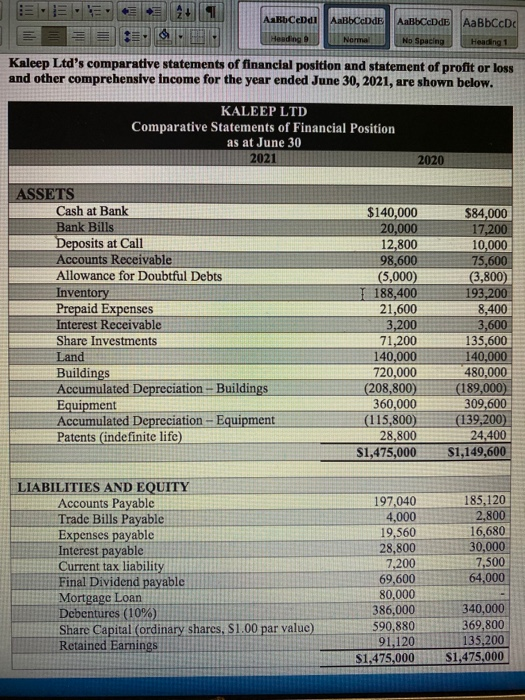

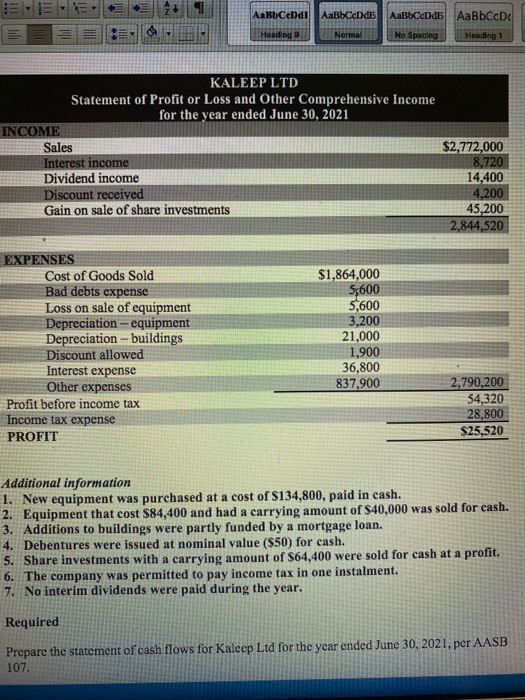

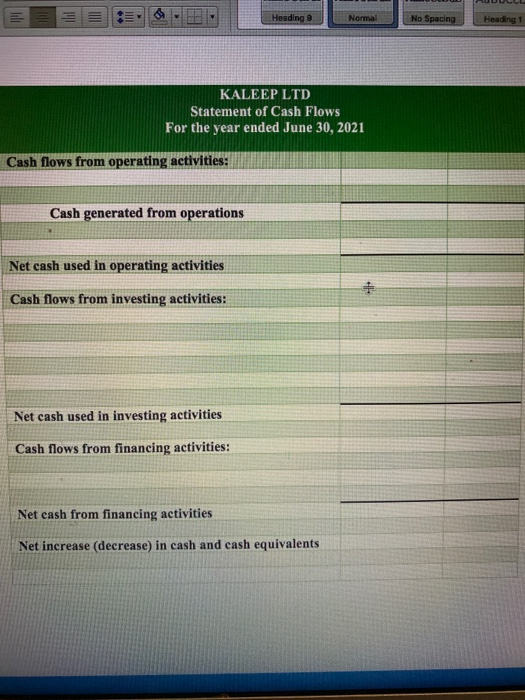

ABCeDdi AaBbCcDdE AalbCeDdE AaBbCcDc Heading Normal No Spacing Heading 1 Kaleep Ltd's comparative statements of financial position and statement of profit or loss and other comprehensive income for the year ended June 30, 2021, are shown below. KALEEP LTD Comparative Statements of Financial Position as at June 30 2021 2020 ASSETS Cash at Bank Bank Bills Deposits at Call Accounts Receivable Allowance for Doubtful Debts Inventory Prepaid Expenses Interest Receivable Share Investments Land Buildings Accumulated Depreciation - Buildings Equipment Accumulated Depreciation - Equipment Patents (indefinite life) $140,000 20,000 12,800 98,600 (5,000) 188,400 21,600 3,200 71,200 140,000 720,000 (208,800) 360,000 (115,800) 28,800 $1,475,000 $84,000 17,200 10,000 75,600 (3,800) 193,200 8,400 3,600 135,600 140,000 480,000 (189,000) 309,600 (139,200) 24,400 $1,149,600 LIABILITIES AND EQUITY Accounts Payable Trade Bills Payable Expenses payable Interest payable Current tax liability Final Dividend payable Mortgage Loan Debentures (10%) Share Capital (ordinary shares. S1.00 par value) Retained Earnings 197,040 4,000 19,560 28,800 7,200 69,600 80,000 386,000 590,880 91,120 $1,475,000 185,120 2,800 16,680 30,000 7,500 64,000 340,000 369,800 135,200 $1,475,000 AaBbcendi AaBbceDdE AaBbCcDdE AaBbCcDc Heading Normal No Spacing Heading 1 KALEEP LTD Statement of Profit or Loss and Other Comprehensive Income for the year ended June 30, 2021 INCOME Sales $2,772,000 Interest income 8,720 Dividend income 14,400 Discount received 4,200 Gain on sale of share investments 45,200 2,844,520 EXPENSES Cost of Goods Sold Bad debts expense Loss on sale of equipment Depreciation - equipment Depreciation - buildings Discount allowed Interest expense Other expenses Profit before income tax Income tax expense PROFIT $1,864,000 5,600 5,600 3,200 21,000 1,900 36,800 837,900 2,790,200 54,320 28,800 $25,520 Additional information 1. New equipment was purchased at a cost of $134,800, paid in cash. 2. Equipment that cost $84,400 and had a carrying amount of $40,000 was sold for cash. 3. Additions to buildings were partly funded by a mortgage loan. 4. Debentures were issued at nominal value (550) for cash. 5. Share investments with a carrying amount of S64,400 were sold for cash at a profit. 6. The company was permitted to pay income tax in one instalment. 7. No interim dividends were paid during the year. Required Prepare the statement of cash flows for Kaleep Ltd for the year ended June 30, 2021, per AASB 107. Heading 9 Normal No Spacing Heading 1 KALEEP LTD Statement of Cash Flows For the year ended June 30, 2021 Cash flows from operating activities: Cash generated from operations Net cash used in operating activities + Cash flows from investing activities: Net cash used in investing activities Cash flows from financing activities: Net cash from financing activities Net increase (decrease) in cash and cash equivalents