above is the instructions.

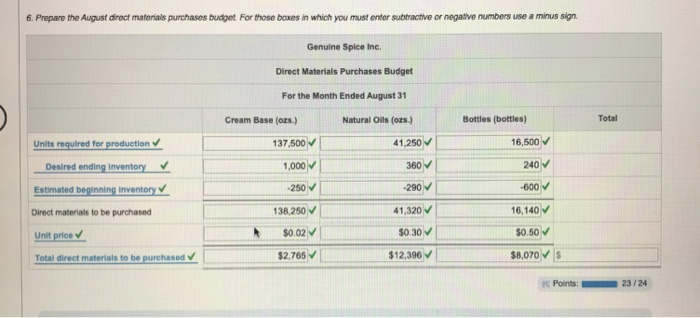

for #6 i need help with the total direct materials to be puchased.

for question number #, please help me with the blank boxes.

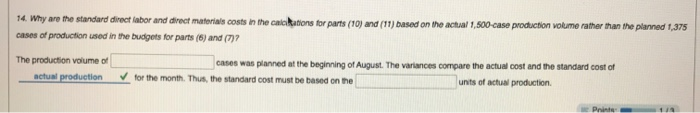

then i need help with number 14 please!

below is part 6&7 also 10 and 11 to help with numner 14

please help me! thank you so much!

