Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Retail had a great year in 2025 with total sales of $23 and a 4% retum rate Retum rate (percent of sales that were

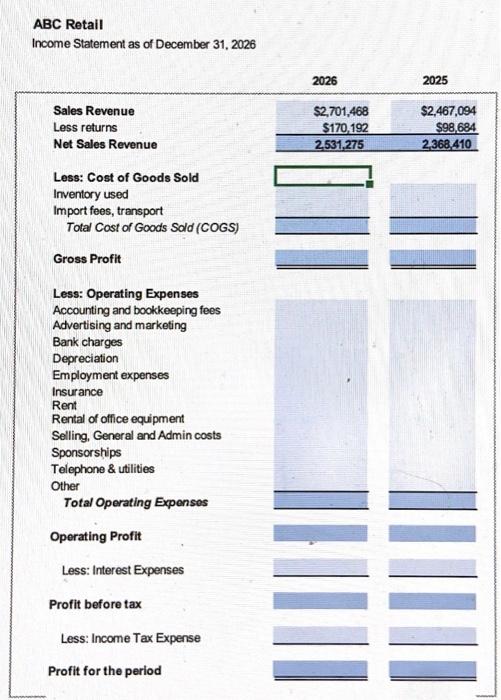

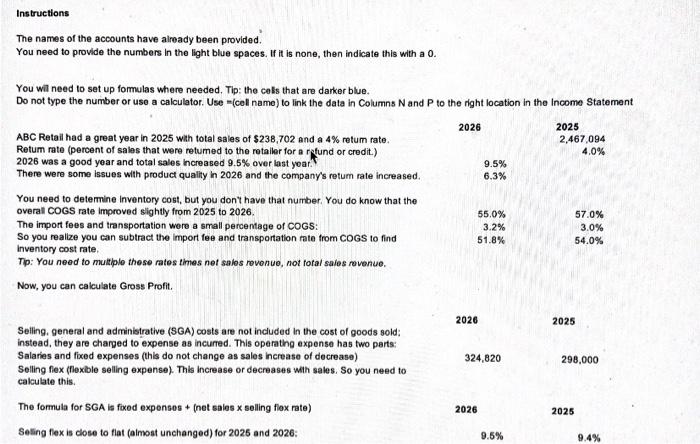

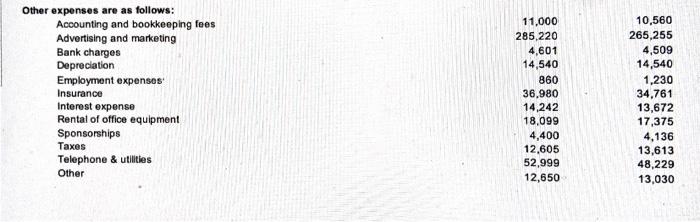

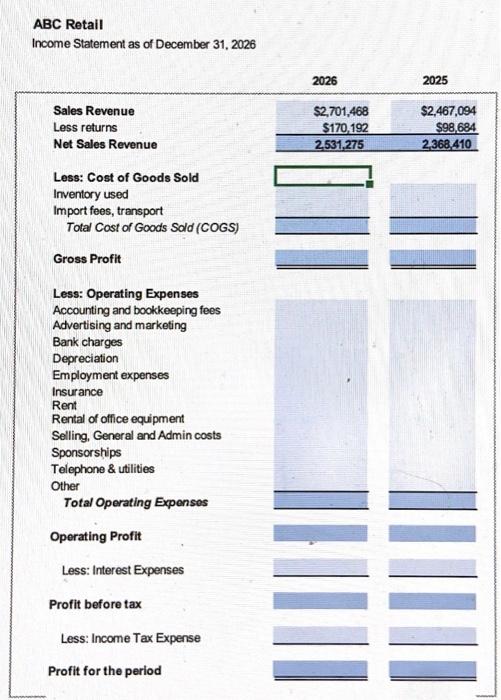

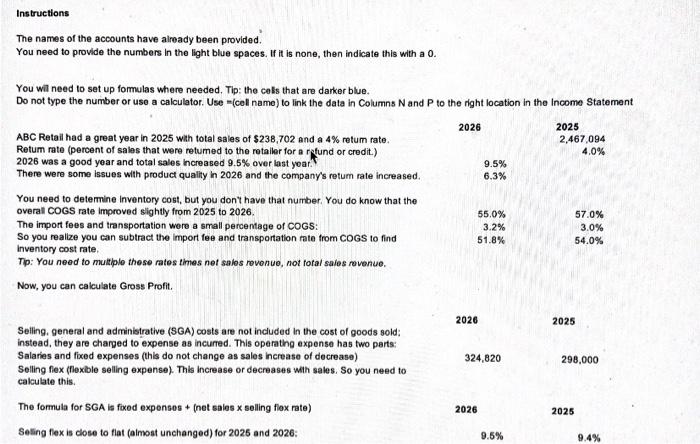

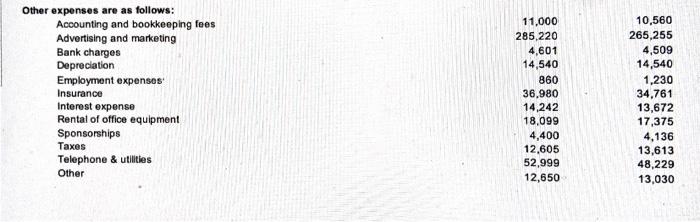

ABC Retail had a great year in 2025 with total sales of \$23 and a 4% retum rate Retum rate (percent of sales that were returned to the retailer for a refund or credit.) 2026 was a good year and total sales increased 9.5% over last year There were some issues with product quality in 2026 and the company's return rate increased You need to determine inventory costbut you don't have that numberYou do know that the overall COGS rate improved slightly from 2025 to 2026 The import fees and transportation were a small percentage of COGS: So you realize you can subtract the import fee and transportation rate from COGS to find Inventory cost rate. Tip: You need to multiple these rates times net sales revenue, not total sales Nowyou can calculate Gross Profit Selling, general and administrative (SGA) costs are not included in the cost of goods sold instead, they are charged to expense as incurred. This operating expense has two parts: Salaries and fixed expens (this do not change as sales increase of decrease) Selling selling expense)This increase or decreases with salesSo you need to calculate this The formula for SGA is fixed expenses net sales selling flex rate) Selling flex is close to flat (almost unchanged) for 2025 and 2026

ABC Retail Income Statement as of December 31, 2026 2026 2025 Sales Revenue Less returns Net Sales Revenue $2,701,468 $170.192 2531,275 $2,467,094 $98,684 2,368,410 Less: Cost of Goods Sold Inventory used Import fees, transport Total Cost of Goods Sold (COGS) Gross Profit Less: Operating Expenses Accounting and bookkeeping fees Advertising and marketing Bank charges Depreciation Employment expenses Insurance Rent Rental of office equipment Selling, General and Admin costs Sponsorships Telephone & utilities Other Total Operating Expenses Operating Profit Less: Interest Expenses Profit before tax Less: Income Tax Expense Profit for the