ABOVE IS INFORMATION AND THE QUESTION IS BELOW:

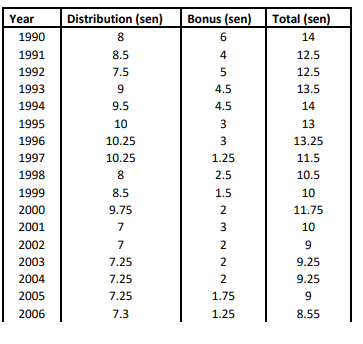

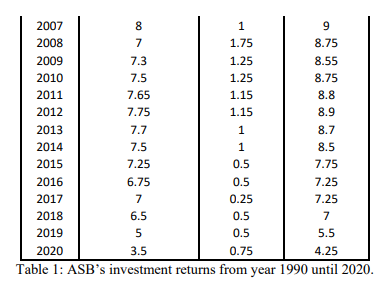

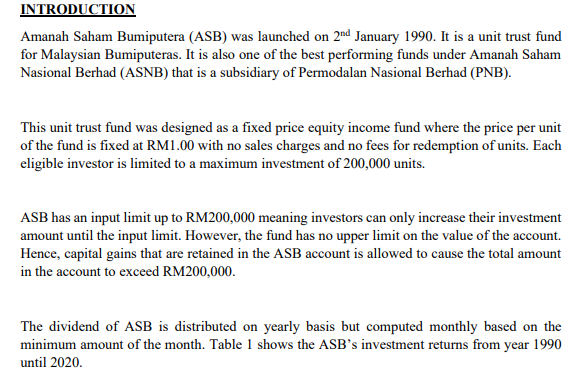

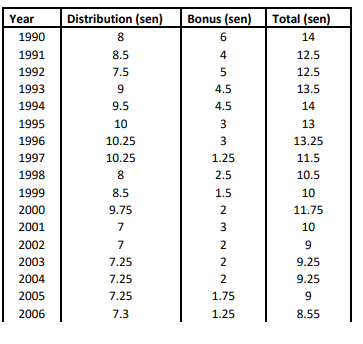

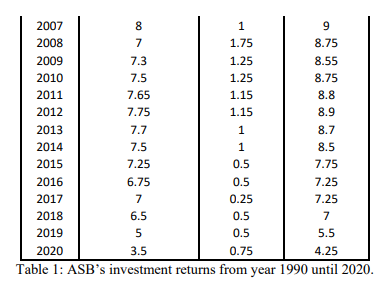

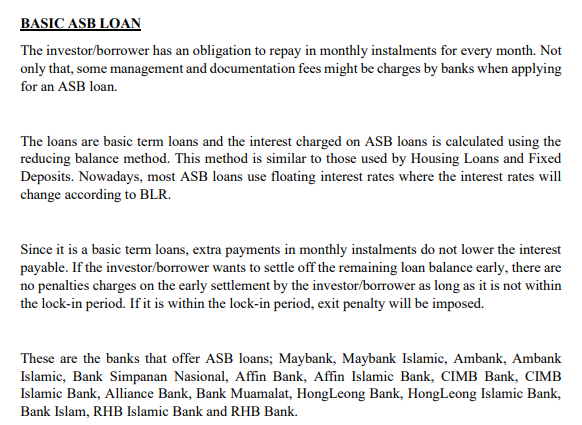

INTRODUCTION Amanah Saham Bumiputera (ASB) was launched on 2nd January 1990. It is a unit trust fund for Malaysian Bumiputeras. It is also one of the best performing funds under Amanah Saham Nasional Berhad (ASNB) that is a subsidiary of Permodalan Nasional Berhad (PNB). This unit trust fund was designed as a fixed price equity income fund where the price per unit of the fund is fixed at RM1.00 with no sales charges and no fees for redemption of units. Each eligible investor is limited to a maximum investment of 200,000 units. ASB has an input limit up to RM200,000 meaning investors can only increase their investment amount until the input limit. However, the fund has no upper limit on the value of the account. Hence, capital gains that are retained in the ASB account is allowed to cause the total amount in the account to exceed RM200,000. The dividend of ASB is distributed on yearly basis but computed monthly based on the minimum amount of the month. Table 1 shows the ASB's investment returns from year 1990 until 2020. Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 Distribution (sen) 8 8.5 7.5 9 9.5 10 10.25 10.25 8 8 8.5 9.75 7 7 7.25 7.25 7.25 7.3 Bonus (sen) 6 4 5 4.5 4.5 3 3 1.25 2.5 1.5 2 3 Total (sen) 14 12.5 12.5 13.5 14 13 13.25 11.5 10.5 10 11.75 10 9 9.25 9.25 9 8.55 1999 2000 2001 2002 2003 2004 2005 2 2 2 1.75 1.25 2006 7.5 2007 8 1 9 2008 7 1.75 8.75 2009 7.3 1.25 8.55 2010 1.25 8.75 2011 7.65 1.15 8.8 2012 7.75 1.15 8.9 2013 7.7 1 8.7 2014 7.5 1 8.5 2015 7.25 0.5 7.75 2016 6.75 0.5 7.25 2017 7 0.25 7.25 2018 6.5 0.5 7 2019 5 0.5 5.5 2020 3.5 0.75 4.25 Table 1: ASB's investment returns from year 1990 until 2020. BASIC ASB LOAN The investor/borrower has an obligation to repay in monthly instalments for every month. Not only that, some management and documentation fees might be charges by banks when applying for an ASB loan. The loans are basic term loans and the interest charged on ASB loans is calculated using the reducing balance method. This method is similar to those used by Housing Loans and Fixed Deposits. Nowadays, most ASB loans use floating interest rates where the interest rates will change according to BLR. Since it is a basic term loans, extra payments in monthly instalments do not lower the interest payable. If the investor/borrower wants to settle off the remaining loan balance early, there are no penalties charges on the early settlement by the investor/borrower as long as it is not within the lock-in period. If it is within the lock-in period, exit penalty will be imposed. These are the banks that offer ASB loans; Maybank, Maybank Islamic, Ambank, Ambank Islamic, Bank Simpanan Nasional, Affin Bank, Affin Islamic Bank, CIMB Bank, CIMB Islamic Bank, Alliance Bank, Bank Muamalat, Hong Leong Bank, Hong Leong Islamic Bank, Bank Islam, RHB Islamic Bank and RHB Bank. TASKS 1) [CLO4] Do provide comparisons between using your own cash to purchase the ASB units (ASB savings) and