Question

ABC Property intends to bid at an auction, to be held today, for a mansion property that has fallen into disrepair. The auctioneer believes that

ABC Property intends to bid at an auction, to be held today, for a mansion property that has fallen into disrepair. The auctioneer believes that the property can be sold for about $900,000. ABC wishes to renovate the property and divide it into flats (9 flats) to be sold for $300,000 each. The renovation will be in two stages and will cover a two-year period.

Stage 1: this stage will cover the first year of the project which will cost $1,000,000 where six flats will be completed and sold for a total of $1,800,000 at the end of the first year.

Stage 2: this stage will cover the second year of the project and will cost $600,000. The remaining three flats are expected to be sold for $900,000 at the end of the second year.

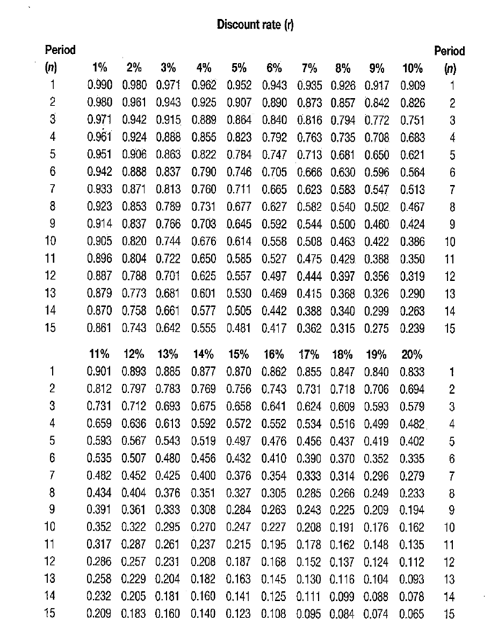

The cost of renovation is subject to a binding agreement with local builders if the mansion property is acquired. The business estimates its cost of capital at 12 percent a year.

Required:

(a) Calculate the net present value (NPV) of the proposed project.

(b) Carry out separate sensitivity analysis to indicate by how much the following factors would have to change to produce an NPV of zero.

(i) Auction price for the mansion property

(ii) Cost of capital (Use part (a) answer and try 20%)

(iii) Sales price of each of the flats (Each flat will be sold for the same price).

(c) Comment on the sensitivity analysis you carried out in part (b) above.

Discount rate (r) Discount rate (r)

Discount rate (r) Discount rate (r) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started