Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abstract For Treslana Food Holdings Limited, the decision of whether or not to expand internationally into Thailand is unclear. Political unrest and public demonstrations are

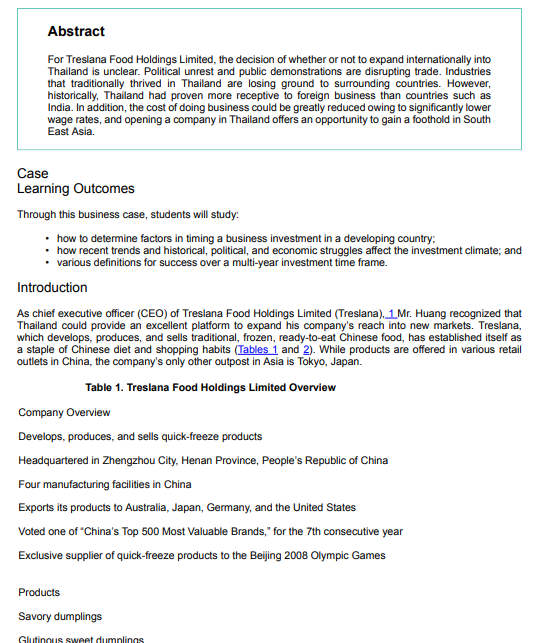

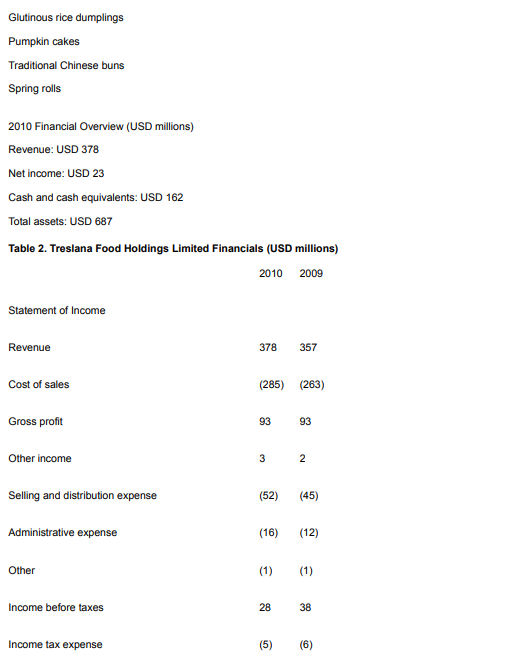

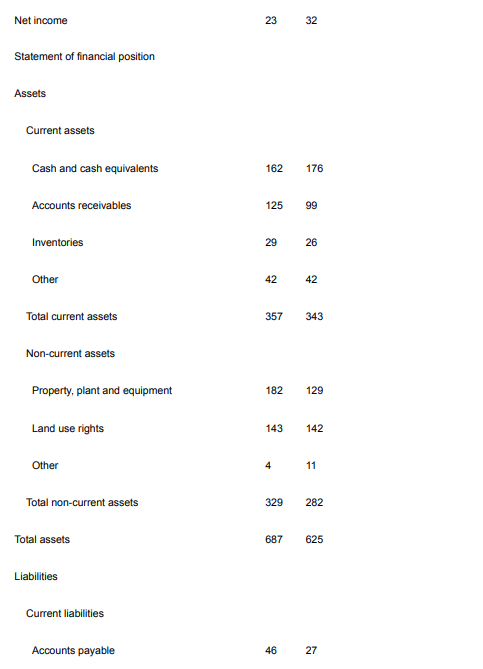

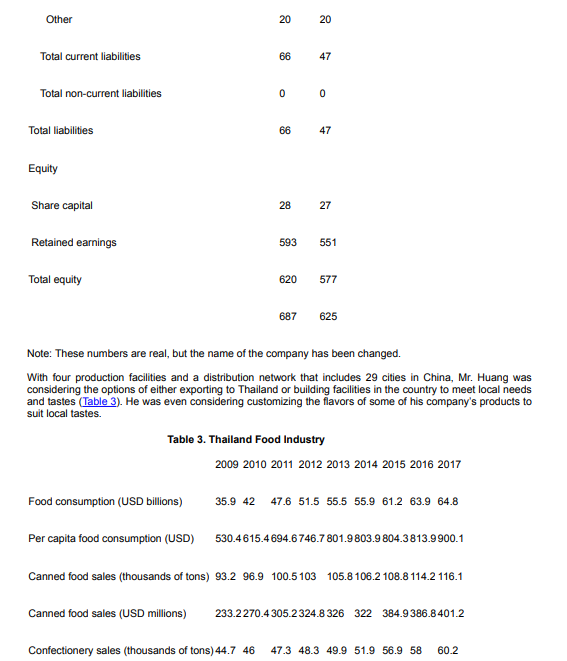

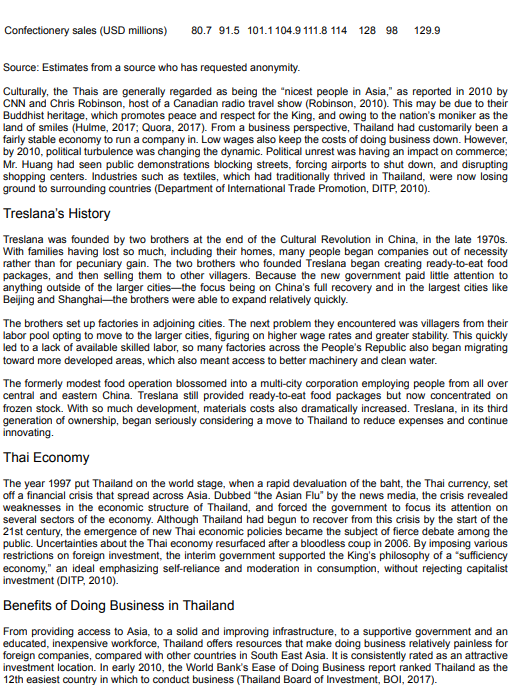

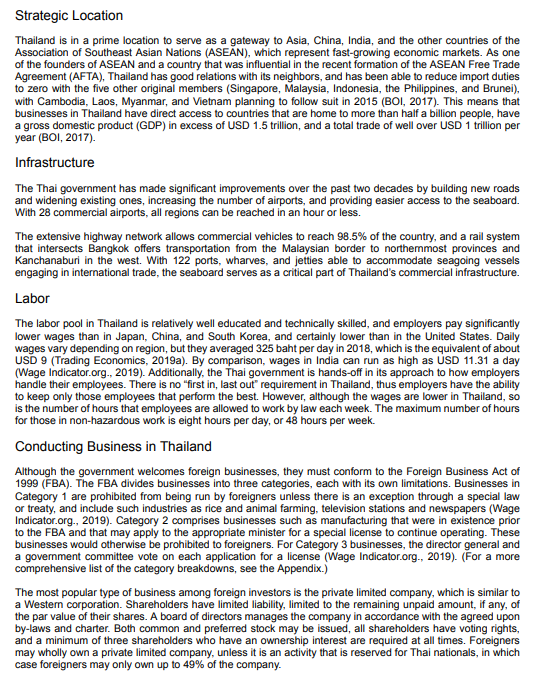

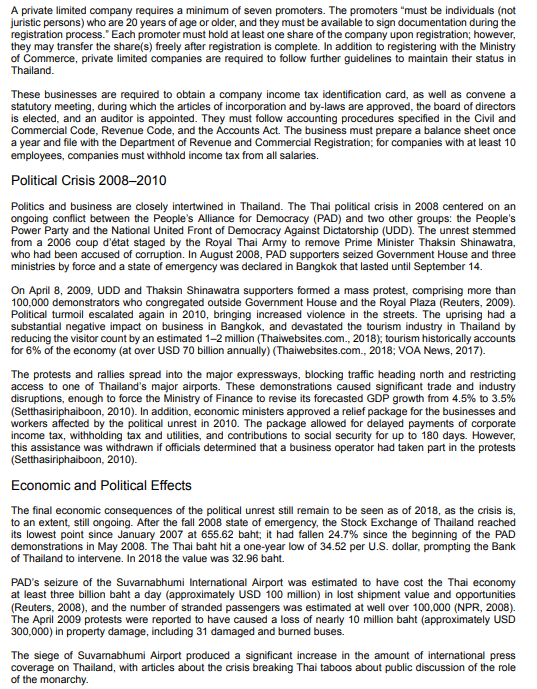

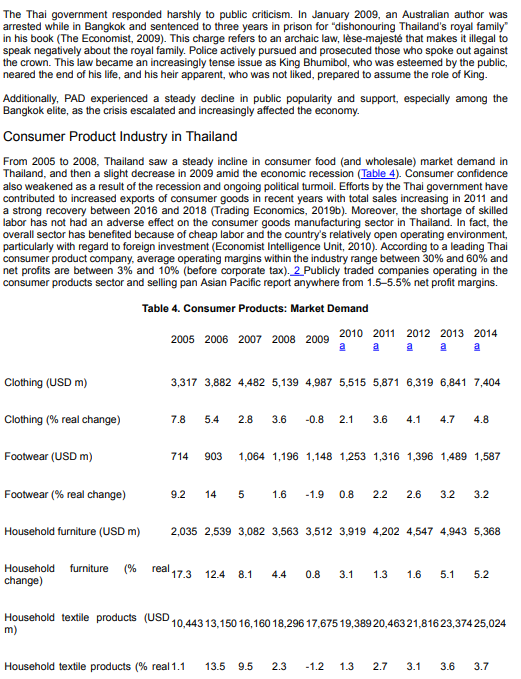

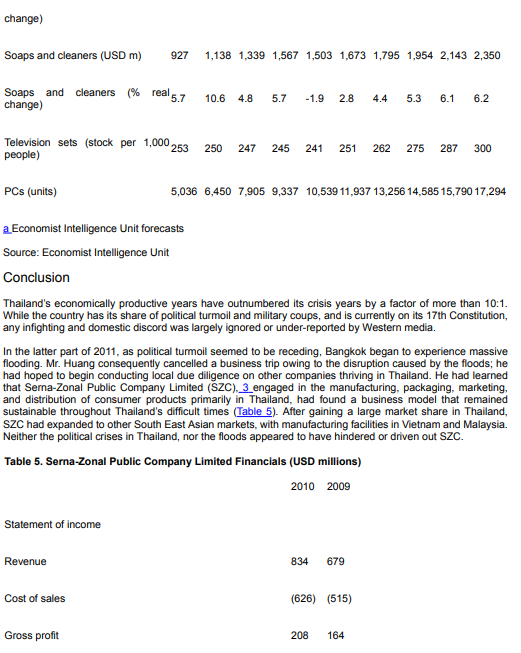

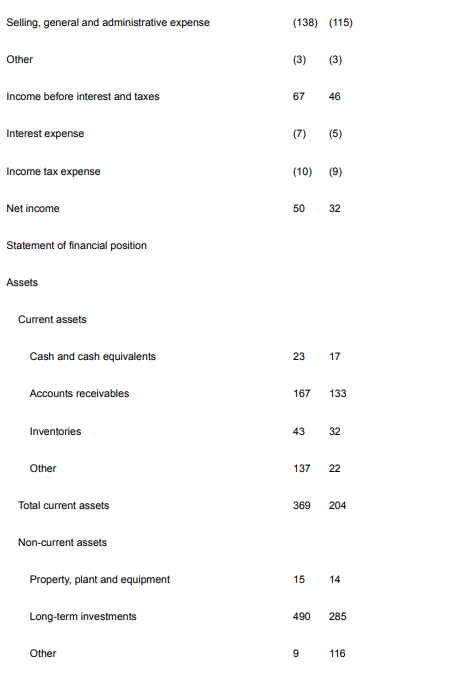

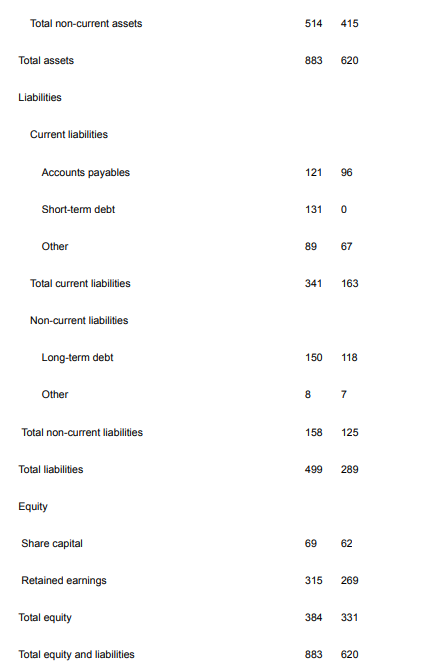

Abstract For Treslana Food Holdings Limited, the decision of whether or not to expand internationally into Thailand is unclear. Political unrest and public demonstrations are disrupting trade. Industries that traditionally thrived in Thailand are losing ground to surrounding countries. However, historically, Thailand had proven more receptive to foreign business than countries such as India. In addition, the cost of doing business could be greatly reduced owing to significantly lower wage rates, and opening a company in Thailand offers an opportunity to gain a foothold in South East Asia. Case Learning Outcomes Through this business case, students will study: how to determine factors in timing a business investment in a developing country; how recent trends and historical, political, and economic struggles affect the investment climate, and various definitions for success over a multi-year investment time frame. Introduction As chief executive officer (CEO) of Treslana Food Holdings Limited (Treslana), 1 Mr. Huang recognized that Thailand could provide an excellent platform to expand his company's reach into new markets. Treslana, which develops, produces, and sells traditional, frozen, ready-to-eat Chinese food, has established itself as a staple of Chinese diet and shopping habits (Tables 1 and 2). While products are offered in various retail outlets in China, the company's only other outpost in Asia is Tokyo, Japan. Table 1. Treslana Food Holdings Limited Overview Company Overview Develops, produces, and sells quick-freeze products Headquartered in Zhengzhou City, Henan Province, People's Republic of China Four manufacturing facilities in China Exports its products to Australia, Japan, Germany, and the United States Voted one of China's Top 500 Most Valuable Brands," for the 7th consecutive year Exclusive supplier of quick-freeze products to the Beijing 2008 Olympic Games Products Savory dumplings Glutinous sweet dumplings Glutinous rice dumplings Pumpkin cakes Traditional Chinese buns Spring rolls 2010 Financial Overview (USD millions) Revenue: USD 378 Net