ASB loan for the followings: a) Minimum investment size b) Maximum investment size c) Return d) Additional costs e) Interest rate risk f) Lock-in period INTRODUCTION Amanah Saham Bumiputera (ASB) was launched on 2nd January 1990. It is a unit trust fund for Malaysian Bumiputeras. It is also one of the best performing funds under Amanah Saham Nasional Berhad (ASNB) that is a subsidiary of Permodalan Nasional Berhad (PNB). This unit trust fund was designed as a fixed price equity income fund where the price per unit of the fund is fixed at RM1.00 with no sales charges and no fees for redemption of units. Each eligible investor is limited to a maximum investment of 200,000 units. ASB has an input limit up to RM200,000 meaning investors can only increase their investment amount until the input limit. However, the fund has no upper limit on the value of the account. Hence, capital gains that are retained in the ASB account is allowed to cause the total amount in the account to exceed RM200,000. The dividend of ASB is distributed on yearly basis but computed monthly based on the minimum amount of the month. Table 1 shows the ASB's investment returns from year 1990 until 2020. Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 Distribution (sen) 8 8.5 7.5 9 9.5 10 10.25 10.25 8 8 8.5 9.75 7 7 7.25 7.25 7.25 7.3 Bonus (sen) 6 4 5 4.5 4.5 3 3 1.25 2.5 1.5 2 3 Total (sen) 14 12.5 12.5 13.5 14 13 13.25 11.5 10.5 10 11.75 10 9 9.25 9.25 9 8.55 1999 2000 2001 2002 2003 2004 2005 2 2 2 1.75 1.25 2006 7.5 2007 8 1 9 2008 7 1.75 8.75 2009 7.3 1.25 8.55 2010 1.25 8.75 2011 7.65 1.15 8.8 2012 7.75 1.15 8.9 2013 7.7 1 8.7 2014 7.5 1 8.5 2015 7.25 0.5 7.75 2016 6.75 0.5 7.25 2017 7 0.25 7.25 2018 6.5 0.5 7 2019 5 0.5 5.5 2020 3.5 0.75 4.25 Table 1: ASB's investment returns from year 1990 until 2020. BASIC ASB LOAN The investor/borrower has an obligation to repay in monthly instalments for every month. Not only that, some management and documentation fees might be charges by banks when applying for an ASB loan. The loans are basic term loans and the interest charged on ASB loans is calculated using the reducing balance method. This method is similar to those used by Housing Loans and Fixed Deposits. Nowadays, most ASB loans use floating interest rates where the interest rates will change according to BLR. Since it is a basic term loans, extra payments in monthly instalments do not lower the interest payable. If the investor/borrower wants to settle off the remaining loan balance early, there are no penalties charges on the early settlement by the investor/borrower as long as it is not within the lock-in period. If it is within the lock-in period, exit penalty will be imposed. These are the banks that offer ASB loans; Maybank, Maybank Islamic, Ambank, Ambank Islamic, Bank Simpanan Nasional, Affin Bank, Affin Islamic Bank, CIMB Bank, CIMB Islamic Bank, Alliance Bank, Bank Muamalat, Hong Leong Bank, Hong Leong Islamic Bank, Bank Islam, RHB Islamic Bank and RHB Bank. TASKS 1) [CLO4] Do provide comparisons between using your own cash to purchase the ASB units (ASB savings) and ASB loan for the followings: a) Minimum investment size b) Maximum investment size c) Return d) Additional costs e) Interest rate risk f) Lock-in period