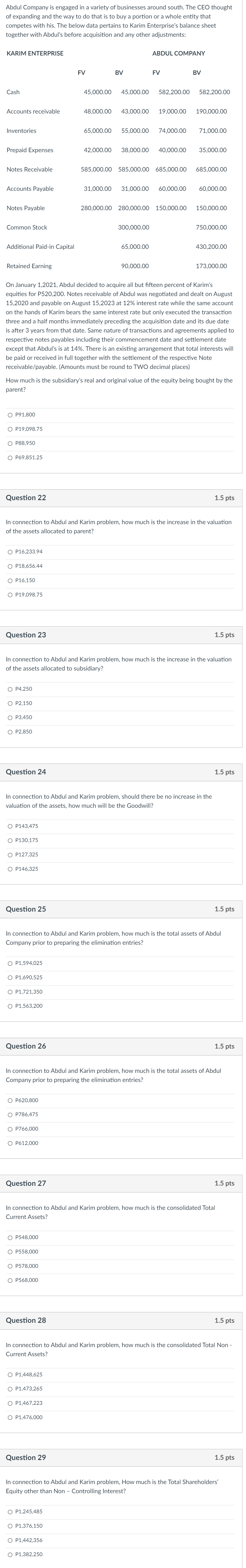

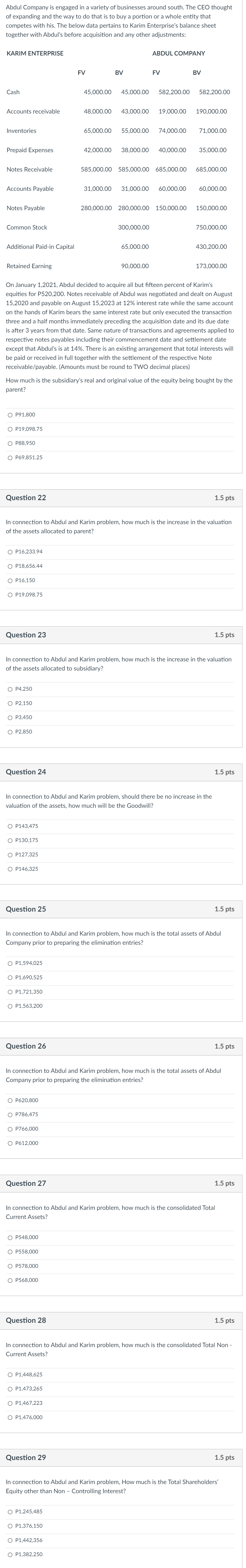

Abdul Company is engaged in a variety of businesses around south. The CEO thought of expanding and the way to do that is to buy a portion or a whole entity that competes with his. The below data pertains to Karim Enterprise's balance sheet together with Abdul's before acquisition and any other adjustments: KARIM ENTERPRISE ABDUL COMPANY FV BV FV BV Cash 45,000.00 45,000.00 582,200.00 582,200.00 Accounts receivable 48,000.00 43,000.00 19,000.00 190,000.00 Inventories 65,000.00 55,000.00 74,000.00 71,000.00 Prepaid Expenses 42,000.00 38,000.00 40,000.00 35,000.00 Notes Receivable 585,000.00 585,000.00 685,000.00 685,000.00 Accounts Payable 31,000.00 31,000.00 60,000.00 60,000.00 Notes Payable 280,000.00 280,000.00 150,000.00 150,000.00 Common Stock 300,000.00 750,000.00 Additional Paid-in Capital 65,000.00 430,200.00 Retained Earning 90,000.00 173,000.00 On January 1,2021, Abdul decided to acquire all but fifteen percent of Karim's equities for P520,200. Notes receivable of Abdul was negotiated and dealt on August 15,2020 and payable on August 15,2023 at 12% interest rate while the same account on the hands of Karim bears the same interest rate but only executed the transaction three and a half months immediately preceding the acquisition date and its due date is after 3 years from that date. Same nature of transactions and agreements applied to respective notes payables including their commencement date and settlement date except that Abdul's is at 14%. There is an existing arrangement that total interests will be paid or received in full together with the settlement of the respective Note receivable/payable. (Amounts must be round to TWO decimal places) How much is the subsidiary's real and original value of the equity being bought by the parent? O P91.800 O P19,098.75 OP88,950 OP69,851.25 Question 22 1.5 pts In connection to Abdul and Karim problem, how much is the increase in the valuation of the assets allocated to parent? O P16,233.94 O P18,656.44 O P16,150 O P19,098.75 Question 23 1.5 pts In connection to Abdul and Karim problem, how much is the increase in the valuation of the assets allocated to subsidiary? O P4,250 O P2,150 OP3,450 O P2,850 Question 24 1.5 pts In connection to Abdul and Karim problem, should there be no increase in the valuation of the assets, how much will be the Goodwill? O P143,475 O P130,175 O P127,325 O P146,325 Question 25 1.5 pts In connection to Abdul and Karim problem, how much is the total assets of Abdul Company prior to preparing the elimination entries? O P1,594.025 O P1,690,525 O P1,721,350 O P1,563,200 Question 26 1.5 pts In connection to Abdul and Karim problem, how much is the total assets of Abdul Company prior to preparing the elimination entries? O P620,800 O P786,475 O P766,000 O P612,000 Question 27 1.5 pts In connection to Abdul and Karim problem, how much is the consolidated Total Current Assets? OP548,000 O P558,000 OP578,000 OP568,000 Question 28 1.5 pts In connection to Abdul and Karim problem, how much is the consolidated Total Non- Current Assets? O P1,448,625 O P1,473,265 O P1,467,223 O P1,476,000 Question 29 1.5 pts In connection to Abdul and Karim problem, How much is the Total Shareholders' Equity other than Non - Controlling Interest? O P1,245,485 O P1,376,150 O P1,442,356 O P1,382,250