Answered step by step

Verified Expert Solution

Question

1 Approved Answer

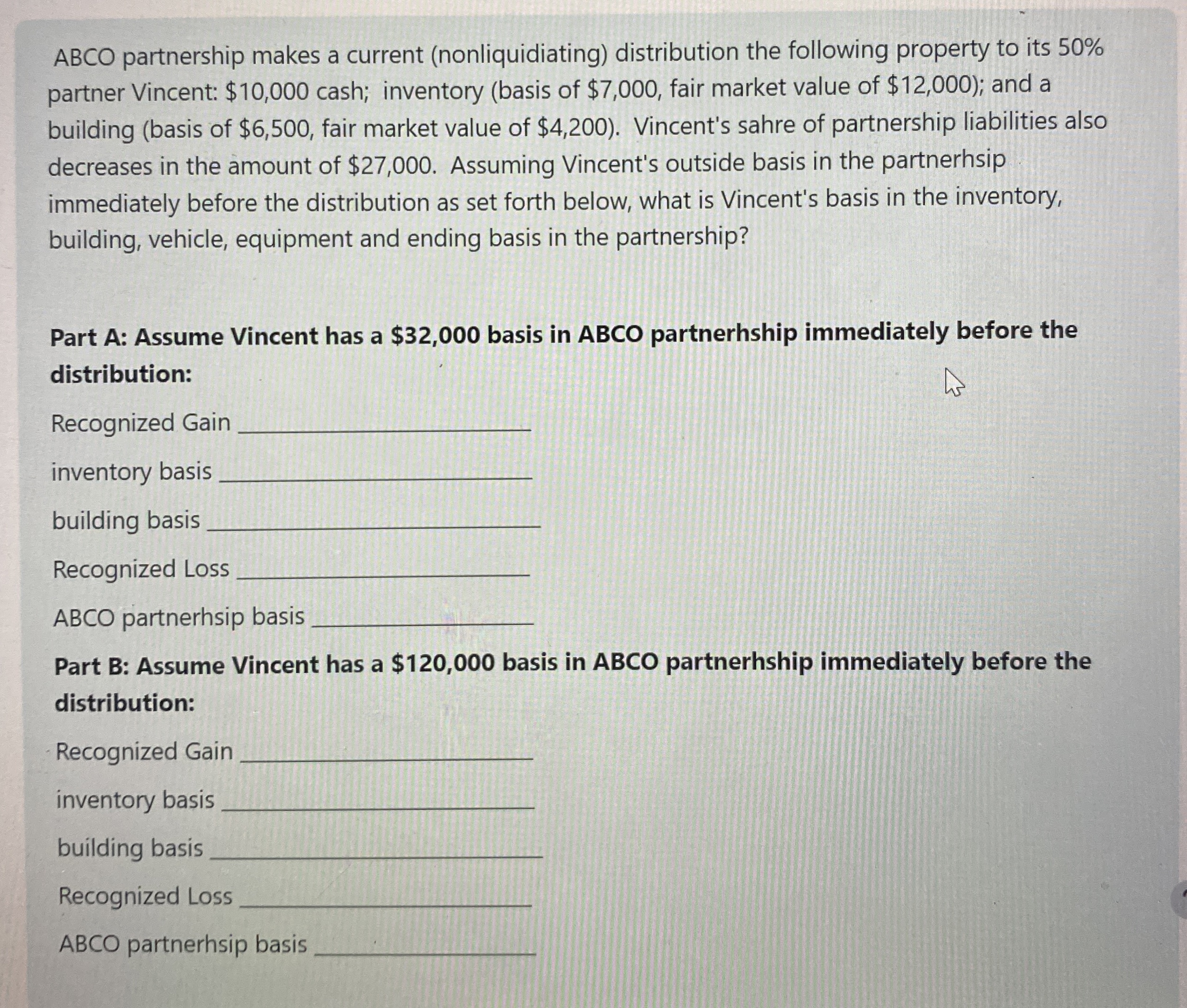

ABCO partnership makes a current ( nonliquidiating ) distribution the following property to its 5 0 % partner Vincent: $ 1 0 , 0 0

ABCO partnership makes a current nonliquidiating distribution the following property to its

partner Vincent: $ cash; inventory basis of $ fair market value of $; and a

building basis of $ fair market value of $ Vincent's sahre of partnership liabilities also

decreases in the amount of $ Assuming Vincent's outside basis in the partnerhsip

immediately before the distribution as set forth below, what is Vincent's basis in the inventory,

building, vehicle, equipment and ending basis in the partnership?

Part A: Assume Vincent has a $ basis in ABCO partnerhship immediately before the

distribution:

Recognized Gain

inventory basis

building basis

Recognized Loss

ABCO partnerhsip basis

Part B: Assume Vincent has a $ basis in ABCO partnerhship immediately before the

distribution:

Recognized Gain

inventory basis

building basis

Recognized Loss

ABCO partnerhsip basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started