Question

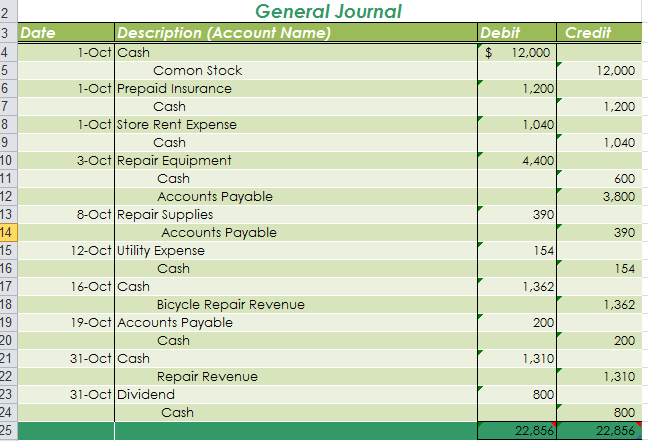

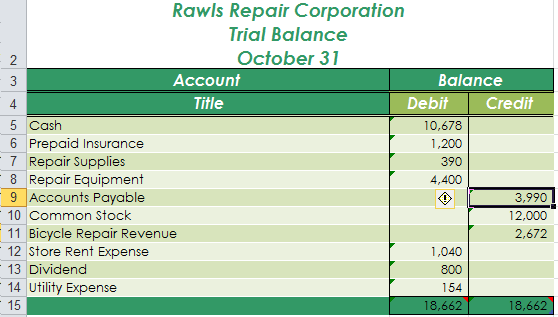

Above is a General Journal and below is the Trial Balance . ____________________________________________________________________________________ Requirement #4: Prepare adjusting entries using the following information in the General

Above is a General Journal and below is the Trial Balance.

____________________________________________________________________________________

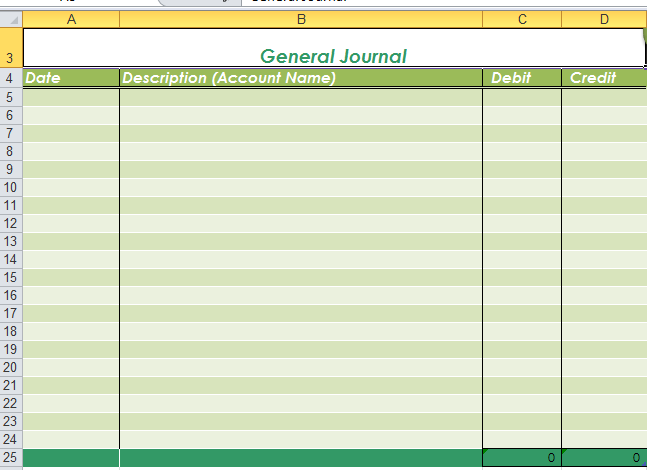

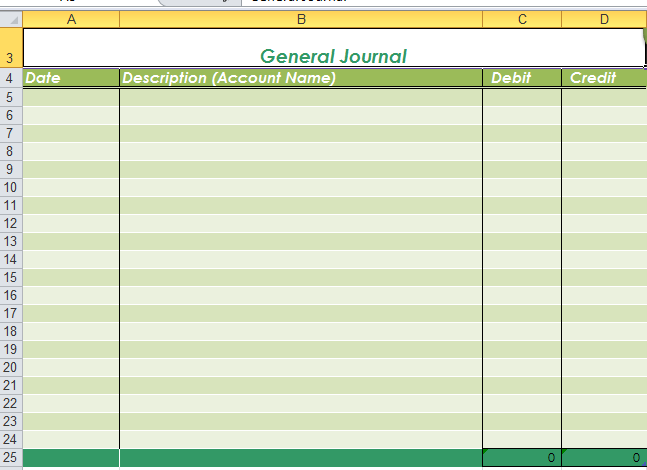

Requirement #4: Prepare adjusting entries using the following information in the General Journal below.

Show your calculations!

a) One month's insurance has expired. b) The remaining inventory of repair supplies is $194. c) The estimated depreciation on repair equipment is $70. d) The estimated income taxes are $40.