income: USD 23 Cash and cash equivalents: USD 162 Total assets: USD 687 Table 2. Treslana Food Holdings Limited Financials (USD millions) 2010 2009 Statement of Income Revenue 378 357 Cost of sales (285) (263) Gross profit 93 93 Other income 3 2 Selling and distribution expense (52) (45) Administrative expense (16) (12) Other (1) (1) Income before taxes 28 38 Income tax expense (5) (6) Net income 23 32 Statement of financial position Assets Current assets Cash and cash equivalents 162 176 Accounts receivables 125 99 Inventories 29 26 Other 42 42 Total current assets 357 343 Non-current assets Property, plant and equipment 182 129 Land use rights 143 142 Other 4 11 Total non-current assets 329 282 Total assets 687 625 Liabilities Current liabilities Accounts payable 46 27 Other 20 20 Total current liabilities 66 47 Total non-current liabilities 0 0 Total liabilities 66 47 Equity Share capital 28 27 Retained earnings 593 551 Total equity 620 577 687 625 Note: These numbers are real, but the name of the company has been changed. With four production facilities and a distribution network that includes 29 cities in China, Mr. Huang was considering the options of either exporting to Thailand or building facilities in the country to meet local needs and tastes (Table 3). He was even considering customizing the flavors of some of his company's products to suit local tastes. Table 3. Thailand Food Industry 2009 2010 2011 2012 2013 2014 2015 2016 2017 Food consumption (USD billions) 35.9 42 47.6 51.5 55.5 55.9 61.2 63.9 64.8 Per capita food consumption (USD) 530.4615.4 694.6746.7801.9803.9 804.3813.9900.1 Canned food sales (thousands of tons) 93.2 96.9 100.5 103 105.8 106.2 108.8 114.2 116.1 Canned food sales (USD millions) 233.2270.4 305.2 324.8 326 322 384.9386.8401.2 Confectionery sales (thousands of tons) 44.7 46 47.3 48.3 49.9 51.9 56.9 58 60.2 Confectionery sales (USD Millions) 80.7 91.5 101.1 104.9 111.8 114 128 98 129.9 Source: Estimates from a source who has requested anonymity. Culturally, the Thais are generally regarded as being the nicest people in Asia," as reported in 2010 by CNN and Chris Robinson, host of a Canadian radio travel show (Robinson, 2010). This may be due to their Buddhist heritage, which promotes peace and respect for the King, and owing to the nation's moniker as the land of smiles (Hulme, 2017; Quora, 2017). From a business perspective, Thailand had customarily been a fairly stable economy to run a company in. Low wages also keep the costs of doing business down. However, by 2010, political turbulence was changing the dynamic. Political unrest was having an impact on commerce; Mr. Huang had seen public demonstrations blocking streets, forcing airports to shut down, and disrupting shopping centers. Industries such as