Question

above is Walmart's Five years Financial Summary Above is Walmarts Net Sales You are the newly appointed treasurer and your partner is the newly appointed

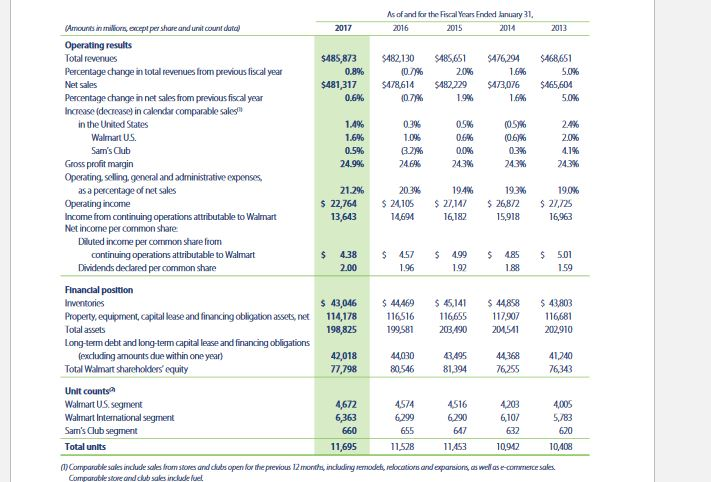

above is Walmart's Five years Financial Summary

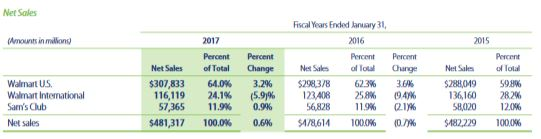

Above is Walmarts Net Sales

You are the newly appointed treasurer and your partner is the newly appointed controller of your company. In order to learn more about your company, you have decided to analyze the companys financial performance over the last 2 years. To do this, you have decided to calculate the following ratios for the companys 2 most recent years in the noted categories

Liquidity Ratio:

Current Ratio

In addition, you will provide a brief analysis of each of the ratios. You will also provide a brief evaluation regarding the companys performance as it relates to the four categories listed above, plus the DuPont Equation. Finally, you will discuss how these ratios will help you make appropriate financial decisions as they relate to your role as a financial manager, and also assist in achieving the firms financial management goals.

As of and for the Fiscal Years Ended khnuary 31, Amounts in miors, encept per share and unat count dutc) Operating results Total revenues Percenitage change in total revenues from previous fiscal year Net sales Pescentage change in net sales from previous fiscal year Increase (decrcase) in caendar comparable sales 2017 2016 2013 $485,873$482,130 $A85,651 $A76294 $468651 15% $481317$478,614 $482229 $A3076 $465,604 107% 1.9% 16% 5.0% in the United States Walrmart US Sam's Club 1.4% 1.6% 0.5% 24% 10% 05% 0.0% 41% Gross profit margin Operating, selling,general and administative expenses, 193% as a percentage of net sales Operating income Income from continuing operations attributable to Walmart Net income per common share 21.2% 194% 190% $ 22,764 2410 2 268/2 21S 16,963 14694 16,182 15,918 Duted income per cormenon share from continuing operations attributable to Walmart $438 $457 $499 $485 $501 159 Dividends dedared per common share 2.00 1.96 1.92 188 Financlal position Property,equipment, capital lease and financing obligation assets,net Total assets Long-term debt and long-term capital lease and financing obligations s 43046 44469 45141 114,17816516 44858 43,803 16681 198,825199581 20B.A90 05 202910 655 0 (excluding amounts due within one year Total Walmart sharcholders equity 42,018 77,798 41,240 80546 81394 Unit counts Walmart US segment Walmart Intenational segment Sam's lub segment Total unlts 4574 4516 4,672 660 11,695 610/ 632 647 11,453 area ra, 620 11,528 10,942 10,408 CQCom arotie sales mdu e sae bom stores and du sopen lor the prevous 12 mont t nou rng sermodeh, re re ande um rete sa es ca we as e Comparoble slore and club sales inclle ueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started