[About Company "Netflix" Current Assets]

1. What is the ending cash plus short-term investments (if applicable) balance of "Netflix" company for the current and previous year?

2. What is Netflix's largest current asset as of the current year-end and what is its balance? Is this surprising to you based on the nature of Netflix's business and why?

3. What is the inventory balance at Netflix company for the current and previous year?

4. What are line items (other than cash and merchandise inventory) are included in current assets?

You can think these questions based on picture of Netflix Financial Statement that I show on this post.

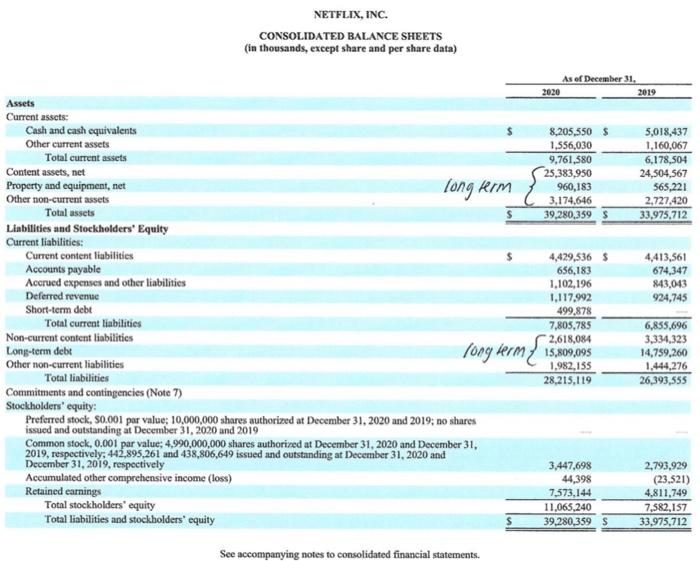

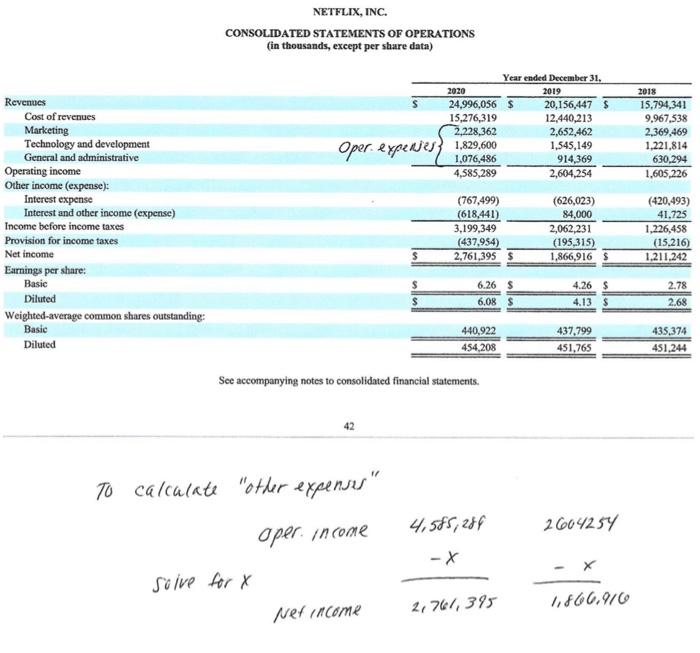

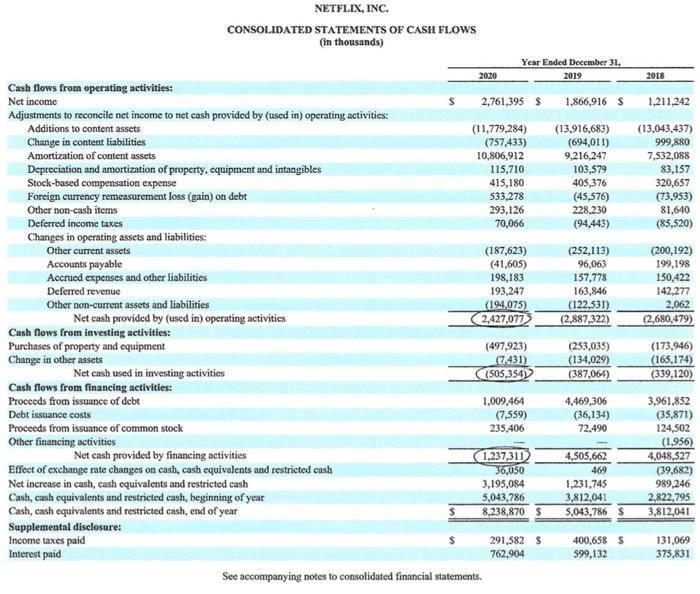

NETFLIX, INC. CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data) long term { $ As of December 31, 2020 2019 Assets Current assets: Cash and cash equivalents 8,205,550 $ 5,018,437 Other current assets 1,556,030 1.160,067 Total current assets 9,761,580 6,178,504 Content assets, net 25,383,950 24,504,567 Property and equipment, net 960,183 565,221 Other non-current assets 3.174.646 2.727.420 Total assets 39,280.359 $ 33.975,712 Liabilities and Stockholders' Equity Current liabilities: Current content liabilities 4,429,536 $ 4,413,561 Accounts payable 656,183 674,347 Accrued expenses and other liabilities 1,102,196 843,043 Deferred revenue 1,117,992 924,745 Short-term debe 499,878 Total current liabilities 7,805,785 6,855,696 Non-current content liabilities 2,618,084 3,334.323 Long-term debt Tong term 15.809,095 14,759,260 Other non-current liabilities 1.982,155 1.444,276 Total liabilities 28,215,119 26,393,555 Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, 50.001 por value; 10,000,000 shares authorized at December 31, 2020 and 2019; no shares issued and outstanding at December 31, 2020 and 2019 Common stock, 0.001 par value: 4.990,000,000 shares authorized at December 31, 2020 and December 31, 2019, respectively: 442,895,261 and 438,806,649 issued and outstanding at December 31, 2020 and December 31, 2019, respectively 3,447,698 2,793,929 Accumulated other comprehensive income (loss) 44,398 (23.521) Retained earnings 7,573,144 4,811,749 Total stockholders' equity 11,065,240 7,582,157 Total liabilities and stockholders' equity s 39,280,359 S 33,975.712 { See accompanying notes to consolidated financial statements. NETFLIX, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) Year ended December 31, 2020 2019 24,996,056 $ 20,156,447 5 15,276,319 12,440,213 2,228,362 2,652,462 1,545,149 1,076,486 914,369 4,585,289 2,604,254 2018 15,794,341 9,967,538 2,369,469 1,221,814 630.294 1,605,226 Oper expenes 1.829.600 Revenues Cost of revenues Marketing Technology and development General and administrative Operating income