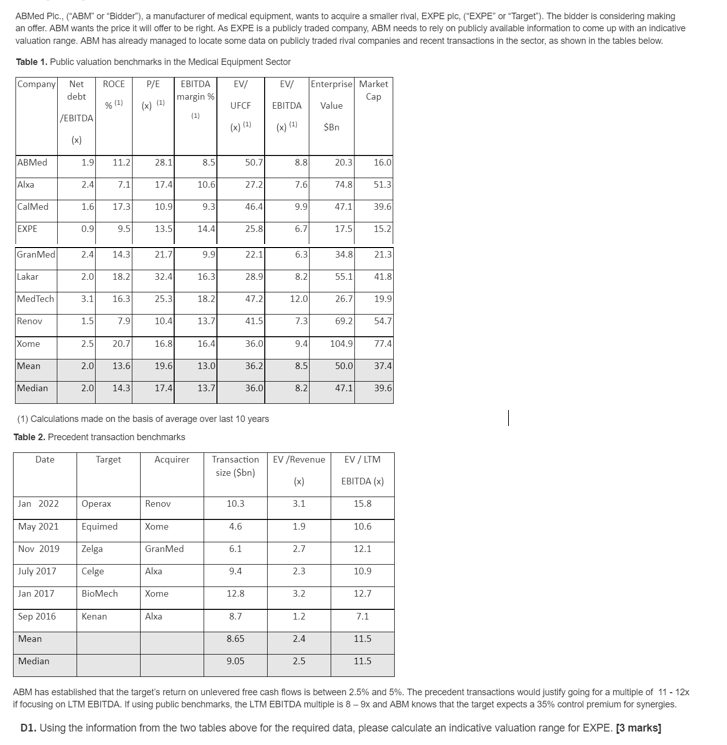

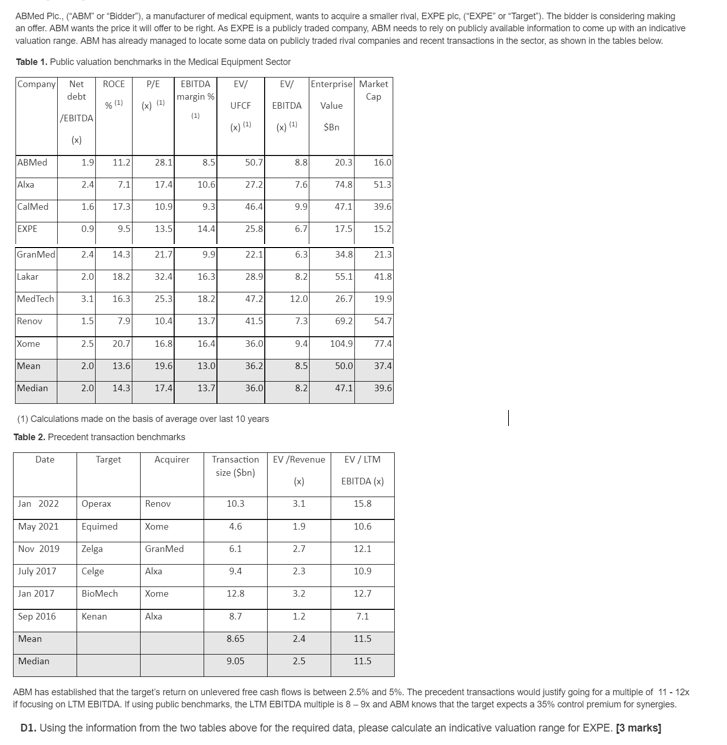

ABMed Plc., ("ABM" or "Bidder"), a manufacturer of medical equipment, wants to acquire a smaller rival, EXPE plc, ("EXPE" or "Target"). The bidder is considering making an offer. ABM wants the price it will offer to be right. As EXPE is a publicly traded company, ABM needs to rely on publicly available information to come up with an indicative valuation range. ABM has already managed to locate some data on publicly traded rival companies and recent transactions in the sector, as shown in the tables below. Table 1. Public valuation benchmarks in the Medical Equipment Sector EV/ Enterprise Market Company Net ROCE P/E debt EBITDA EV/ margin % Cap (x) UFCF EBITDA Value /EBITDA (x) (2) (x) (2) $Bn (x) ABMed 1.9 11.2 28.1 8.5 8.8 Alxa 2.4 7.1 17.4 10.6 7.6 CalMed 1.6 17.3 10.9 9.3 9.9 EXPE 0.9 9.5 13.5 14.4 25.8 6.7 GranMed 2.4 14.3 21.7 9.9 22.1 6.3 Lakar 2.0 18.2 32.4 16.3 28.9 8.2 MedTech 3.1 16.3 25.3 18.2 47.2 12.0 Renov 1.5 7.9 10.4 13.7 41.5 7.3 Xome 2.5 20.7 16.8 16.4 36.0 9.4 Mean 2.0 13.6 19.6 13.0 36.2 8.5 Median 2.0 14.3 17.4 13.7 36.0 8.2 (1) Calculations made on the basis of average over last 10 years Table 2. Precedent transaction ben marks Date Target Acquirer Transaction EV /Revenue EV/LTM size (sbn) (x) EBITDA (x) Jan 2022 Operax Renov 10.3 3.1 15.8 May 2021 Equimed Xome 4.6 1.9 10.6 Nov 2019 Zelga GranMed 6.1 2.7 12.1 July 2017 Alxa 9.4 2.3 10.9 Celge BioMech Jan 2017 Xome 12.8 3.2 12.7 Sep 2016 Kenan Alxa 8.7 1.2 7.1 Mean 8.65 2.4 11.5 Median 9.05 2.5 11.5 ABM has established that the target's return on unlevered free cash flows is between 2.5% and 5%. The precedent transactions would justify going for a multiple of 11-12x if focusing on LTM EBITDA. If using public benchmarks, the LTM EBITDA multiple is 8-9x and ABM knows that the target expects a 35% control premium for synergies. D1. Using the information from the two tables above for the required data, please calculate an indicative valuation range for EXPE. [3 marks] 96 (2) 50.7 27.2 46.4 20.3 74.8 47.1 17.5 16.0 51.3 39.6 15.2 34.8 21.3 55.1 41.8 26.7 19.9 