textiles, which had traditionally thrived in Thailand, were now losing ground to surrounding countries (Department of International Trade Promotion, DITP, 2010). Treslana's History Treslana was founded by two brothers at the end of the Cultural Revolution in China, in the late 1970s. With families having lost so much, including their homes, many people began companies out of necessity rather than for pecuniary gain. The two brothers who founded Treslana began creating ready-to-eat food packages, and then selling them to other villagers. Because the new government paid little attention to anything outside of the larger citiesthe focus being on China's full recovery and in the largest cities like Beijing and Shanghaithe brothers were able to expand relatively quickly. The brothers set up factories in adjoining cities. The next problem they encountered was villagers from their labor pool opting to move to the larger cities, figuring on higher wage rates and greater stability. This quickly led to a lack of available skilled labor, so many factories across the People's Republic also began migrating toward more developed areas, which also meant access to better machinery and clean water. The formerly modest food operation blossomed into a multi-city corporation employing people from all over central and eastern China. Treslana still provided ready-to-eat food packages but now concentrated on frozen stock. With so much development, materials costs also dramatically increased. Treslana, in its third generation of ownership, began seriously considering a move to Thailand to reduce expenses and continue innovating. Thai Economy The year 1997 put Thailand on the world stage, when a rapid devaluation of the baht, the Thai currency, set off a financial crisis that spread across Asia. Dubbed "the Asian Flu" by the news media, the crisis revealed weaknesses in the economic structure of Thailand, and forced the goverment to focus its attention on several sectors of the economy. Although Thailand had begun to recover from this crisis by the start of the 21st century, the emergence of new Thai economic policies became the subject of fierce debate among the public. Uncertainties about the Thai economy resurfaced after a bloodless coup in 2006. By imposing various restrictions on foreign investment, the interim government supported the King's philosophy of a "sufficiency economy," an ideal emphasizing self-reliance and moderation in consumption, without rejecting capitalist investment (DITP, 2010). Benefits of Doing Business in Thailand From providing access to Asia, to a solid and improving infrastructure, to a supportive government and an educated, inexpensive workforce, Thailand offers resources that make doing business relatively painless for foreign companies, compared