Requirement #5:

- Post the adjusting entries on October 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed.

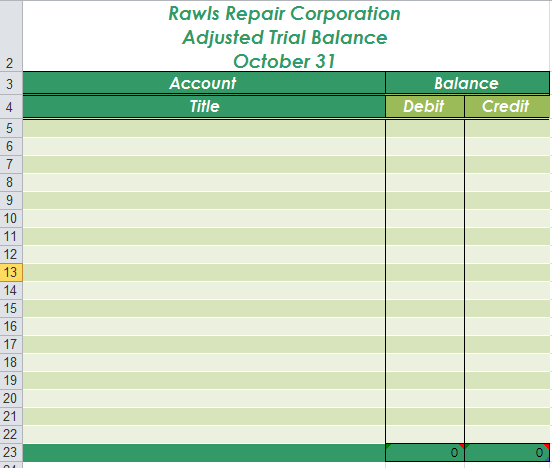

REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below.

Requirement #7:

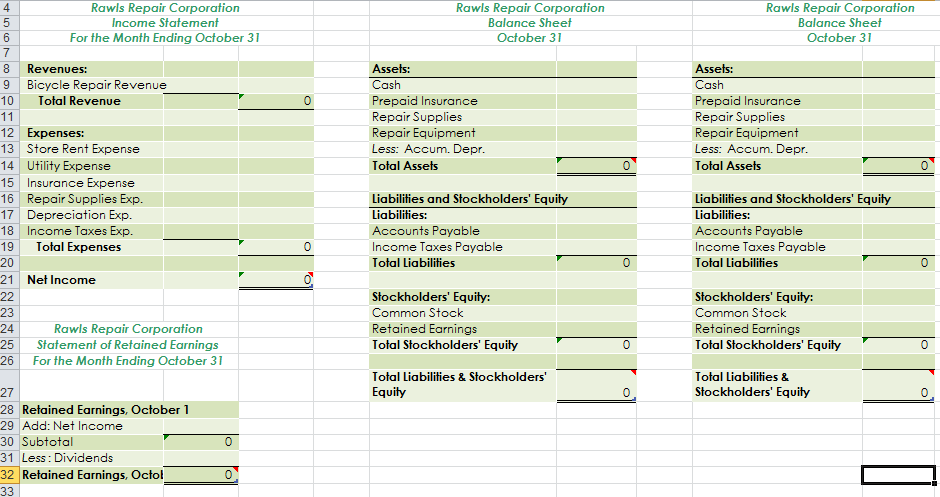

- ? Prepare the financial statements for Rawls Repair Corporation as of October 31 in the space below.

- You will only be preparing the Income Statement, Statement of Retained Earning and the Balance Sheet.

- The Statement of Cash Flows is a required Financial Statement, but is not required for this Project.

Requirement #8:

- Prepare the closing entries at October 31 in the General Journal below. Hint: use the balances for each account which appear on the Adjusted Trial Balance for your closing entries.

Requirement #9:

- Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending balances. Just add to the adjusted balances already listed.

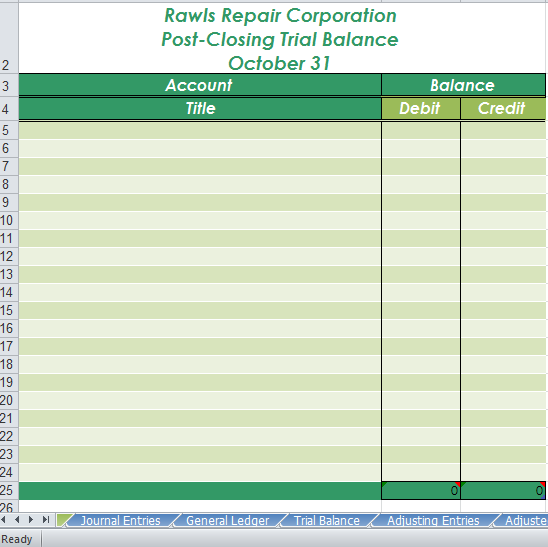

Requirement #10: Prepare a post-closing trial balance as of October 31 in the space below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started