Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Able to help me answer Question 4(a) to 4(e)? Thank you! :) Question 4 Ideal Company owns a department store selling furniture and home furnishing.

Able to help me answer Question 4(a) to 4(e)?

Thank you! :)

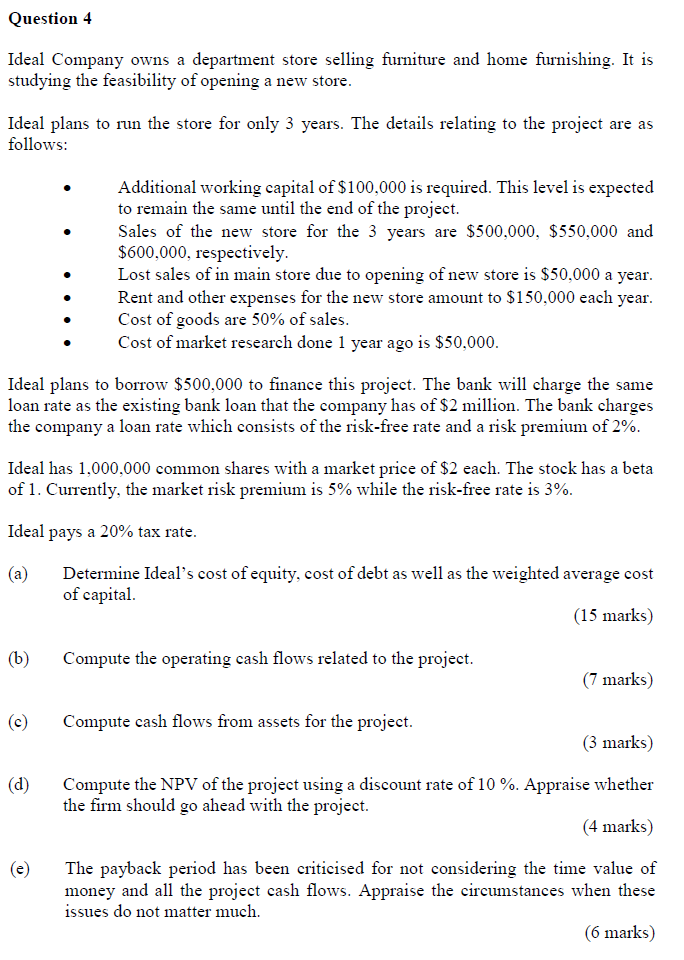

Question 4 Ideal Company owns a department store selling furniture and home furnishing. It is studying the feasibility of opening a new store. Ideal plans to run the store for only 3 years. The details relating to the project are as follows: Additional working capital of $100,000 is required. This level is expected to remain the same until the end of the project. Sales of the new store for the 3 years are $500,000, $550,000 and $600,000, respectively. Lost sales of in main store due to opening of new store is $50,000 a year. Rent and other expenses for the new store amount to $150,000 each year. Cost of goods are 50% of sales. Cost of market research done 1 year ago is $50,000. Ideal plans to borrow $500,000 to finance this project. The bank will charge the same loan rate as the existing bank loan that the company has of $2 million. The bank charges the company a loan rate which consists of the risk-free rate and a risk premium of 2%. Ideal has 1,000,000 common shares with a market price of $2 each. The stock has a beta of 1. Currently, the market risk premium is 5% while the risk-free rate is 3%. Ideal pays a 20% tax rate. (a) Determine Ideal's cost of equity, cost of debt as well as the weighted average cost of capital (15 marks) (6) Compute the operating cash flows related to the project. (7 marks) (c) Compute cash flows from assets for the project. (3 marks) (d) Compute the NPV of the project using a discount rate of 10%. Appraise whether the firm should go ahead with the project. (4 marks) The payback period has been criticised for not considering the time value of money and all the project cash flows. Appraise the circumstances when these issues do not matter much. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started