with other countries in South East Asia. It is consistently rated as an attractive investment location. In early 2010, the World Bank's Ease of Doing Business report ranked Thailand as the 12th easiest country in which to conduct business (Thailand Board of Investment, BOI, 2017). Strategic Location Thailand is in a prime location to serve as a gateway to Asia, China, India, and the other countries of the Association of Southeast Asian Nations (ASEAN), which represent fast-growing economic markets. As one of the founders of ASEAN and a country that was influential in the recent formation of the ASEAN Free Trade Agreement (AFTA), Thailand has good relations with its neighbors, and has been able to reduce import duties to zero with the five other original members (Singapore, Malaysia, Indonesia, the Philippines, and Brunei), with Cambodia, Laos, Myanmar, and Vietnam planning to follow suit in 2015 (BOI, 2017). This means that businesses in Thailand have direct access to countries that are home to more than half a billion people, have a gross domestic product (GDP) in excess of USD 1.5 trillion, and a total trade of well over USD 1 trillion per year (BOI, 2017). Infrastructure The Thai government has made significant improvements over the past two decades by building new roads and widening existing ones, increasing the number of airports, and providing easier access to the seaboard. With 28 commercial airports, all regions can be reached in an hour or less. The extensive highway network allows commercial vehicles to reach 98.5% of the country, and a rail system that intersects Bangkok offers transportation from the Malaysian border to northernmost provinces and Kanchanaburi in the west. With 122 ports, wharves, and jetties able to accommodate seagoing vessels engaging in international trade, the seaboard serves as a critical part of Thailand's commercial infrastructure. Labor The labor pool in Thailand is relatively well educated and technically skilled, and employers pay significantly lower wages than in Japan, China, and South Korea, and certainly lower than in the United States. Daily wages vary depending on region, but they averaged 325 baht per day in 2018, which is the equivalent of about USD 9 (Trading Economics, 2019a). By comparison, wages in India can run as high as USD 11.31 a day (Wage Indicator.org., 2019). Additionally, the Thai government is hands-off in its approach to how employers handle their employees. There is no "first in, last out" requirement in Thailand, thus employers have the ability to keep only those employees that perform the best. However, although the wages are lower in Thailand, so is the number of hours that employees are allowed to work by law each week. The maximum number of hours for those in non-hazardous