variable

expenses you can either disallow completely or prorate the

expense. Provide justification for all expenses

continueddiscontinued See additional assumptions on Enclosure

d

Calculate the gross receipts lost during the period of interruption to

the business utilizing the information provided on enclosure b

Remember, projected income during the period of interruption has

to be reduced by actual income earned; provide justification for all

assumptions and calculations.

Calculate the loss due to the business interruption based on the

formula provided on enclosure c

Note:

Examples for calculating projected sales:

Enclosure b

Period Gross Receipts

YR to YR$

YR to YR$

YR to YR$

YR to YR$

YR to YR$

YR to YR

One method of projecting sales for a short term loss period may be

based on historical income trends year over year growth rates should be

considered as well as period averages

Compare sales from YR to YR to sales from

YR to YR Apply the growth rate to sales from

YR to YR to see the expected level of sales during the

downtime.

Calculate the average sales during the period immediately preceding

the downtime YR to YR and rely on that monthly

average as the expected level of sales during the downtime.

Rely on the sales that were experienced during the same period as

Lost Gross Receipts $ Enclosure b

Multiplied by Business Interruption Value Enclosure a

Loss Due to Business Interruption $

ABC PEST CONTROL

SUMMARY LOSS

Enclosure c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started