Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC sells franchise arrangement throughout La Trinidad and Itogon. Under a franchise agreement, ABC receives 1,000,000 in exchange for satisfying the following separate performance

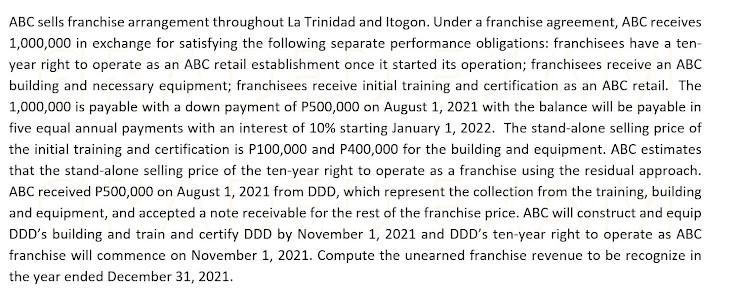

ABC sells franchise arrangement throughout La Trinidad and Itogon. Under a franchise agreement, ABC receives 1,000,000 in exchange for satisfying the following separate performance obligations: franchisees have a ten- year right to operate as an ABC retail establishment once it started its operation; franchisees receive an ABC building and necessary equipment; franchisees receive initial training and certification as an ABC retail. The 1,000,000 is payable with a down payment of P500,000 on August 1, 2021 with the balance will be payable in five equal annual payments with an interest of 10% starting January 1, 2022. The stand-alone selling price of the initial training and certification is P100,000 and P400,000 for the building and equipment. ABC estimates that the stand-alone selling price of the ten-year right to operate as a franchise using the residual approach. ABC received P500,000 on August 1, 2021 from DDD, which represent the collection from the training, building and equipment, and accepted a note receivable for the rest of the franchise price. ABC will construct and equip DDD's building and train and certify DDD by November 1, 2021 and DDD's ten-year right to operate as ABC franchise will commence on November 1, 2021. Compute the unearned franchise revenue to be recognize in the year ended December 31, 2021.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 250000 Explanation Franchise ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started