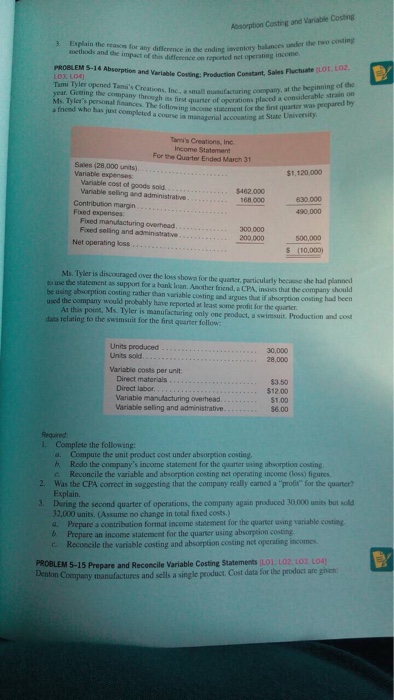

Absorption Costing and Variable Costing in the ending iaventory balances under the two costing Tami Tyler opened Tami's Creations, Inc., a small masufacturing companye strain on 3 Explain the reason for atry difference in the ending iaven methods and the impact of thins difference on reported net o PROBLEM 5-14 Absorptiom and Variable Costing: Production g income Costing: Production Constant, Sales Fluctuate LO1.L02 year. Gesting the company through its first quarter of operatioms aquarter was prcpared by epured by ng company, at the beginning of the Ms. Tyler's personal finances. The following income statement for the fir a fnced who has just completed a course ia managerial accouating at State the first quarter was accouating at State Ueiversity Tami's Creations, Inc Income Statement For the Quarter Ended March 31 Sales (28,000 units) Variable expenses $1,120,000 Variable cost of goods sold. Variable seling and administrative $462.000 168000 Contribution margin Fixed expenses 630,000 490,000 , Fixed manulacturing overhead Fixed seling and administratve 300.000 200.000 500,000 Net operating loss S (10,000) Ms. Tyler is discouraged over the loss shown for the quarter, porticularly becasse she had planned o use the statement as support for a hank loan.Amother friend, a CPA, insists that the company be using absorption costing rather cran variable costing und argues thet if absorption costing had been used the company would probably harve reported at least some profit for the quarier hould Ar this poiet, Ms. Tyler is manufacturing only one peodast, a swinsuit. Production and cost data relating to the swimsuit for the first quarter follow Units produced Unts sold 30,000 28,000 Variable costs per unit Direct materials Direct labor Variable manufacturing overhead Variable seling and administrative $3.50 $12.00 1.00 6.00 l. Complete the following: a. Compute the unit product cost under absorption costing b Redo the company's income statement for the quarter using absorption costing. e. Reconcile the variable and absorption costing net operating income (loss) figures 2. Was the CPA correct in suggesting that the company really eamed a "profit for the quarter? Explain 3. During the second quarter of operations, the company again produced 30,000 units but sold 32,000 units. (Assume no change in total fixed costs) a. Prepare a contribution format income statement for the quarter asing variable costing b. Prepare an income statement for the quarner using absorpsion costing c. Reconcile the variable costing and absorption costing net operating incomes PROBLEM 5-15 Prepare and Reconcile Variable Costing Statements (LO1, L02. LO3 LO4) Denton Company t ompany manufactures and sells a single product. Cost data for the product are ginen