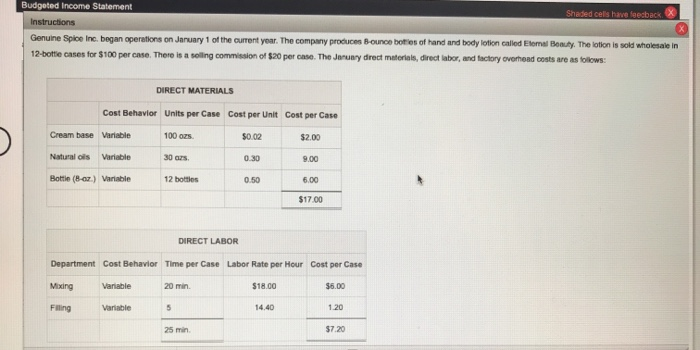

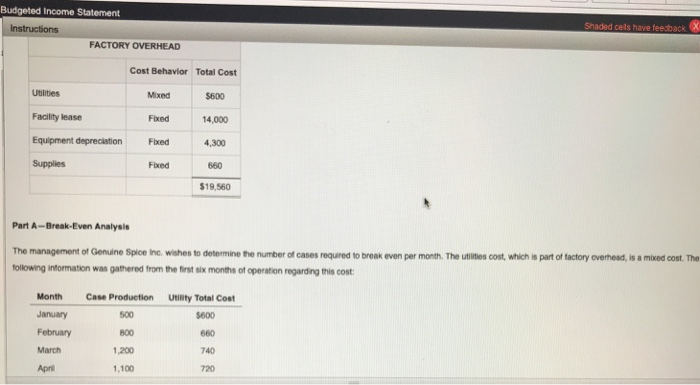

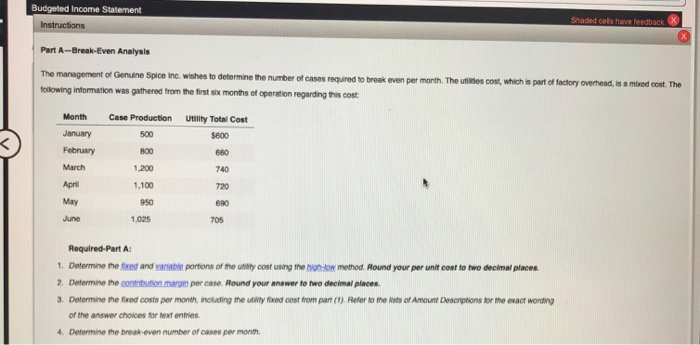

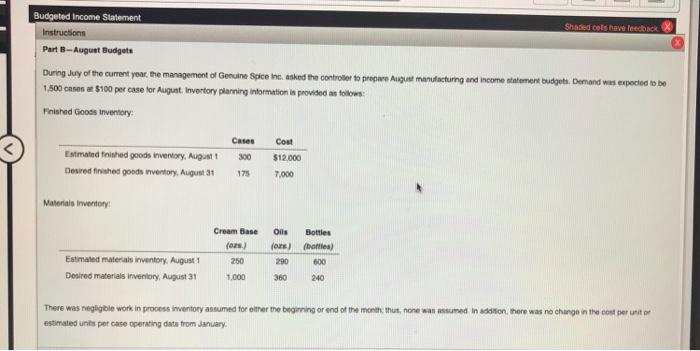

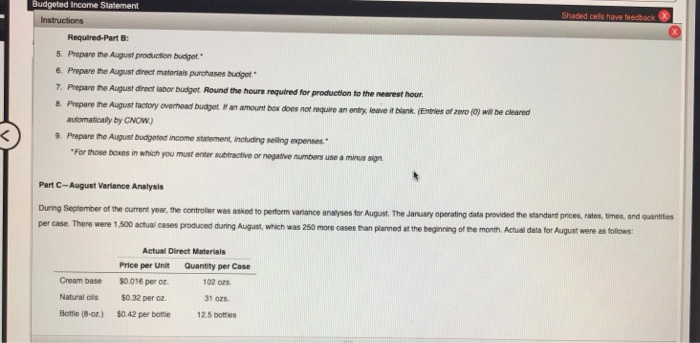

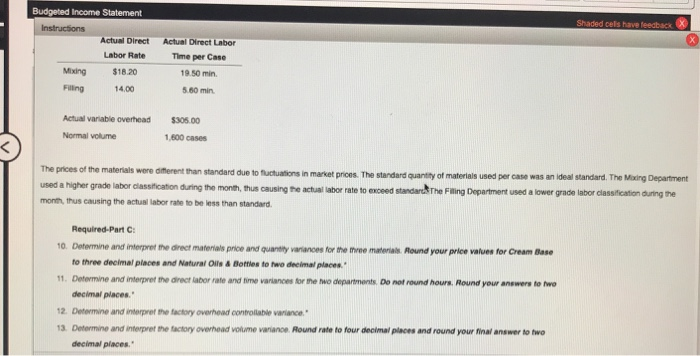

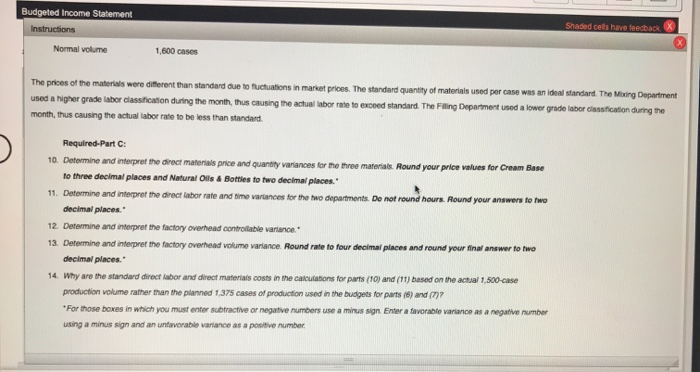

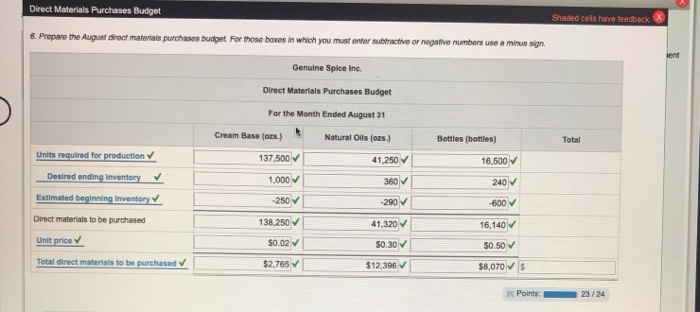

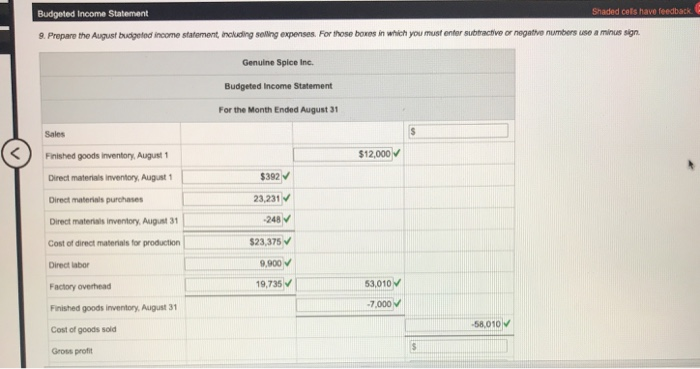

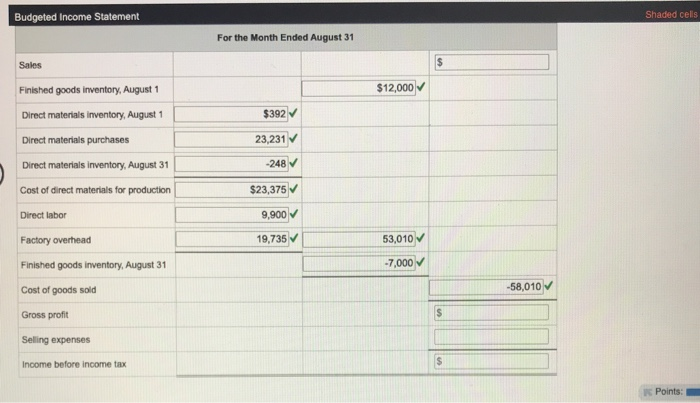

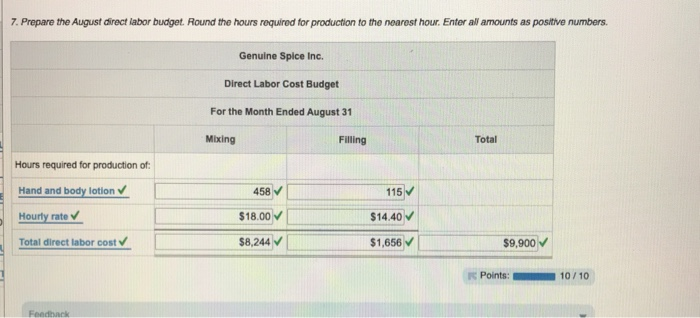

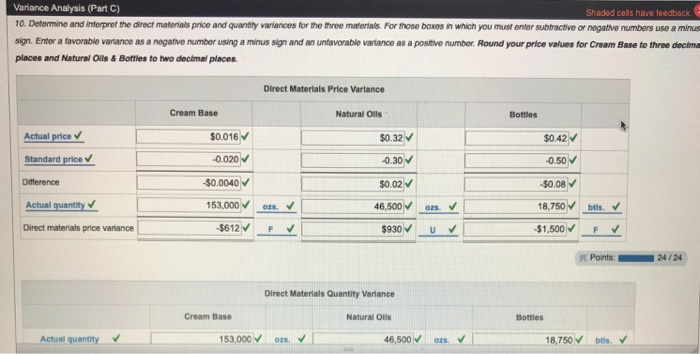

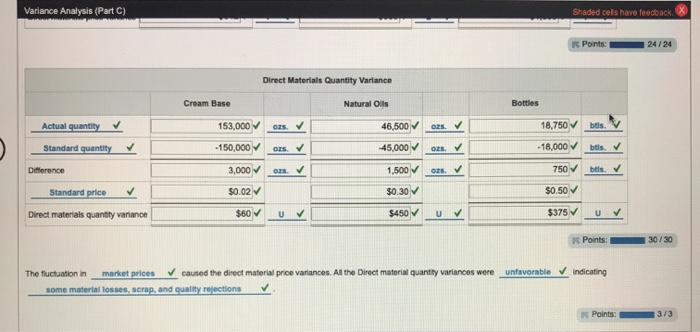

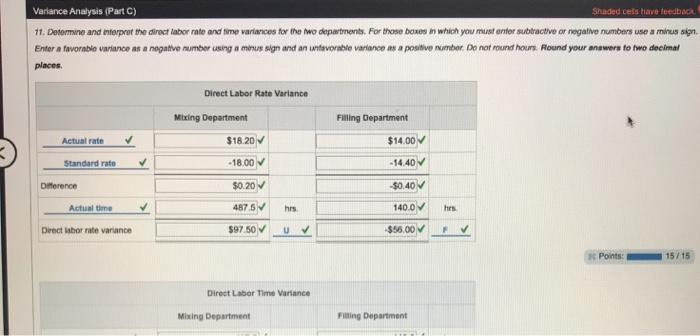

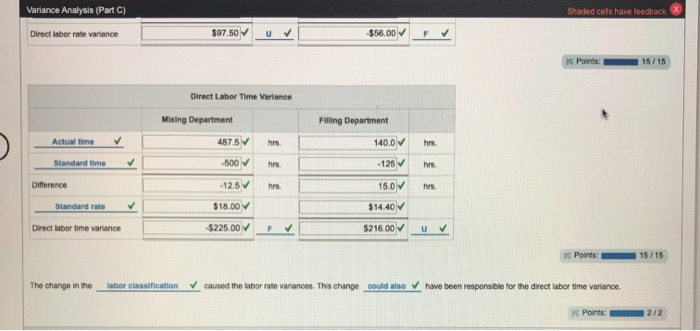

Budgeted Income Statement Shaded cels have feedback Instructions Genuine Spice Inc. began operations on January 1 of the current year. The company produces Bounce bottles of hand and body lotion called Elmal Beauty The lotion is sold wholesale in 12-bottle cases for $100 percase. There is a selling commission of $20 per case. The Januarydret materials, direct labor, and factory overhead costs are as follows: DIRECT MATERIALS Cost Behavior Units per Case Cost per Unit Cost per Case Cream base Variable 100 rs $0.02 $2.00 Natural oils Variable 30 0.30 9.00 Bottie (8-0) Variable 12 bottles 0.50 6.00 $17.00 DIRECT LABOR Department Cost Behavior Time per Case Labor Rate per Hour Cost per Case Mixing Variable 20 min. $18.00 $6.00 Filling Variable 5 14.40 1.20 25 min $7.20 Budgeted Income Statement Instructions FACTORY OVERHEAD Shaded cels have feedback X Cost Behavior Total Cost Utilities Mixed 5600 Facility lease Fixed 14,000 Equipment depreciation Fixed 4,300 Supplies Fixed 660 $19,560 Part A--Break Even Analysis The management of Genuine Spice Inc. wishes to determine the number of cases required to break even per month. The unites cost, which is part of factory overhead, is a mixed cont. The followng information was gathered from the first six months of operation regarding this cout Case Production Utility Total Cost January 500 5600 February Month 800 660 March 1,200 740 Apri 1.100 720 Budgeted Income Statement Instructions Shaded cels have feedback. X Part A-Break-Even Analysis The management of Genuine Spice Inc. wishes to determine the number of cases required to break even per month. The utiles cost, which is part of factory overhead, in a mixed cont. The following information was gathered from the first six months of operation regarding this cost: Month January February March Case Production Utility Total Cost 500 $600 800 660 1,200 740 1.100 April May 720 690 950 June 1.025 705 Required-Part A 1. Determine the fixed and variable portions of the utility cost using the tow method Round your per unit cost to two decimal places 2. Determine