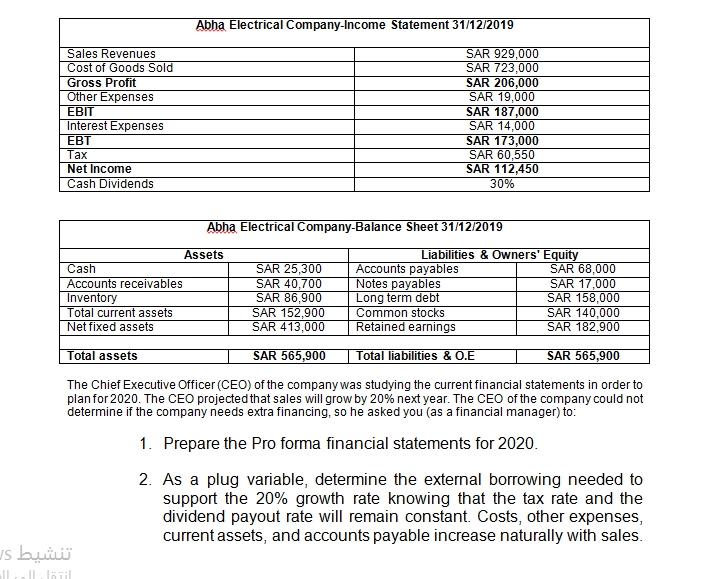

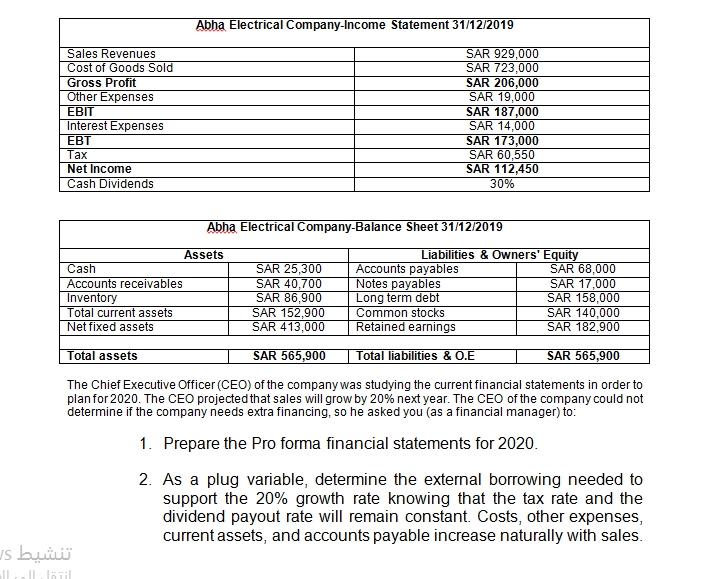

Abha Electrical Company-Income Statement 31/12/2019 Sales Revenues Cost of Goods Sold Gross Profit Other Expenses EBIT Interest Expenses EBT Tax Net Income Cash Dividends SAR 929,000 SAR 723,000 SAR 206,000 SAR 19,000 SAR 187,000 SAR 14,000 SAR 173,000 SAR 60,550 SAR 112,450 30% Abha Electrical Company-Balance Sheet 31/12/2019 Assets Cash Accounts receivables Inventory Total current assets Net fixed assets SAR 25,300 SAR 40,700 SAR 86,900 SAR 152,900 SAR 413.000 Liabilities & Owners' Equity Accounts payables SAR 68,000 Notes payables SAR 17,000 Long term debt SAR 158,000 Common stocks SAR 140.000 Retained earnings SAR 182.900 Total assets SAR 565,900 Total liabilities & O.E SAR 565,900 The Chief Executive Officer (CEO) of the company was studying the current financial statements in order to plan for 2020. The CEO projected that sales will grow by 20% next year. The CEO of the company could not determine if the company needs extra financing, so he asked you (as a financial manager) to: 1. Prepare the Pro forma financial statements for 2020. 2. As a plug variable, determine the external borrowing needed to support the 20% growth rate knowing that the tax rate and the dividend payout rate will remain constant. Costs, other expenses, current assets, and accounts payable increase naturally with sales. IS 11 lil Abha Electrical Company-Income Statement 31/12/2019 Sales Revenues Cost of Goods Sold Gross Profit Other Expenses EBIT Interest Expenses EBT Tax Net Income Cash Dividends SAR 929,000 SAR 723,000 SAR 206,000 SAR 19,000 SAR 187,000 SAR 14,000 SAR 173,000 SAR 60,550 SAR 112,450 30% Abha Electrical Company-Balance Sheet 31/12/2019 Assets Cash Accounts receivables Inventory Total current assets Net fixed assets SAR 25,300 SAR 40,700 SAR 86,900 SAR 152,900 SAR 413.000 Liabilities & Owners' Equity Accounts payables SAR 68,000 Notes payables SAR 17,000 Long term debt SAR 158,000 Common stocks SAR 140.000 Retained earnings SAR 182.900 Total assets SAR 565,900 Total liabilities & O.E SAR 565,900 The Chief Executive Officer (CEO) of the company was studying the current financial statements in order to plan for 2020. The CEO projected that sales will grow by 20% next year. The CEO of the company could not determine if the company needs extra financing, so he asked you (as a financial manager) to: 1. Prepare the Pro forma financial statements for 2020. 2. As a plug variable, determine the external borrowing needed to support the 20% growth rate knowing that the tax rate and the dividend payout rate will remain constant. Costs, other expenses, current assets, and accounts payable increase naturally with sales. IS 11 lil