Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Pharmacy began the year with 300 units of Product A in inventory with a unit cost of $40. The ollowing additional purchases of

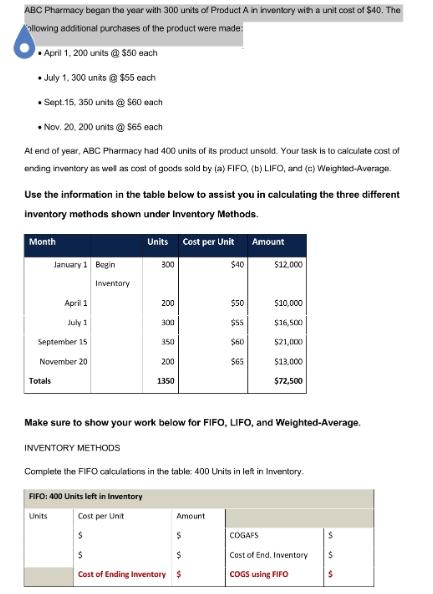

ABC Pharmacy began the year with 300 units of Product A in inventory with a unit cost of $40. The ollowing additional purchases of the product were made: April 1, 200 units @ $50 each July 1, 300 units @ $55 each .Sept.15, 350 units @ $60 each .Nov. 20, 200 units @ $65 each At end of year, ABC Pharmacy had 400 units of its product unsold. Your task is to calculate cost of ending inventory as well as cost of goods sold by (a) FIFO, (b) LIFO, and (c) Weighted-Average. Use the information in the table below to assist you in calculating the three different inventory methods shown under Inventory Methods. Month January 1 Begin April 1 July 1 September 15 November 20 Totals Inventory Units 300 200 300 350 200 1350 Cost per Unit Amount $40 $ $ $ Cost of Ending Inventory $ $50 $55 $60 $65 Amount $12,000 $10,000 $16,500 Make sure to show your work below for FIFO, LIFO, and Weighted-Average. INVENTORY METHODS Complete the FIFO calculations in the table: 400 Units in left in Inventory. FIFO: 400 Units left in Inventory Units Cost per Unit $21,000 $13,000 $72,500 COGAFS Cost of End. Inventory COGS using FIFO $ $

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

January 1 Beginning inventory 300 units at 40 each COGS 300 units at 40 each Remaining units 0 units ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started