the contribution mari per case. Round your answer to two decimal places 3. Determine the foxed costs per month, including the lyfied cost from part(1). Refer to the Nists of Amount Descriptions for the exact wording of the answer choices for text entries 4. Determine the break-even number of cases per month Budgeted Income Statement Shaded cols have feedback. X Instructions Part 8-August Budgets During Juy of the current year, the management of Genuine Spice Inc. asked the controller to preparo August manufacturing and income statement budgets. Demand was expected to be 1,500 cases at $100 per case for August. Inventory planning Intormation is provided as follows: Finished Goods Inventory Cases Estimated finished goods inventory, August Desired finished goods nventory, August 31 Cost $12,000 7,000 175 Materials inventory: Cream Base Oils (ons) Bottles (bottles) 250 Estimated materials inventory, August 1 Desired materials inventory, August 31 290 360 600 240 1.000 There was negligible work in process inventory assumed for either the beginning or end of the monththus, none was assumed. In addition, there was no change in the cost per unit estimated units per case operating data from January Shaded cells have feedback X Budgeted Income Statement Instructions Required-Part B: 5. Prepare the August production budget 6. Prepare the August direct materiais purchases budget 7. Prepare the August direct labor budget. Round the hours required for production to the nearest hour 8. Prepare the August factory overhead budget an amount box does not require an entry, leave it blunk. (Entries of roro (0) will be cleared automatically by CNOW) 9. Prepare the August budgeted income statement, including selling experies. *For those bones in which you must enter subtractive or negative numbers use a minus sign Part C-August Vartance Analysis During September of the current year, the controller was asked to perform variance analyses for August. The January operating data provided the standard prices, rutes, times, and quantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the beginning of the month. Actual data for August were as follows: Cream base Actual Direct Materials Price per Unit Quantity per Case $0.016 per or 102 $0.32 per oz. 31 oz $0.42 per bottle 125 boties Natural oils Bottle (8-02) Shaded cells have feedback Budgeted Income Statement Instructions Actual Direct Labor Rate Mixing $18.20 Filling 14.00 Actual Direct Labor Time per Case 19.50 min 5.60 min Actual variable overhead Normal volume $305.00 1.600 cases The prices of the materials were different than standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Moding Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standards