a,b,c

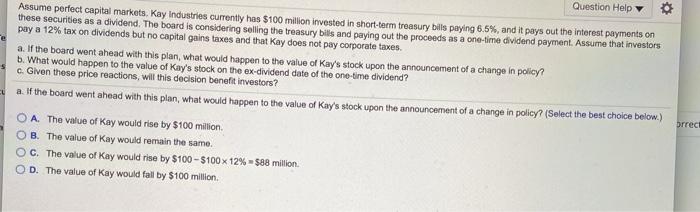

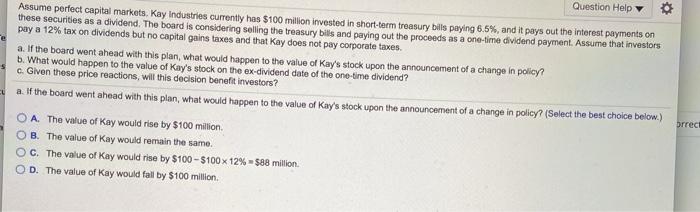

Question Help Assume perfect capital markets. Kay Industries currently has $100 million invested in short-term treasury bills paying 6.5%, and it pays out the interest payments on these securities as a dividend. The board is considering selling the treasury bills and paying out the proceeds as a one-time dividend payment. Assume that investors pay a 12% tax on dividends but no capital gains taxes and that Kay does not pay corporate taxes a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? b. What would happen to the value of Kay's stock on the ex-dividend date of the one-time dividend? c. Given these price reactions, will this decision benefit investors? a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? (Select the best choice below) O A The value of Kay would rise by $100 milion OB. The value of Kay would remain the same. OC. The value of Kay would rise by $100-$100 x 12% 588 million D. The value of Kay would fall by $100 million orrect Question Help Assume perfect capital markets. Kay Industries currently has $100 million invested in short-term treasury bills paying 6.5%, and it pays out the interest payments on these securities as a dividend. The board is considering selling the treasury bills and paying out the proceeds as a one-time dividend payment. Assume that investors pay a 12% tax on dividends but no capital gains taxes and that Kay does not pay corporate taxes a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? b. What would happen to the value of Kay's stock on the ex-dividend date of the one-time dividend? c. Given these price reactions, will this decision benefit investors? a. If the board went ahead with this plan, what would happen to the value of Kay's stock upon the announcement of a change in policy? (Select the best choice below) O A The value of Kay would rise by $100 milion OB. The value of Kay would remain the same. OC. The value of Kay would rise by $100-$100 x 12% 588 million D. The value of Kay would fall by $100 million orrect

a,b,c

a,b,c