Other income (expense): Interest expense Interest and other income (expense) Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Weighted average common shares outstanding: Basie Diluted (767,499) (618,441) 3,199,349 (437,954) 2,761,395 $ (626,023) 84,000 2,062,231 (195,315) 1,866,916 $ (420,493) 41,725 1,226,458 (15,216) 1.211.242 $ 6.26 $ 6.08 $ 4.26 $ 4.13 $ 2.78 2.68 440,922 454,208 437,799 451,765 435,374 451 244 See accompanying notes to consolidated financial statements. 42 70 calculate "other expenses" 4,585, 286 2604254 oper income -X solve for X Ner income 2,761,395 1,866,916 2018 1.211.242 (13,043,437) 999,880 7,532,088 83,157 320,657 (73.953) 81,640 (85,520) NETFLIX, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Year Ended December 31. 2020 2019 Cash flows from operating activities: Net income 2,761,395 $ 1,866,916 s Adjustments to reconcile net income to net cash provided by (used in) operating activities: Additions to content assets (11,779,284) (13,916,683) Change in content liabilities (757,433) (694,011) Amortization of content assets 10,806,912 9,216,247 Depreciation and amortization of property, equipment and intangibles 115,710 103,579 Stock-based compensation expense 415,180 405,376 Foreign currency remeasurement loss (gain) on debt 533,278 (45,576) Other non-cash items 293.126 228,230 Deferred income taxes 70,066 (94,443) Changes in operating assets and liabilities: Other current assets (187,623) (252,113) Accounts payable (41,605) 96,063 Accrued expenses and other liabilities 198,183 157,778 Deferred revenue 193,247 163,846 Other non-current assets and liabilities (194,075) (122,531) Net cash provided by (used in) operating activities 2,427,077 (2,887,322) Cash flows from investing activities: Purchases of property and equipment (497,923) (253,035) Change in other assets (7.431) (134,029) Net cash used in investing activities (505,354) (387,064) Cash flows from financing activities: Proceeds from issuance of debt 1,009,464 4,469,306 Debt issuance costs (7,559) (36,134) Proceeds from issuance of common stock 235,406 72.490 Other financing activities Net cash provided by financing activities 1,237,311 4,505,662 Effect of exchange rate changes on cash, cash equivalents and restricted cash 36,050 469 Net increase in cash, cash equivalents and restricted cash 3,195,084 1,231,745 Cash, cash equivalents and restricted cash, beginning of year 5,043,786 3,812,041 Cash, cash equivalents and restricted cash, end of year 8,238,8705 5,043,786 5 Supplemental disclosure: Income taxes paid 291,582 $ 400,658 5 Interest paid 762,904 599,132 See accompanying notes to consolidated financial statements. (200,192) 199.198 150,422 142,277 2,062 (2.680,479) (173,946) (165,174) (339,120) 3,961,852 (35,871) 124,502 (1.956) 4,048,527 (39,682) 989,246 2,822,795 3,812,041 131,069 375,831