Answered step by step

Verified Expert Solution

Question

1 Approved Answer

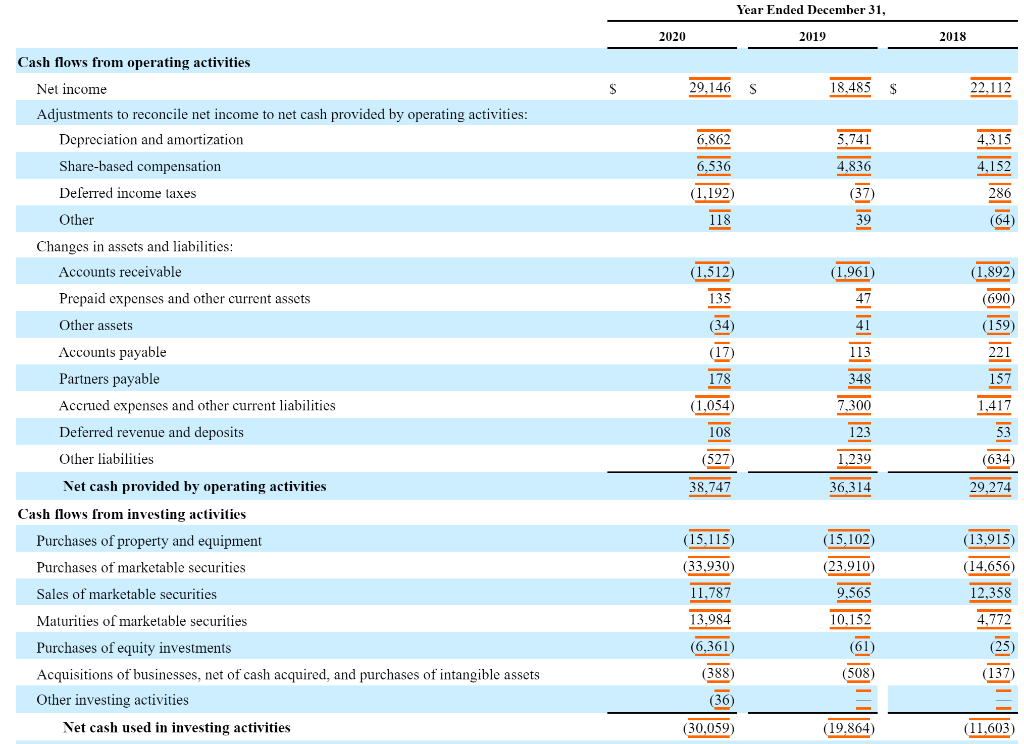

Above is Facebook's Cash Flow from operating activities. Is other liabilities and other assets part of current or non current liabilities? Year Ended December 31,

Above is Facebook's Cash Flow from operating activities. Is other liabilities and other assets part of current or non current liabilities?

Year Ended December 31, 2020 2019 2018 29,146 S 18,485 $ Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Share-based compensation Deferred income taxes 6,862 5,741 6,536 4,836 (1,192) Other 118 Changes in assets and liabilities: Accounts receivable Prepaid expenses and other current assets (1,961) (1,512) 135 Other assets (17) 178 (1,054 I 1948 38 131565-31 3809 2016121 OF 13423 ) SEES 92806330 328 7,300 108 (527) Accounts payable Partners payable Accrued expenses and other current liabilities Deferred revenue and deposits Other liabilities Net cash provided by operating activities Cash flows from investing activities Purchases of property and equipment Purchases of marketable securities Sales of marketable securities Maturities of marketable securities Purchases of equity investments Acquisitions of businesses, net of cash acquired, and purchases of intangible assets Other investing activities Net cash used in investing activities 1,239 38,747 36,314 (15,115 (15,102 (33,930) (23.910) 11,787 9,565 13.984 10.152 (6,361) (388 (36) (30,059) (19.864) (11,603)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started