period Instructions The names of the accounts have already been provided. You need to provide the numbers in the light blue spaces. If it is none, then indicate this with a 0. You will need to set up formulas where needed. Tip: the cells that are darkorblue. Do not type the number or use a calculator. Use (cel name) to link the data in Columns N and P to the right location in the Income Statement 2026 2025 2,467,094 4.0% 9.5% 6.3% ABC Retail had a great year in 2025 with total sales of $238,702 and a 4% retum rate, Retum rato (percent of sales that were retumed to the retailer for a refund or credit.) 2026 was a good year and total sales increased 9.5% over last year. There were some issues with product quality in 2026 and the company's retum rate increased. You need to determine Inventory cost, but you don't have that number. You do know that the overal COGS rate Improved slightly from 2025 to 2026. The import fees and transportation were a small percentage of COGS: So you realize you can subtract the import fee and transportation rate from COGS to find Inventory cost rate Tip: You need to multiple those ratos times net sales revenue, not total sales revenue. Now, you can calculate Gross Profit 55.0% 3.2% 51.8% 57.0% 3.0% 54.0% 2026 2025 324,820 298,000 Selling general and administrative (SGA) costs are not included in the cost of goods sold instead, they are charged to expense as incurred. This operating expense has two parts: Salaries and fixed expenses (this do not change as sales increase of decrease) Selling flex (flexible selling expense). This increase or decreases with sales. So you need to calculate this. The formula for SGA is fixed expenses + (net sales x soling flex rate) Seling flex is close to flat (almost unchanged) for 2025 and 2026 2026 2025 9.5% 9.4% Other expenses are as follows: Accounting and bookkeeping fees Advertising and marketing Bank charges Depreciation Employment expenses Insurance Interest expense Rental of office equipment Sponsorships Taxes Telephone & utilities Other 11,000 285,220 4,601 14,540 860 36.980 14,242 18,099 4,400 12,605 52,999 12,650 10,560 265,255 4,509 14,540 1,230 34,761 13,672 17,375 4,136 13,613 48,229 13,030 (USING EXCEL TO FILL IN THE INCOME STATEMENT)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started