Question

ABC Technologies Inc. filed its 2010 10-K report on February 16, 2011. On March 19, 2011, the company announced in a press release that it

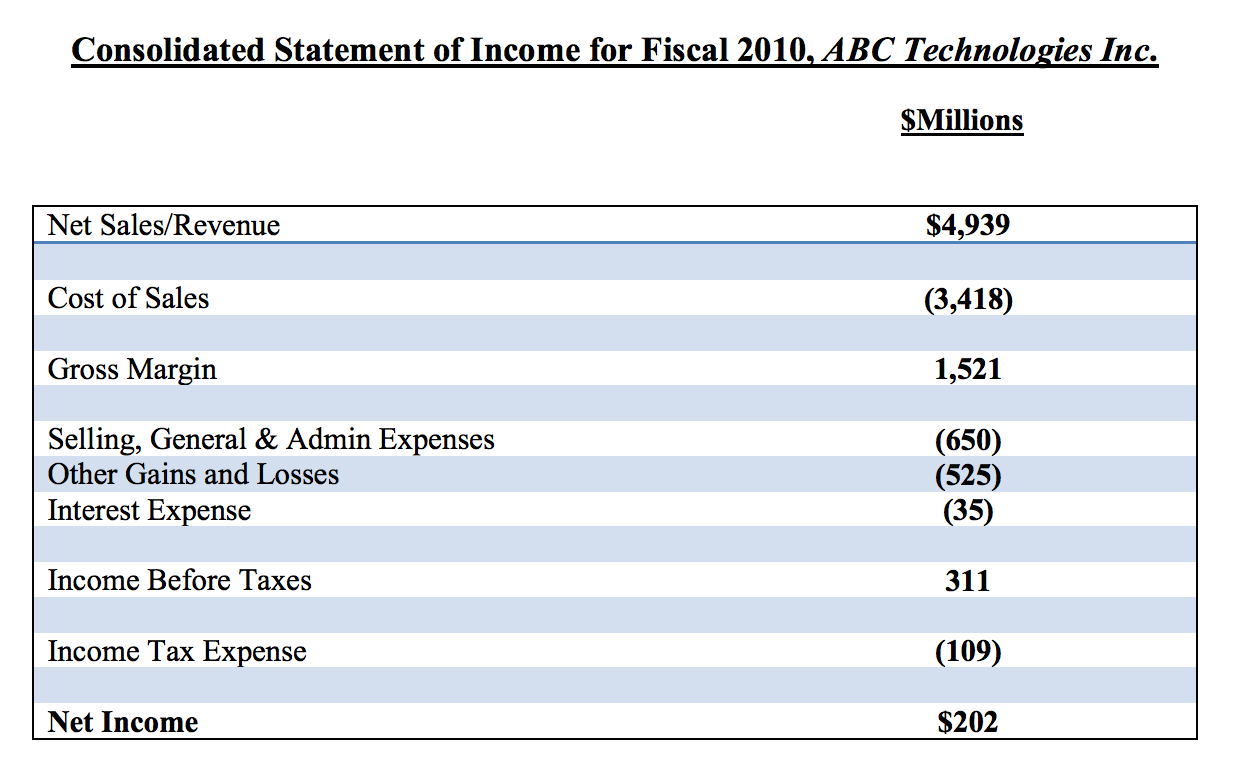

ABC Technologies Inc. filed its 2010 10-K report on February 16, 2011. On March 19, 2011, the company announced in a press release that it was revising its 2010 year-end results because of revenue recognition problems discovered after the 10-K report was filed. Allegedly, one distributor of ABC Technologies complained that the company was stuffing the channels. On April 15, 2011, the company released its restated financial results where it significantly revised its originally reported revenue downward. The company detailed the following revenue recognition issues in its restated report. During 2010, the company shipped $180 millions goods to customers where the customers reserve exclusive rights to return the goods until June 30, 2011 if the goods fail to meet customer specifications and fulfill their needs. The company acknowledged that recognizing $180 million as revenue for goods where right of return exists was a mistake and reversed this revenue. The restated report also mentioned that the company made shipments of several batches of equipments to whole sellers and distributors and recognized $410 million as revenue, but later agreed to take these shipments back because the distributors couldnt sell these goods to the end customers. As a result, the company backed out $410 million from its originally reported 2010 revenue figure. Finally, ABC offered $89 million credits and sales allowance to customers, but erroneously this amount was not subtracted to arrive at the net revenue figure. Consequently, ABC revised its net revenue downward by $89 million in the restated financial statement. Note, in this case, no goods have been shipped; the company simply failed to subtract $89 million of sales allowance to arrive at its (before restatement) net revenue figure. The restated report further specified that apart from revising revenue downward, the company also increased its Allowance for Doubtful Accounts number by $225 million to compute the restated figures(that is, the restated allowance is $225 million more than the originally reported allowance). ABCs restated income statement is attached at the end of this question. To answer the following queries, assume that ABCs average corporate tax rate is 35%.

1.Write down all the necessary journal entries (including tax) the company had to record to back out the revenues and remove their effects from the Income Statement and Balance Sheet where goods have been shipped to customers, whole sellers and distributors. For answering this question, assume that the Cost of Sales to Revenue ratio remained unchanged before and after the restatement. Also, assume that restatement didnt change any other cost/expense in the income statement other than cost of sales. [6]

2.What journal entries (including tax) did ABC record to restate its revenue downward by $89 million because the company originally forgot to subtract this allowance to arrive at the net revenue figure? [4] (iv) What was ABCs 2010 Net Revenue before the restatement? Note that the attached Income Statement reports data after the restatement. [3]

3.What was ABCs 2010 Cost of Sales before the restatement? [2]

4.What was ABCs 2010 Net Income before the restatement? [4]

5.The restated financial statements mention that ABC increased its Allowance for Doubtful Accounts by $225 million for computing the restated data. The 2010 restated balance sheet reports Net Accounts Receivables figure of $8,750 million after subtracting $475 million allowance for doubtful accounts. What were the gross and net amounts of Accounts Receivables before the restatement? [5]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started