Above are my answers thus far. I require additional support for question 5 & 6.

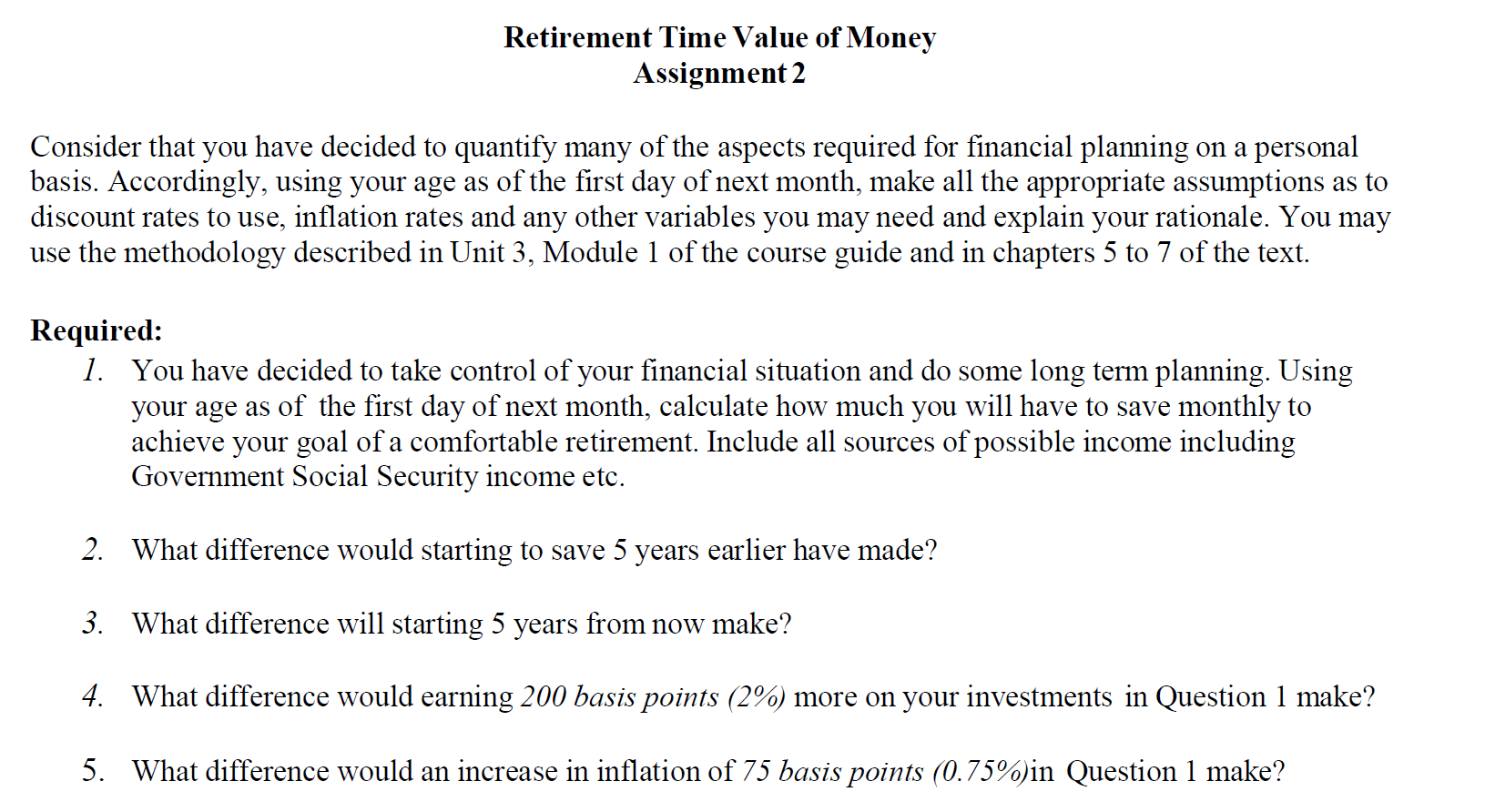

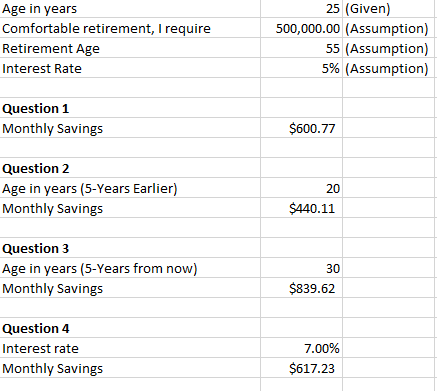

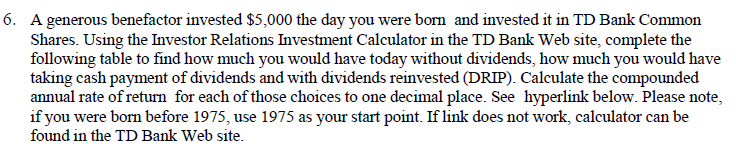

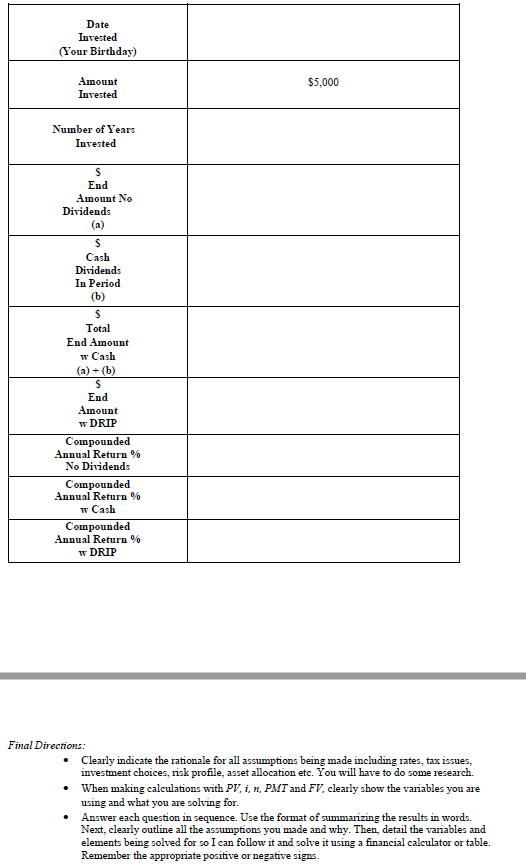

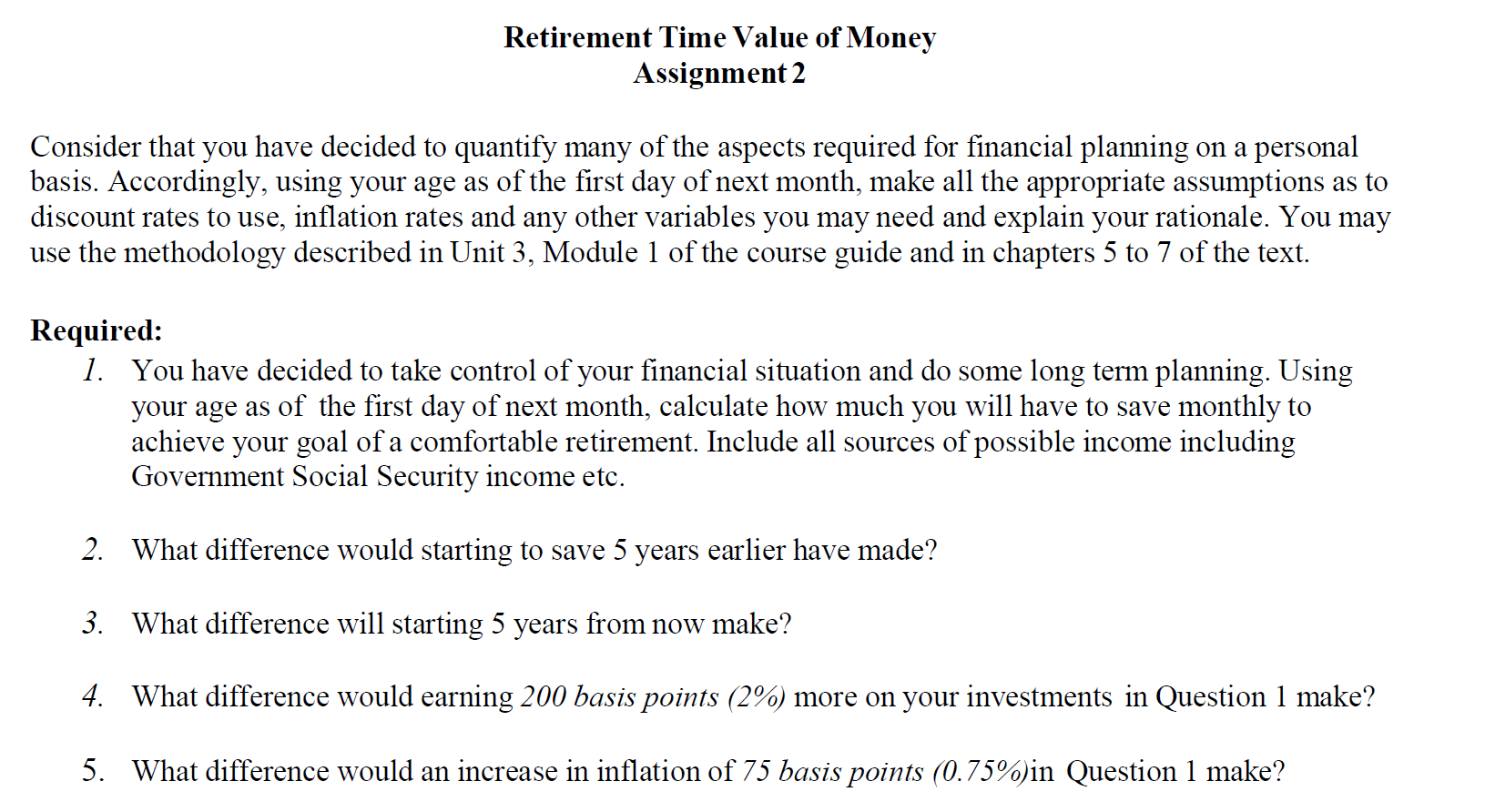

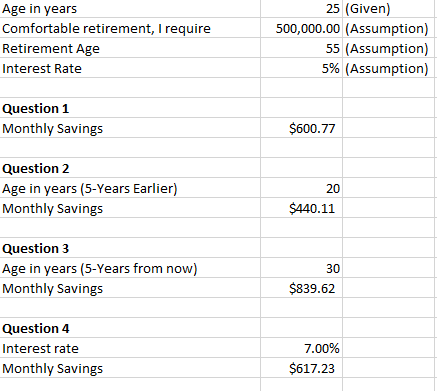

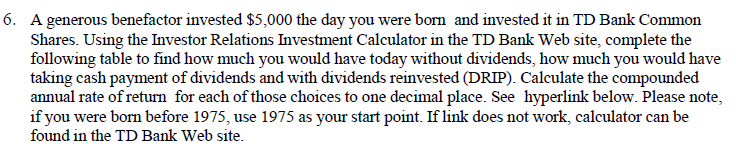

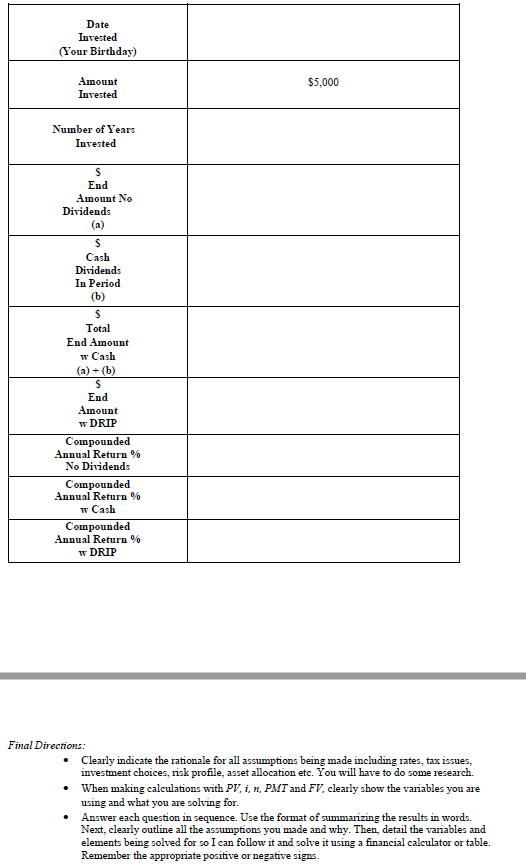

Retirement Time Value of Money Assignment 2 Consider that you have decided to quantify many of the aspects required for financial planning on a personal basis. Accordingly, using your age as of the first day of next month, make all the appropriate assumptions as to discount rates to use, inflation rates and any other variables you may need and explain your rationale. You may use the methodology described in Unit 3, Module 1 of the course guide and in chapters 