work is eight hours per day, or 48 hours per week. Conducting Business in Thailand Although the government welcomes foreign businesses, they must conform to the Foreign Business Act of 1999 (FBA). The FBA divides businesses into three categories, each with its own limitations. Businesses in Category 1 are prohibited from being run by foreigners unless there is an exception through a special law or treaty, and include such industries as rice and animal farming, television stations and newspapers (Wage Indicator.org., 2019). Category 2 comprises businesses such as manufacturing that were in existence prior to the FBA and that may apply to the appropriate minister for a special license to continue operating. These businesses would otherwise be prohibited to foreigners. For Category 3 businesses, the director general and a government committee vote on each application for a license (Wage Indicator.org., 2019). (For a more comprehensive list of the category breakdowns, see the Appendix.) The most popular type of business among foreign investors is the private limited company, which is similar to a Western corporation. Shareholders have limited liability, limited to the remaining unpaid amount, if any, of the par value of their shares. A board of directors manages the company in accordance with the agreed upon by-laws and charter. Both common and preferred stock may be issued, all shareholders have voting rights, and a minimum of three shareholders who have an ownership interest are required at all times. Foreigners may wholly own a private limited company, unless it is an activity that is reserved for Thai nationals, in which case foreigners may only own up to 49% of the company. A private limited company requires a minimum of seven promoters. The promoters "must be individuals (not juristic persons) who are 20 years of age or older, and they must be available to sign documentation during the registration process." Each promoter must hold at least one share of the company upon registration, however, they may transfer the share(s) freely after registration is complete. In addition to registering with the Ministry of Commerce, private limited companies are required to follow further guidelines to maintain their status in Thailand. These businesses are required to obtain a company income tax identification card, as well as convene a statutory meeting, during which the articles of incorporation and by-laws are approved, the board of directors is elected, and an auditor is appointed. They must follow accounting procedures specified in the Civil and Commercial Code, Revenue Code, and the Accounts Act. The business must prepare a balance sheet once a year and file with the Department of Revenue and Commercial Registration, for companies with at least 