Answered step by step

Verified Expert Solution

Question

1 Approved Answer

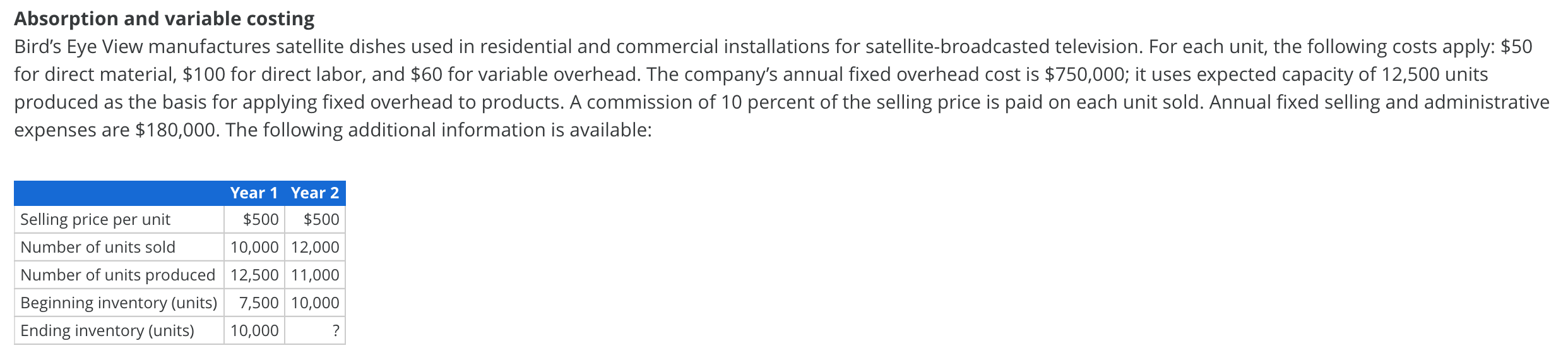

Absorption and variable costing Bird's Eye View manufactures satellite dishes used in residential and commercial installations for satellite-broadcasted television. For each unit, the following