The Filing Department used a lower grade labor classification during the month, thus causing the actual labor rate to be less than standard. Required-Part: 10. Determine and interpret the direct materials price and quantity variances for the tree materias. Round your price values for Cream Base to three decimal places and Natural Oils & Bottles to two decimal places 11. Determine and interpret the direct labor rate and time variances for me to compartments. Do not round hours. Round your answers to two decimal places 12. Determine and interpret the factory overhead controllable variance 13. Determine and interpret the factory overhead volume variance. Round rate to four decimal places and round your Ninal answer to two decimal places Budgeted Income Statement Instructions Normal volume Shaded cells have feedback 1,600 cases The prices of the materials were different than standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Moding Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filing Department uned a lower grade labor ciusstication during the month, thus causing the actual labor rate to be less than standard. Required-Part C: 10. Determine and interpret the direct materials price and quantity variances for the three materials. Round your price values for Cream Base to three decimal places and Natural Oils & Bottles to two decimal places. 11. Determine and interpret the direct labor rate and time variances for the two departments. Do not round hours. Round your answers to two decimal places 12. Determine and interpret the factory overhead controllable variance." 13. Determine and interpret the factory overhead volume variance. Round rate to four decimal places and round your final answer to two decimal places. 14. Why are the standard direct labor and direct materials costs in the calculations for parts (10) and (11) based on the actual 1,500-case production volume rather than the planned 1,375 cases of production used in the budgets for parts (6) and (7? For those boxes in which you must enter subtractive or negative numbers use a minus sign. Enter a favorabilo variance as a negative number using a minus sign and an unfavorable variance as a positive number Shaded cells have feedback Direct Materials Purchases Budget 6. Prepare the August roct materials purchases budget. For those boxes in which you must enter subtractive or negative numbers use a minus sign. lent Genuine Spice Inc. Direct Materials Purchases Budget For the Month Ended August 31 Cream Base (os.) Natural Oils (os.) Bottles (bottles) Total 137,500 41.250 16.500 1.000 360 240 Units required for production Desired ending inventory Estimated beginning inventory