5 to 7 of the text. Required: 1. You have decided to take control of your financial situation and do some long term planning. Using your age as of the first day of next month, calculate how much you will have to save monthly to achieve your goal of a comfortable retirement. Include all sources of possible income including Government Social Security income etc. 2. What difference would starting to save 5 years earlier have made? 3. What difference will starting 5 years from now make? 4. What difference would earning 200 basis points (2%) more on your investments in Question 1 make? 5. What difference would an increase in inflation of 75 basis points (0.75%)in Question 1 make? Age in years Comfortable retirement, I require Retirement Age Interest Rate 25 (Given) 500,000.00 (Assumption) 55 (Assumption) 5% (Assumption) Question 1 Monthly Savings $600.77 Question 2 Age in years (5-Years Earlier) Monthly Savings 20 $440.11 Question 3 Age in years (5-Years from now) Monthly Savings 30 $839.62 Question 4 Interest rate Monthly Savings 7.00% $617.23 6. A generous benefactor invested $5,000 the day you were born and invested it in TD Bank Common Shares. Using the Investor Relations Investment Calculator in the TD Bank Web site, complete the following table to find how much you would have today without dividends, how much you would have taking cash payment of dividends and with dividends reinvested (DRIP). Calculate the compounded annual rate of return for each of those choices to one decimal place. See hyperlink below. Please note, if you were born before 1975, use 1975 as your start point. If link does not work, calculator can be found in the TD Bank Web site. Date Invested (Your Birthday) $5,000 Amount Invested Number of Years Invested $ End Amount No Dividends (a) $ Cash Dividends In Period (b) S Total End Amount w Cash (a) + (6) S End Amount w DRIP Compounded Annual Return % No Dividends Compounded Annual Return % w Cash Compounded Annual Return % W DRIP Final Directions: Clearly indicate the rationale for all assumptions being made including rates, tax issues, investment choices, risk profile, asset allocation etc. You will have to do some research. When making calculations with PV, i, n. PMT and FV, clearly show the variables you are using and what you are solving for. Answer each question in sequence. Use the format of summarizing the results in words. Next, clearly outline all the assumptions you made and why. Then, detail the variables and elements being solved for so I can follow it and solve it using a financial calculator or table. Remember the appropriate positive or negative signs