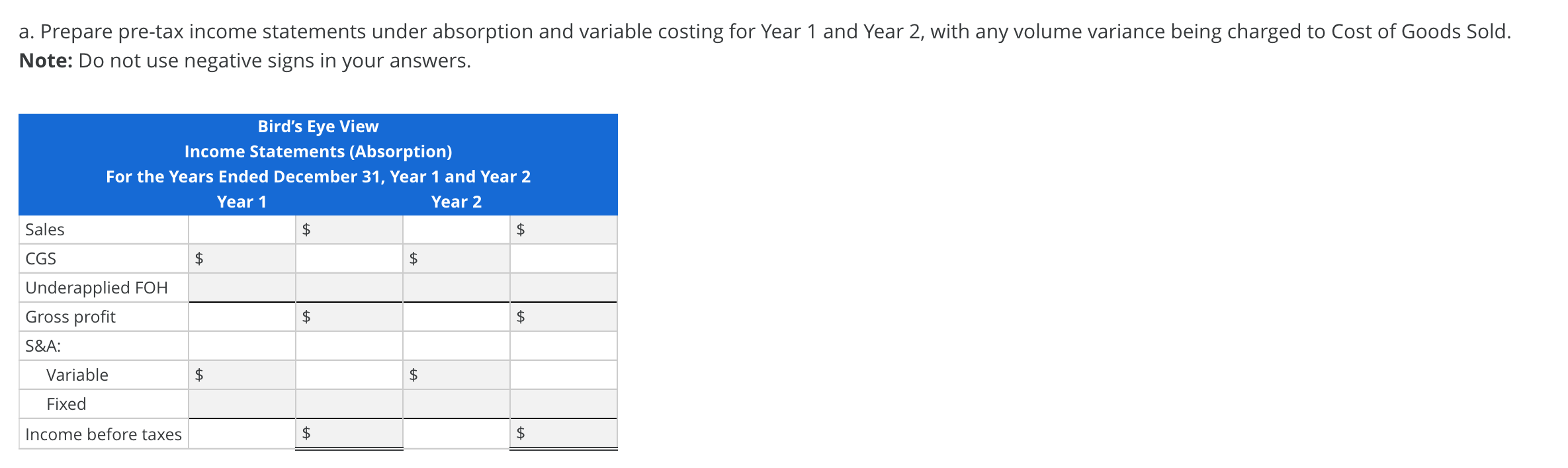

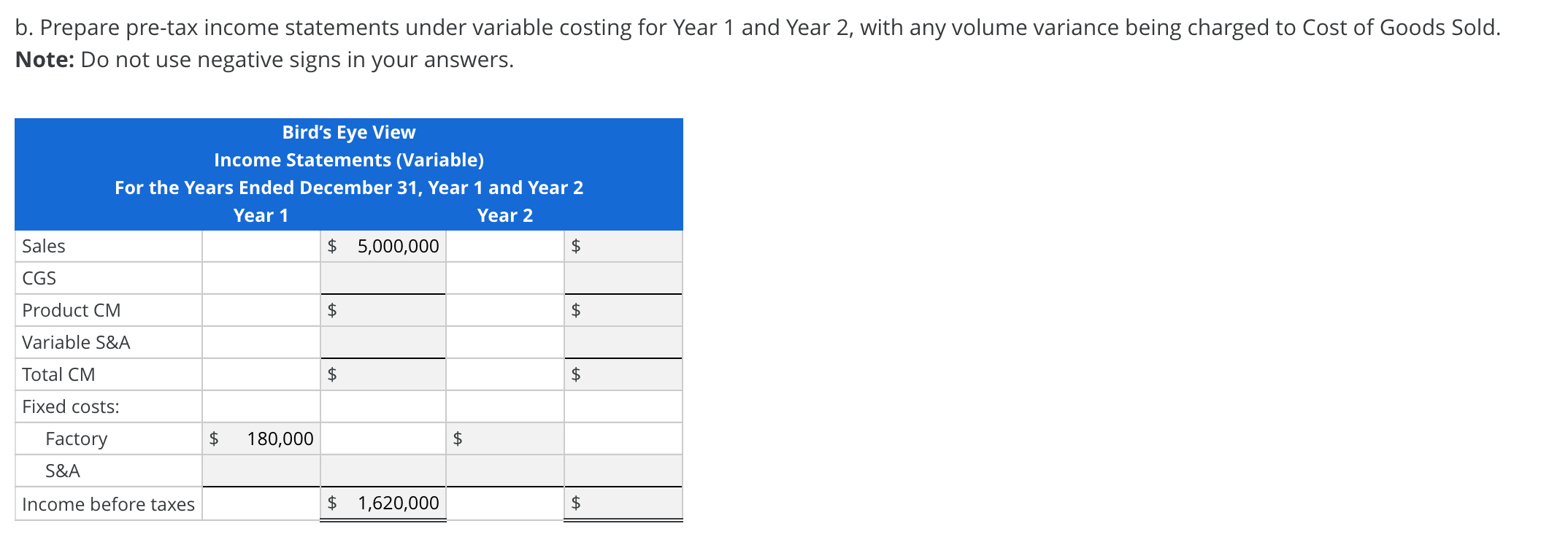

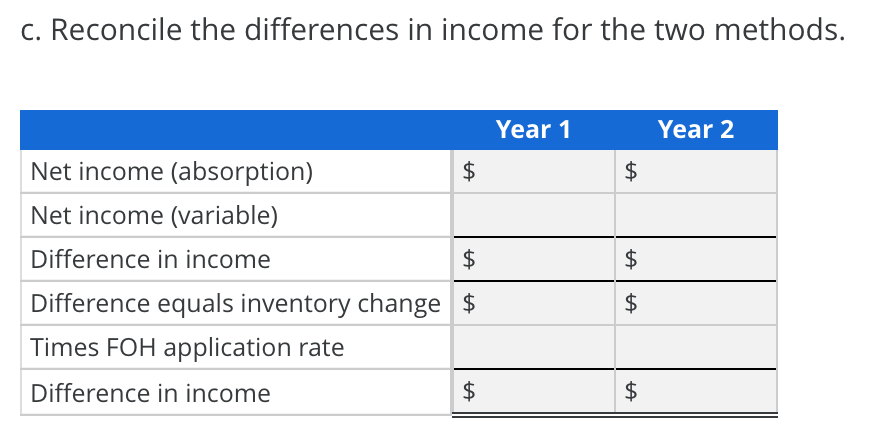

Absorption and variable costing Bird's Eye View manufactures satellite dishes used in residential and commercial installations for satellite-broadcasted television. For each unit, the following costs apply: $50 for direct material, $100 for direct labor, and $60 for variable overhead. The company's annual fixed overhead cost is $750,000; it uses expected capacity of 12,500 units produced as the basis for applying fixed overhead to products. A commission of 10 percent of the selling price is paid on each unit sold. Annual fixed selling and administrative expenses are $180,000. The following additional information is available: Selling price per unit Number of units sold Number of units produced Beginning inventory (units) Ending inventory (units) Year 1 Year 2 $500 $500 10,000 12,000 12,500 11,000 7,500 10,000 10,000 ? a. Prepare pre-tax income statements under absorption and variable costing for Year 1 and Year 2, with any volume variance being charged to Cost of Goods Sold. Note: Do not use negative signs in your answers. Bird's Eye View Income Statements (Absorption) For the Years Ended December 31, Year 1 and Year 2 Sales CGS $ Underapplied FOH Gross profit S&A: Variable $ Fixed Income before taxes Year 1 $ $ $ $ $ Year 2 $ $ +A $ b. Prepare pre-tax income statements under variable costing for Year 1 and Year 2, with any volume variance being charged to Cost of Goods Sold. Note: Do not use negative signs in your answers. Bird's Eye View Income Statements (Variable) For the Years Ended December 31, Year 1 and Year 2 Year 1 $ 5,000,000 Sales CGS Product CM $ Variable S&A Total CM $ Fixed costs: Factory S&A Income before taxes $ 180,000 $ 1,620,000 $ Year 2 $ $ $ $ c. Reconcile the differences in income for the two methods. Year 1 $ Net income (absorption) Net income (variable) Difference in income +A $ Difference equals inventory change $ Times FOH application rate Difference in income +A $ Year 2 +A $ $ +A $ +A $ +A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started