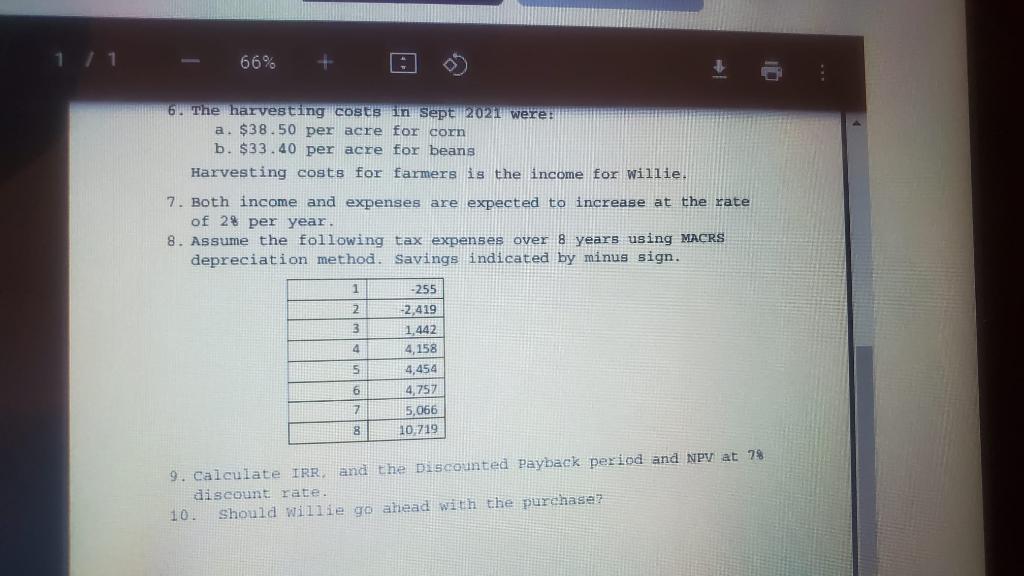

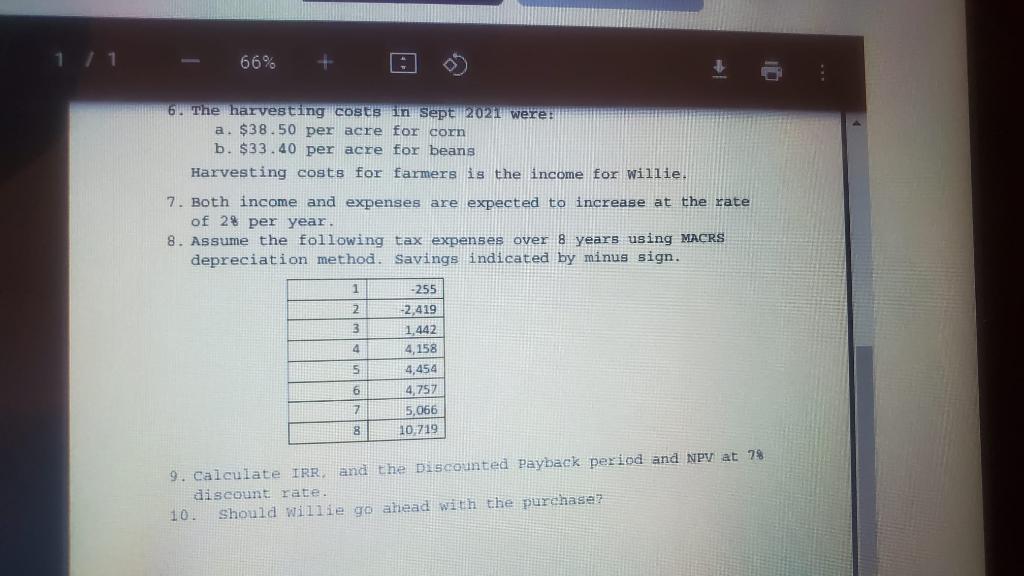

ABE 452/553 Investment Analys Willie is considering the purchase of a combine to use for custom work (implying not for own farm but as an operator) on 3,000 acres (50-50 on corn and soybean) with the following financial info: 1. Initial purchase price: a. Combine power unit: $300,000 b. 12-row, 30- corn head $ 65,000 c. Soybean head = $35,000 2. Useful life = 8 years 3. Salvage value (all units) = $80,000 4. Based on his financial records and after checking with farmer friends, he estimates total operating expenses per acre: a. $16. 24 per aere for corn b. $15 . 88 per acne for beans 5. Other costs for Housing Insurance + Maintenanee a. $3.30 per aere for com b. 93.15 per acre for beans 6. The harvesting costs in Sept 2021 were: ca. 38.50 per acre for en 3:38 PM 3/11/2022 st Rain/snow 1 / 1 66% 6. The harvesting costs in sept 2021 were: a. $38.50 per acre for corn b. $33.40 per acre for beans Harvesting costs for farmers is the income for Willie. 7. Both income and expenses are expected to increase at the rate of 2% per year. 8. Assume the following tax expenses over 8 years using MACRS depreciation method. Savings indicated by minus sign. 1 2 3 4 -255 -2,419 1,442 4,158 4,454 4,757 5,066 10,719 5 6 7 8 9. Calculate IRR and the Discounted Payback period and NPV at 78 discount rate. 10. Should willie go ahead with the purchase ABE 452/553 Investment Analys Willie is considering the purchase of a combine to use for custom work (implying not for own farm but as an operator) on 3,000 acres (50-50 on corn and soybean) with the following financial info: 1. Initial purchase price: a. Combine power unit: $300,000 b. 12-row, 30- corn head $ 65,000 c. Soybean head = $35,000 2. Useful life = 8 years 3. Salvage value (all units) = $80,000 4. Based on his financial records and after checking with farmer friends, he estimates total operating expenses per acre: a. $16. 24 per aere for corn b. $15 . 88 per acne for beans 5. Other costs for Housing Insurance + Maintenanee a. $3.30 per aere for com b. 93.15 per acre for beans 6. The harvesting costs in Sept 2021 were: ca. 38.50 per acre for en 3:38 PM 3/11/2022 st Rain/snow 1 / 1 66% 6. The harvesting costs in sept 2021 were: a. $38.50 per acre for corn b. $33.40 per acre for beans Harvesting costs for farmers is the income for Willie. 7. Both income and expenses are expected to increase at the rate of 2% per year. 8. Assume the following tax expenses over 8 years using MACRS depreciation method. Savings indicated by minus sign. 1 2 3 4 -255 -2,419 1,442 4,158 4,454 4,757 5,066 10,719 5 6 7 8 9. Calculate IRR and the Discounted Payback period and NPV at 78 discount rate. 10. Should willie go ahead with the purchase