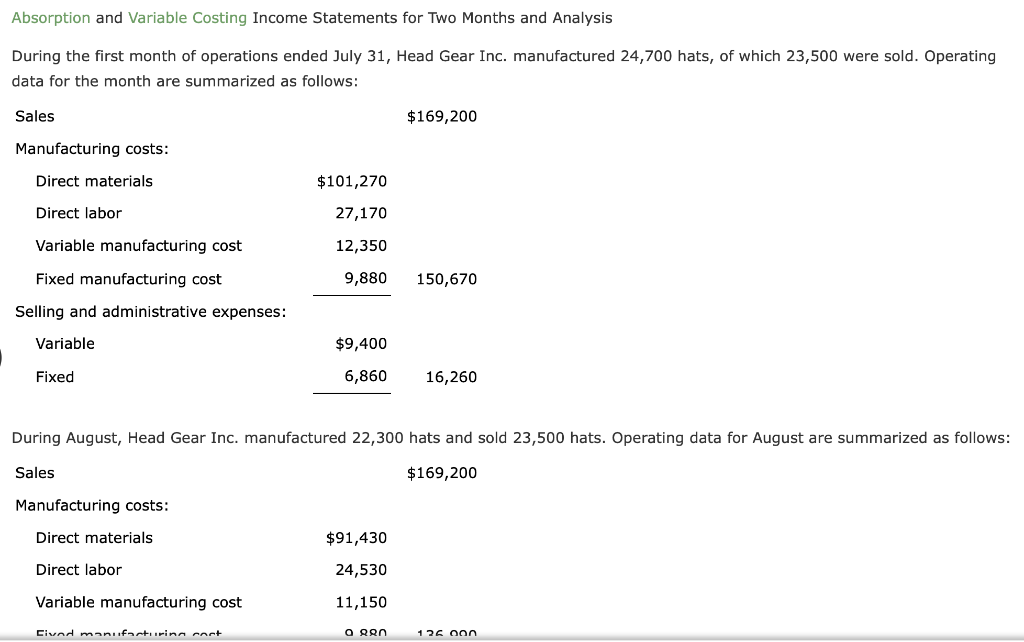

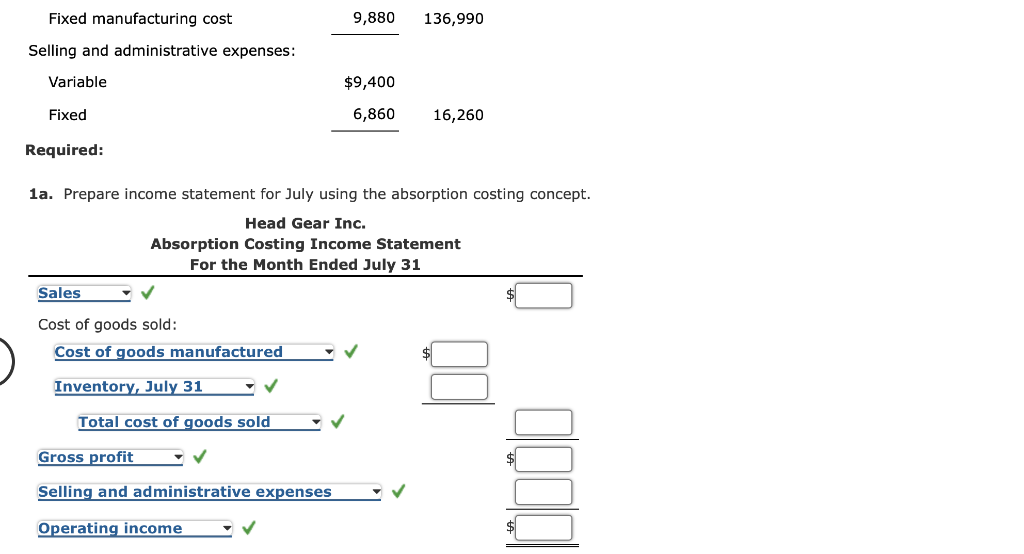

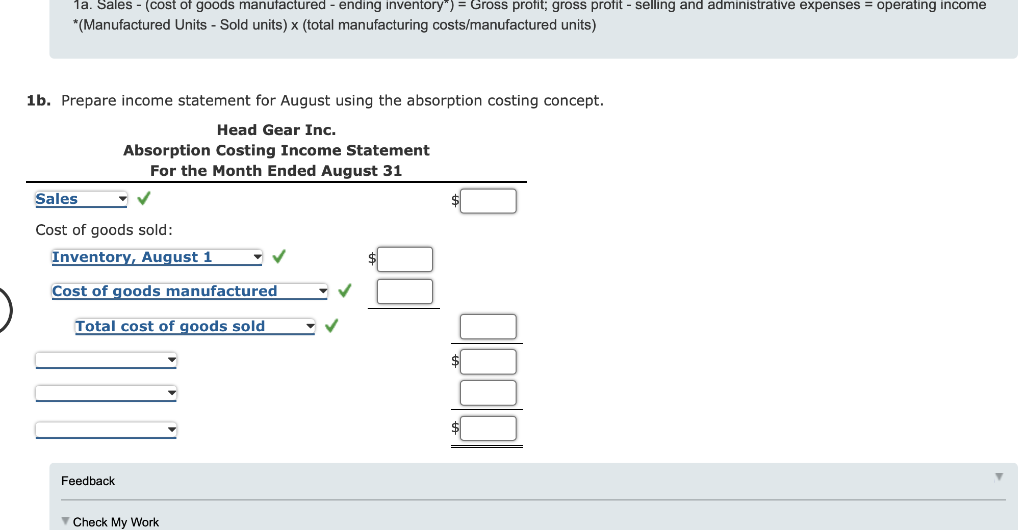

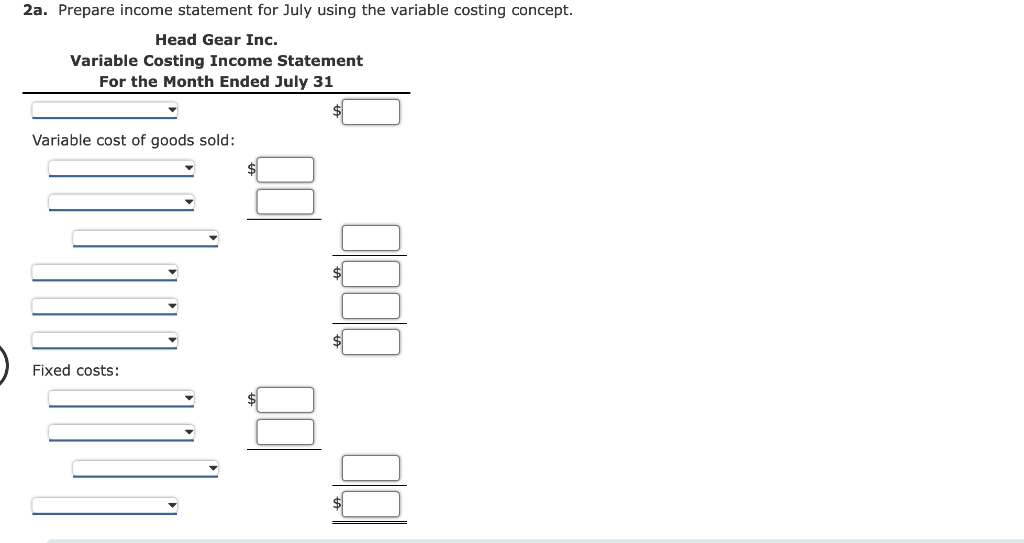

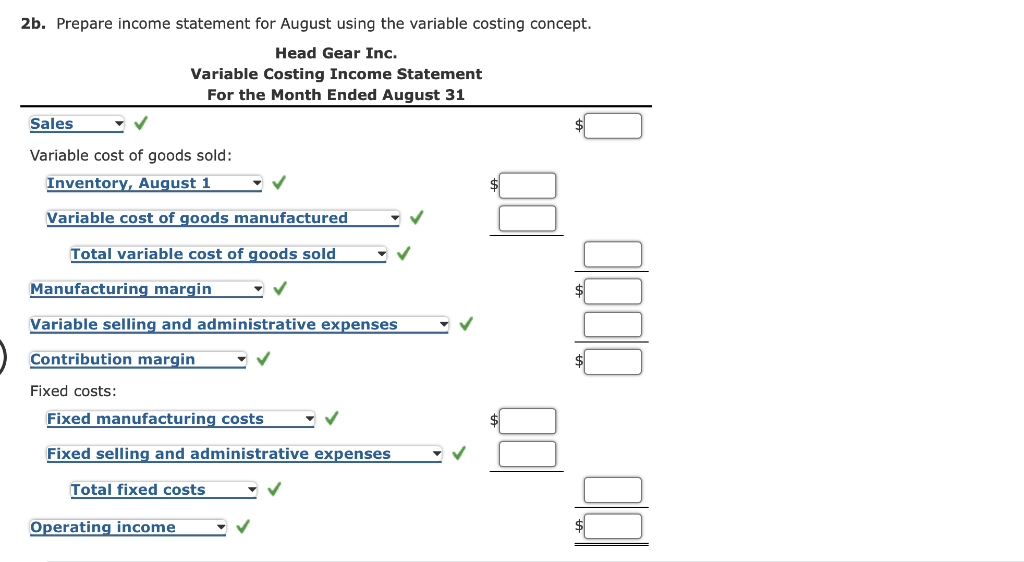

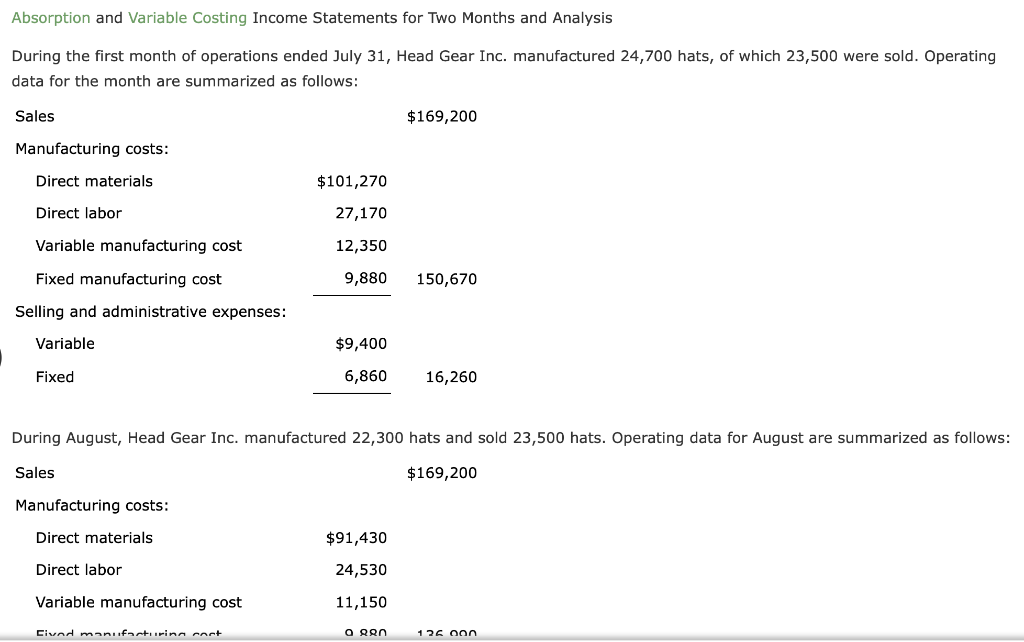

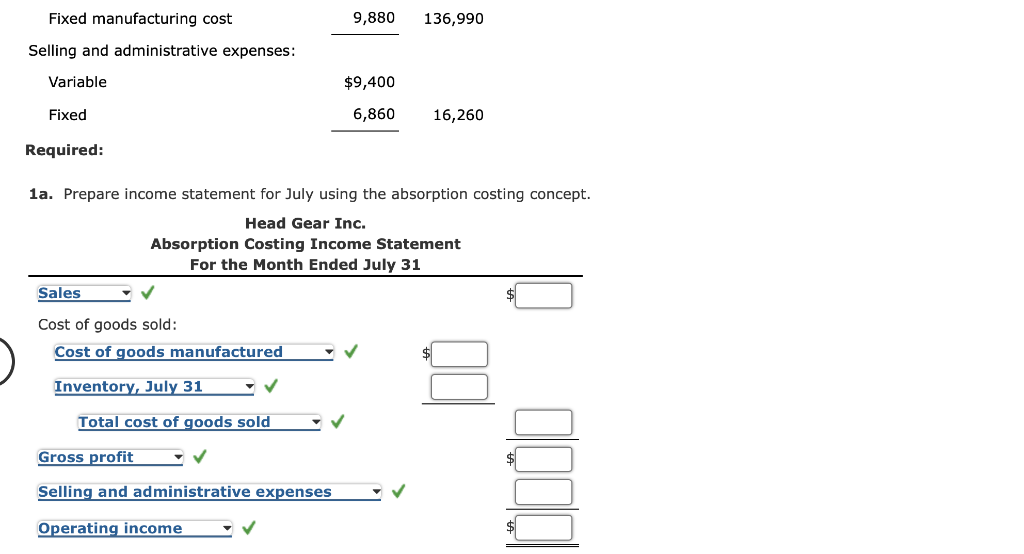

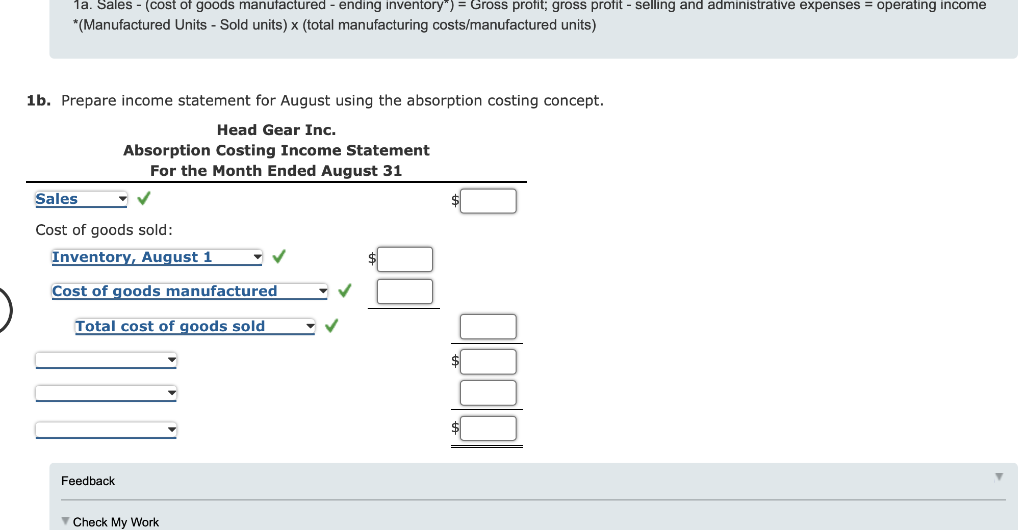

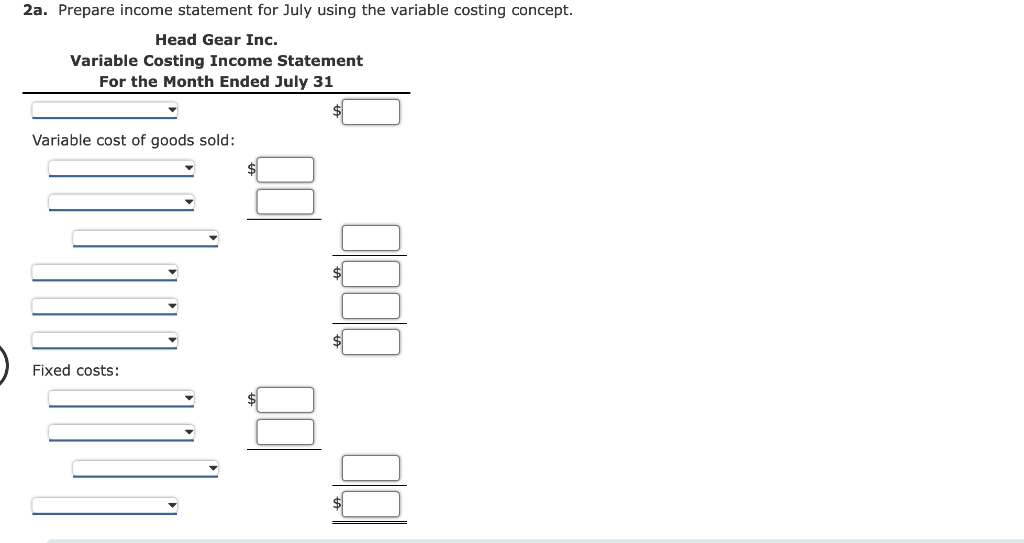

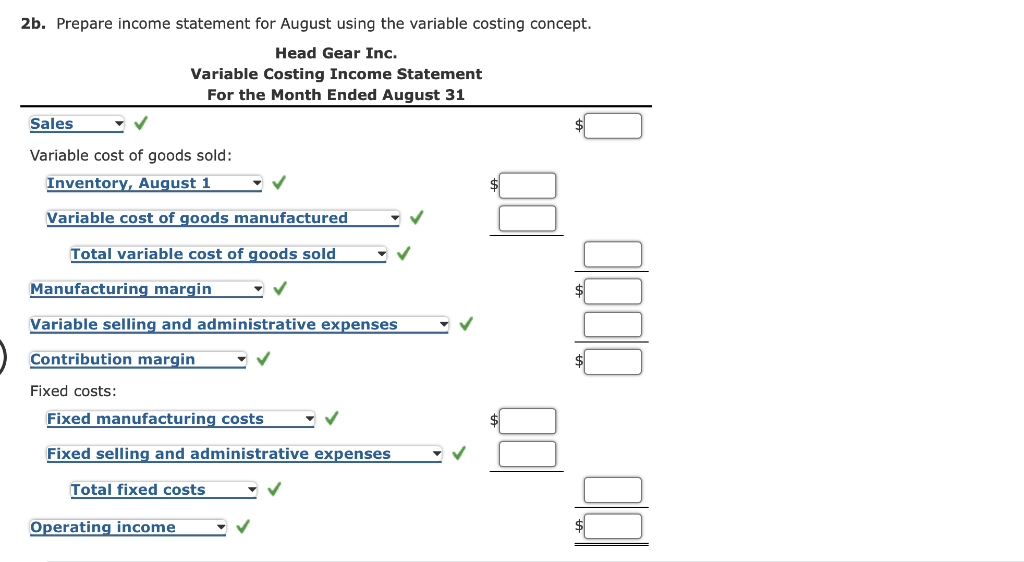

Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 24,700 hats, of which 23,500 were sold. Operating data for the month are summarized as follows: Sales $169,200 Manufacturing costs: Direct materials $101,270 Direct labor 27,170 12,350 Variable manufacturing cost Fixed manufacturing cost 9,880 150,670 Selling and administrative expenses: Variable $9,400 Fixed 6,860 16,260 During August, Head Gear Inc. manufactured 22,300 hats and sold 23,500 hats. Operating data for August are summarized as follows: Sales $169,200 Manufacturing costs: Direct materials $91,430 Direct labor 24,530 Variable manufacturing cost 11,150 Civad manufacturina mort ogen 126 oon Fixed manufacturing cost 9,880 136,990 Selling and administrative expenses: Variable $9,400 Fixed 6,860 16,260 Required: 1a. Prepare income statement for July using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended July 31 Sales Cost of goods sold: Cost of goods manufactured Inventory, July 31 Total cost of goods sold Gross profit LOOD Selling and administrative expenses Operating income 1a. Sales - cost of goods manufactured - ending inventory") = Gross profit; gross profit - selling and administrative expenses = operating income *(Manufactured Units - Sold units) (total manufacturing costs/manufactured units) 1b. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales $ Cost of goods sold: Inventory, August 1 Cost of goods manufactured Total cost of goods sold $ Feedback Check My Work 2a. Prepare income statement for July using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold: Fixed costs: $ 2b. Prepare income statement for August using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended August 31 Sales Variable cost of goods sold: Inventory, August 1 Variable cost of goods manufactured Total variable cost of goods sold Manufacturing margin $ Variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses DO Total fixed costs Operating income