69.2 54.7 104.9 77.4 50.0 37.4 47.1 39.6 ABMed Plc., ("ABM" or "Bidder"), a manufacturer of medical equipment, wants to acquire a smaller rival, EXPE plc, ("EXPE" or "Target"). The bidder is considering making an offer. ABM wants the price it will offer to be right. As EXPE is a publicly traded company, ABM needs to rely on publicly available information to come up with an indicative valuation range. ABM has already managed to locate some data on publicly traded rival companies and recent transactions in the sector, as shown in the tables below. Table 1. Public valuation benchmarks in the Medical Equipment Sector EV/ Enterprise Market Company Net ROCE P/E debt EBITDA EV/ margin % Cap (x) UFCF EBITDA Value /EBITDA (x) (2) (x) (2) $Bn (x) ABMed 1.9 11.2 28.1 8.5 8.8 Alxa 2.4 7.1 17.4 10.6 7.6 CalMed 1.6 17.3 10.9 9.3 9.9 EXPE 0.9 9.5 13.5 14.4 25.8 6.7 GranMed 2.4 14.3 21.7 9.9 22.1 6.3 Lakar 2.0 18.2 32.4 16.3 28.9 8.2 MedTech 3.1 16.3 25.3 18.2 47.2 12.0 Renov 1.5 7.9 10.4 13.7 41.5 7.3 Xome 2.5 20.7 16.8 16.4 36.0 9.4 Mean 2.0 13.6 19.6 13.0 36.2 8.5 Median 2.0 14.3 17.4 13.7 36.0 8.2 (1) Calculations made on the basis of average over last 10 years Table 2. Precedent transaction ben marks Date Target Acquirer Transaction EV /Revenue EV/LTM size (sbn) (x) EBITDA (x) Jan 2022 Operax Renov 10.3 3.1 15.8 May 2021 Equimed Xome 4.6 1.9 10.6 Nov 2019 Zelga GranMed 6.1 2.7 12.1 July 2017 Alxa 9.4 2.3 10.9 Celge BioMech Jan 2017 Xome 12.8 3.2 12.7 Sep 2016 Kenan Alxa 8.7 1.2 7.1 Mean 8.65 2.4 11.5 Median 9.05 2.5 11.5 ABM has established that the target's return on unlevered free cash flows is between 2.5% and 5%. The precedent transactions would justify going for a multiple of 11-12x if focusing on LTM EBITDA. If using public benchmarks, the LTM EBITDA multiple is 8-9x and ABM knows that the target expects a 35% control premium for synergies. D1. Using the information from the two tables above for the required data, please calculate an indicative valuation range for EXPE. [3 marks] 96 (2) 50.7 27.2 46.4 20.3 74.8 47.1 17.5 16.0 51.3 39.6 15.2 34.8 21.3 55.1 41.8 26.7 19.9 69.2 54.7 104.9 77.4 50.0 37.4 47.1 39.6