Answered step by step

Verified Expert Solution

Question

1 Approved Answer

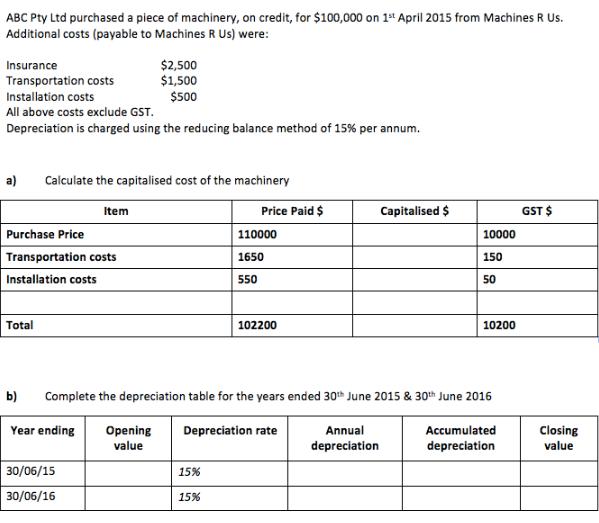

ABC Pty Ltd purchased a piece of machinery, on credit, for $100,000 on 1st April 2015 from Machines R Us. Additional costs (payable to

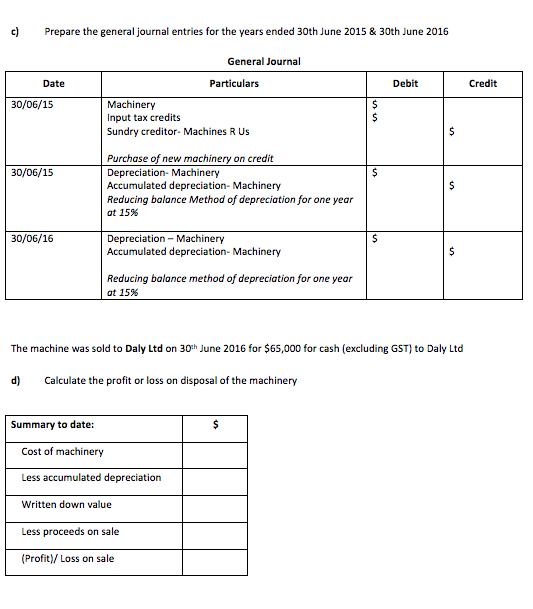

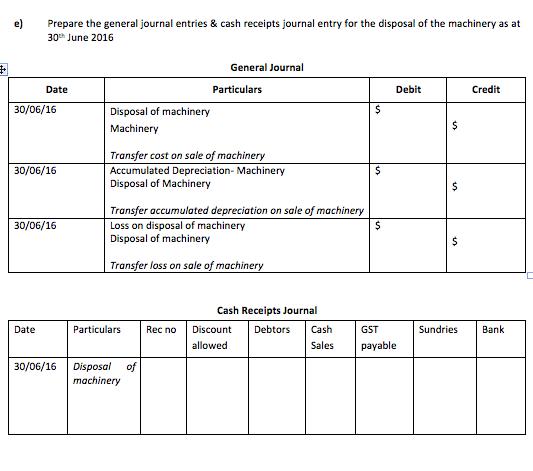

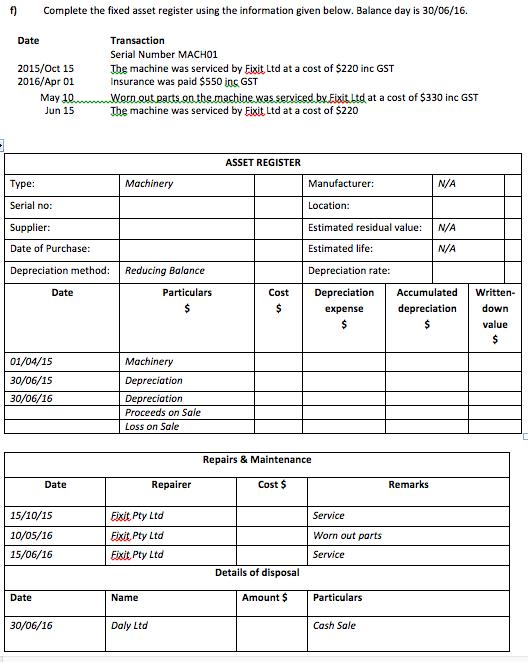

ABC Pty Ltd purchased a piece of machinery, on credit, for $100,000 on 1st April 2015 from Machines R Us. Additional costs (payable to Machines R Us) were: Insurance Transportation costs Installation costs All above costs exclude GST. Depreciation is charged using the reducing balance method of 15% per annum. a) Calculate the capitalised cost of the machinery Purchase Price Transportation costs Installation costs Total Item $2,500 $1,500 $500 30/06/15 30/06/16 Opening value Price Paid $ 15% 110000 1650 550 15% 102200 b) Complete the depreciation table for the years ended 30th June 2015 & 30th June 2016 Year ending Depreciation rate Capitalised $ Annual depreciation 10000 150 50 10200 Accumulated depreciation GST $ Closing value c) Prepare the general journal entries for the years ended 30th June 2015 & 30th June 2016 General Journal Date 30/06/15 30/06/15 30/06/16 d) Summary to date: Machinery Input tax credits Sundry creditor- Machines R Us Particulars Purchase of new machinery on credit Depreciation Machinery Accumulated depreciation- Machinery Reducing balance Method of depreciation for one year at 15% Depreciation - Machinery Accumulated depreciation- Machinery Reducing balance method of depreciation for one year at 15% Cost of machinery Less accumulated depreciation Written down value Less proceeds on sale (Profit)/ Loss on sale $ $ $ Debit $ 12 The machine was sold to Daly Ltd on 30th June 2016 for $65,000 for cash (excluding GST) to Daly Ltd Calculate the profit or loss on disposal of the machinery $ $ in Credit # Prepare the general