Direct materials to be purchased Unit price -250 -290 -600 138,250 41,320 16,140 $0.02 50.30 $0.50 Total direct materials to be purchased $2.765 $12,396 $8,070 S Points: 23/24 Budgeted Income Statement Shaded cels have feedback 9. Prepare the August budgeted income statement, including seling expenses. For those boxes in which you must enter subtractive or negative numbers use a minus sign Genuine Spice Inc. Budgeted Income Statement For the Month Ended August 31 Sales $12,000 $392 Finished goods inventory, August 1 Direct materials inventory, August 1 Direct materials purchases Direct materials invertory, August 31 Cost of direct materials for production 23,231 -2487 $23,375 9,900 Direct labor Factory overhead 19,735 53,010 Finished goods inventory, August 31 -7.000 -58,010 Cost of goods sold Gross profit Budgeted Income Statement Shaded cells For the Month Ended August 31 Sales $ $12,000 $392 23,231 -248 $23,375 Finished goods inventory, August 1 Direct materials inventory, August 1 Direct materials purchases Direct materials inventory, August 31 Cost of direct materials for production Direct labor Factory overhead Finished goods inventory, August 31 Cost of goods sold Gross profit 9.900 19,735 53,010 -7,000 -58,010 S Selling expenses Income before income tax $ Points: 14. Why are the standard direct labor and direct materials costs in the calculations for parts (10) and (11) based on the actual 1,500-case production volume rather than the planned 1,375 cases of production used in the budgets for parts (6) and (7)? The production volume of Cases was planned at the beginning of August. The variances compare the actual cost and the standard cost of actual production for the month. Thus, the standard cost must be based on the units of actual production Pri 6. Prepare the August direct materials purchases budget. For those boxes in which you must enter subtractive or negative numbers use a minus sign. Genuine Spice Inc. Direct Materials Purchases Budget For the Month Ended August 31 Cream Base (os.) Natural Oils (ozs.) Bottles (bottles) Total Units required for production 137,500 41,250 16,500 1,000 360 240 -250 -290 -600 Desired ending inventory Estimated beginning inventory Direct materials to be purchased Unit price Total direct materials to be purchased 138,250 41,320 16,140 $0.02 $0.30 $0.50 $2.765 $12,396 $8,070 S Points 23/24 7. Prepare the August direct labor budget. Round the hours required for production to the nearest hour. Enter all amounts as positive numbers. Genuine Spice Inc. Direct Labor Cost Budget For the Month Ended August 31 Mixing Filling Total Hours required for production of: 458 115 Hand and body lotion Hourly rate Total direct labor