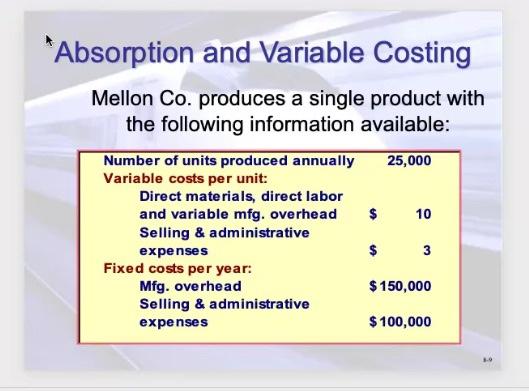

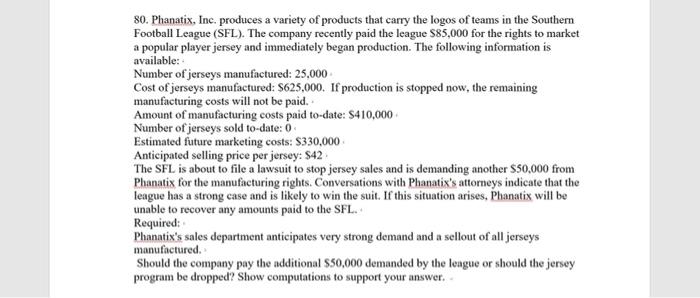

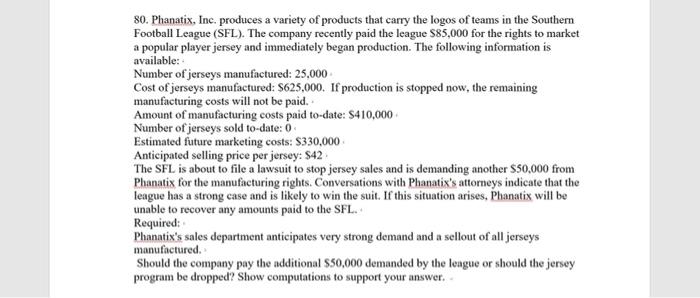

*Absorption and Variable Costing Mellon Co. produces a single product with the following information available: 25,000 $ 10 Number of units produced annually Variable costs per unit: Direct materials, direct labor and variable mfg. overhead Selling & administrative expenses Fixed costs per year: Mfg. overhead Selling & administrative expenses $ 3 $ 150,000 $ 100,000 w 80. Phanatix, Inc. produces a variety of products that carry the logos of teams in the Southern Football League (SFL). The company recently paid the league $85,000 for the rights to market a popular player jersey and immediately began production. The following information is available: Number of jerseys manufactured: 25.000 Cost of jerseys manufactured: 5625.000. If production is stopped now, the remaining manufacturing costs will not be paid. Amount of manufacturing costs paid to-date: $410,000 Number of jerseys sold to-date: 0 Estimated future marketing costs: $330,000 Anticipated selling price per jersey: $42 The SFL is about to file a lawsuit to stop jersey sales and is demanding another $50,000 from Phanatix for the manufacturing rights. Conversations with Phanatix's attorneys indicate that the league has a strong case and is likely to win the suit. If this situation arises. Phanatix will be unable to recover any amounts paid to the SFL. Required: Phanatix's sales department anticipates very strong demand and a sellout of all jerseys manufactured Should the company pay the additional $50,000 demanded by the league or should the jersey program be dropped? Show computations to support your answer. *Absorption and Variable Costing Mellon Co. produces a single product with the following information available: 25,000 $ 10 Number of units produced annually Variable costs per unit: Direct materials, direct labor and variable mfg. overhead Selling & administrative expenses Fixed costs per year: Mfg. overhead Selling & administrative expenses $ 3 $ 150,000 $ 100,000 w 80. Phanatix, Inc. produces a variety of products that carry the logos of teams in the Southern Football League (SFL). The company recently paid the league $85,000 for the rights to market a popular player jersey and immediately began production. The following information is available: Number of jerseys manufactured: 25.000 Cost of jerseys manufactured: 5625.000. If production is stopped now, the remaining manufacturing costs will not be paid. Amount of manufacturing costs paid to-date: $410,000 Number of jerseys sold to-date: 0 Estimated future marketing costs: $330,000 Anticipated selling price per jersey: $42 The SFL is about to file a lawsuit to stop jersey sales and is demanding another $50,000 from Phanatix for the manufacturing rights. Conversations with Phanatix's attorneys indicate that the league has a strong case and is likely to win the suit. If this situation arises. Phanatix will be unable to recover any amounts paid to the SFL. Required: Phanatix's sales department anticipates very strong demand and a sellout of all jerseys manufactured Should the company pay the additional $50,000 demanded by the league or should the jersey program be dropped? Show computations to support your