journal entries & cash receipts journal entry for the disposal of the machinery as at 30th June 2016 Date 30/06/16 30/06/16 Date 30/06/16 30/06/16 Disposal of machinery Machinery Transfer cost on sale of machinery Accumulated Depreciation- Machinery Disposal of Machinery Particulars General Journal Transfer accumulated depreciation on sale of machinery Loss on disposal of machinery Disposal of machinery Transfer loss on sale of machinery Disposal of machinery Particulars Rec no Cash Receipts Journal Discount Debtors Cash allowed Sales $ $ $ Debit GST payable $ 12 $ $ Sundries Credit Bank f) Date Complete the fixed asset register using the information given below. Balance day is 30/06/16. Transaction Serial Number MACH01 The machine was serviced by Eixit, Ltd at a cost of $220 inc GST Insurance was paid $550 in GST 2015/Oct 15 2016/Apr 01 May 10 Jun 15 Type: Serial no: Supplier: Date of Purchase: Depreciation method: Date Date 01/04/15 30/06/15 30/06/16 Date 15/10/15 10/05/16 15/06/16 Worn out parts on the machine was serviced by Eixit.Ltd at a cost of $330 inc GST The machine was serviced by Eixit Ltd at a cost of $220 30/06/16 Machinery Reducing Balance Machinery Depreciation Depreciation Proceeds on Sale Loss on Sale Particulars $ Name Eixit Pty Ltd Fixit, Pty Ltd Eixit, Pty Ltd Daly Ltd Repairer ASSET REGISTER Cost $ Manufacturer: Details of disposal Amount $ Location: Estimated residual value: Estimated life: Depreciation rate: Depreciation expense $ Repairs & Maintenance Cost $ Service Worn out parts Service Particulars Cash Sale N/A Remarks N/A N/A Accumulated depreciation $ Written- down value $

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

I can see there are several parts to the question provided in the images Lets address each part one by one a Calculate the capitalized cost of the machinery The capitalized cost of the machinery is th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started