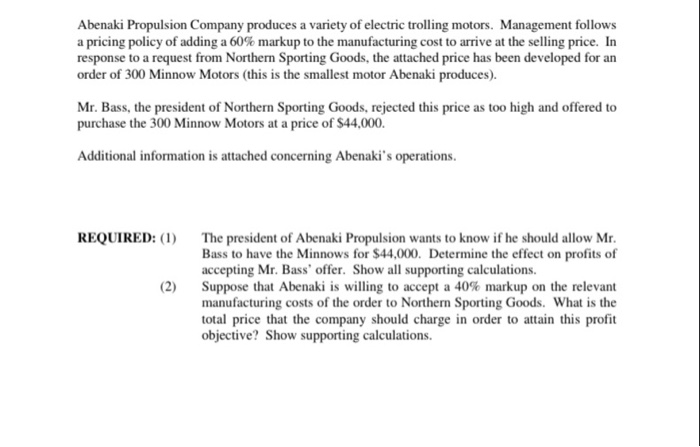

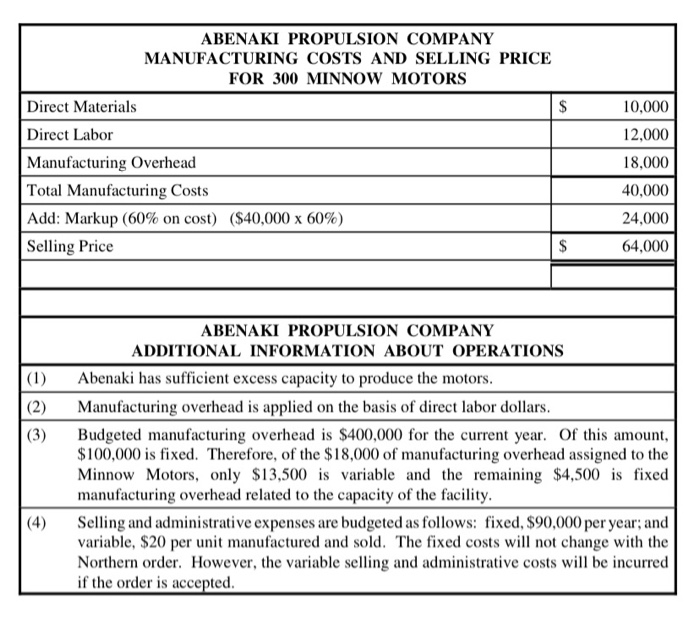

Abenaki Propulsion Company produces a variety of electric trolling motors. Management follows a pricing policy of adding a 60% markup to the manufacturing cost to arrive at the selling price. In response to a request from Northern Sporting Goods, the attached price has been developed for an order of 300 Minnow Motors (this is the smallest motor Abenaki produces). Mr. Bass, the president of Northern Sporting Goods, rejected this price as too high and offered to purchase the 300 Minnow Motors at a price of $44,000. Additional information is attached concerning Abenaki's operations. REQUIRED: (1) (2) The president of Abenaki Propulsion wants to know if he should allow Mr. Bass to have the Minnows for $44,000. Determine the effect on profits of accepting Mr. Bass' offer. Show all supporting calculations. Suppose that Abenaki is willing to accept a 40% markup on the relevant manufacturing costs of the order to Northern Sporting Goods. What is the total price that the company should charge in order to attain this profit objective? Show supporting calculations. $ ABENAKI PROPULSION COMPANY MANUFACTURING COSTS AND SELLING PRICE FOR 300 MINNOW MOTORS Direct Materials Direct Labor Manufacturing Overhead Total Manufacturing Costs Add: Markup (60% on cost) ($40,000 x 60%) Selling Price 10,000 12,000 18,000 40,000 24,000 64,000 $ (2) (3) ABENAKI PROPULSION COMPANY ADDITIONAL INFORMATION ABOUT OPERATIONS Abenaki has sufficient excess capacity to produce the motors. Manufacturing overhead is applied on the basis of direct labor dollars. Budgeted manufacturing overhead is $400,000 for the current year. Of this amount, $100,000 is fixed. Therefore, of the $18,000 of manufacturing overhead assigned to the Minnow Motors, only $13,500 is variable and the remaining $4,500 is fixed manufacturing overhead related to the capacity of the facility. Selling and administrative expenses are budgeted as follows: fixed, $90,000 per year, and variable, $20 per unit manufactured and sold. The fixed costs will not change with the Northern order. However, the variable selling and administrative costs will be incurred if the order is accepted