cost v $18.00 $14,40 $8,244 $1,656 $9,900 Points: 10/10 Feedback Variance Analysis (Part C) Shaded cells have feedback 10. Determine and interpret the direct materiais price and quantly variances for the three materials. For those boxes in which you must enter subtractive or negative numbers use a minus sign. Enter a favorable variance as a negative number using a minus sign and an untavorablo variance as a positive number. Round your price values for Cream Base to three decim places and Natural Oils & Bottles to two decimal places. Direct Materials Price Variance Cream Base Natural Oils Bottles $0.016 $0.32 $0.42 -0.020 -0.30 -0.50 Actual price Standard price Difference Actual quantity Direct materials price variance $0.0040 $0.02 -$0.08 153,000 . 46,500 O. 18,750 btls. -5612 F $930 U -$1,500 F Points 24/24 Direct Materials Quantity Variance Cream Base Natural Oils Bottles Actual quantity 153,000 OZS 46,500 V OTS 18.750 bts. Variance Analysis (Part C) Shaded cels have feedback. X Ponts: 24/24 Direct Materials Quantity Variance Cream Base Natural Oils Bottles Actual quantity 153,000 Ozs. 46,500 ozs. 18,750 btis Standard quantity - 150,000 OZ. -45,000 OZS - 18,000 btls. Difference 3,000 os. 1,500 ozs. 750 btls $0.02 $0.30 $0.50 Standard price Direct materials quantity variance $60 U $450 U $375 U Points 30/30 The fluctuation in market prices caused the direct material price variances. All the Direct material quantity variances were unfavorable indicating some material losses, scrap, and quality rejections Points: 3/3 Variance Analysis (Part C) Shaded cels have feedback. 11. Determine and interpret the direct labor rate and time variances for the two departments. For those boxes in which you must enter subtractive or negative numbers use a minus sign. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Do not round hours. Round your answers to two decimal places Direct Labor Rate Variance Mixing Department Filling Department Actual rate $18.20 $14.00 Standard rate - 18.00 - 14.40 Difference $0.20 $0.40 Actual time 487.5 hrs 140.0 hes Direct labor rate variance $97.50 U -$56.00 F Points: 15/15 Direct Labor Time Variance Mixing Department Filling Department Shaded cels have feedback Variance Analysis (Part C) Direct labor rate variance $97.50 -$56.00 Points: 15/15 Direct Labor Time Variance Mixing Department Filling Department Actualtime 487.5 hrs 140.0 hrs Standard time -500 hr hrs -125 15.0 Difference - 12.5 hr hrs $18.00 $14.40 Standard rate Direct inbor time variance $225.00 $216.00 U Points: 15/15 The change in the labor classification caused the labor rate variances. This change could also have been responsible for the direct labor time variance. Points 212