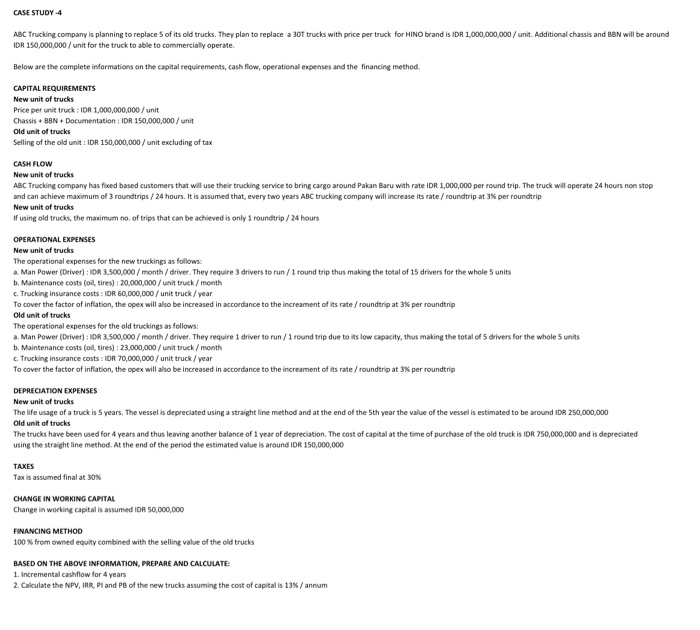

ABC Trucking company is planning to replace S of its old trucks. They plan to replace a 30T trucks with price per truck for HINO brand is IDR 1,000,000,000/unit. Additional chassis and BSN will be around IDR 150,000,000/unit for the truck to able to commercially operate. Below are the complete informations on the capital requirements, cash flow, operational expenses and the financing method. CAPITAL REQUIREMENTS New unit of trucks Price per unit truck: IDR 1,000,000,000/unit Chassis 8BN +Documentation: IDR 150,000,000/unit Old unit of trucks Selling of the old unit: IDR 150,000,000/unit excluding of tax New unit of trucks ABC Trucking company has fixed based customers that will use their trucking service to bring cargo around Pakan Baru with rate IDR 1,000,000 per round trip. The truck will operate 24 hours non stop and can achieve maximum of 3 roundtrips / 24 hours. It is assumed that every two years ABC trucking company will increase its rate / roundtrip at 356 per roundtrip New unit of trucks If using old trucks, the maximum no, of trips that can be achieved is only 1 roundtrip/24 hours New unit of trucks The operational expenses for the new truckings as follows a Man Power (Driver) :DR 3.500,000 / month / driver. They require 3 drivers to run / 1 round trip thus making the total of 15 drivers for the whole 5 units b. Maintenance costs (oil, tires) : 20,000,000/ unit truck/ month c. Trucking insurance costs: IDR 60,000,000/ unit truck/year To cover the factor of inflation, the opex will also be increased in accordance to the increament of its rate / roundtrip at 3% per roundtrip Old unit of tracks The operational expenses for the old truckings as follows: a. Man Power (Driver): IDR 3,500,000/month / driver. They require 1 driver to run /1 round trip due to its low capacity, thus making the total of 5 drivers for the whole 5 units b. Maintenance costs (oil, tires): 23,000,000/unit truck/month c. Trucking insurance costs: IOR 70,000,000/unit truck/year To cover the factor of inflation, the opex will also be increased in accordance to the increament of its rate / roundtrip at 3% per roundtrip DEPRECIATION EXPENSES The life usage of a truck is 5 years. The vessel is depreciated using a straight line method and at the end of the 5th year the value of the vessel is estimated to be around IDR 250,000,000 Old unit of tracks The trucks have been used for 4 years and thus leaving another balance of 1 year of depreciation. The cost of capital at the time of purchase of the old truck is IDR 750,000,000 and is depreciated using the straight line method. At the end of the period the estimated value is around IDR 150,000,000 Tax es assumed final at 30% CHANGE IN WORKING CAPITAL Change in working capital is assumed IDR 50,000,000 FINANCING METHOD 100 % from owned equity combined with the selling value of the old trucks BASED ON THE ABOVE INFORMATION, PREPARE AND CALCULATE 1. Incremental cashflow for 4 years 2. Calculate the NPV, IRR, Pl and PB of the new trucks assuming the cost of capital is 13% / annum