10 employees, companies must withhold income tax from all salaries. Political Crisis 2008-2010 Politics and business are closely intertwined in Thailand. The Thai political crisis in 2008 centered on an ongoing conflict between the People's Alliance for Democracy (PAD) and two other groups: the People's Power Party and the National United Front of Democracy Against Dictatorship (UDD). The unrest stemmed from a 2006 coup d'tat staged by the Royal Thai Army to remove Prime Minister Thaksin Shinawatra, who had been accused of corruption. In August 2008, PAD supporters seized Government House and three ministries by force and a state of emergency was declared in Bangkok that lasted until September 14. On April 8, 2009, UDD and Thaksin Shinawatra supporters formed a mass protest, comprising more than 100,000 demonstrators who congregated outside Government House and the Royal Plaza (Reuters, 2009). Political turmoil escalated again in 2010, bringing increased violence in the streets. The uprising had a substantial negative impact on business in Bangkok, and devastated the tourism industry in Thailand by reducing the visitor count by an estimated 1-2 million (Thaiwebsites.com., 2018); tourism historically accounts for 6% of the economy (at over USD 70 billion annually) (Thaiwebsites.com., 2018; VOA News, 2017). The protests and rallies spread into the major expressways, blocking traffic heading north and restricting access to one of Thailand's major airports. These demonstrations caused significant trade and industry disruptions, enough to force the Ministry of Finance to revise its forecasted GDP growth from 4.5% to 3.5% (Setthasiriphaiboon, 2010). In addition, economic ministers approved a relief package for the businesses and workers affected by the political unrest in 2010. The package allowed for delayed payments of corporate income tax, withholding tax and utilities, and contributions to social security for up to 180 days. However, this assistance was withdrawn if officials determined that a business operator had taken part in the protests (Setthasiriphaiboon, 2010). Economic and Political Effects The final economic consequences of the political unrest still remain to be seen as of 2018, as the crisis is, to an extent, still ongoing. After the fall 2008 state of emergency, the Stock Exchange of Thailand reached its lowest point since January 2007 at 655.62 baht; it had fallen 24.7% since the beginning of the PAD demonstrations in May 2008. The Thai baht hit a one-year low of 34.52 per U.S. dollar, prompting the Bank of Thailand to intervene. In 2018 the value was 32.96 baht. PAD's seizure of the Suvarnabhumi International Airport was estimated to have cost the Thai economy at least three billion baht a day (approximately USD 100 million) in lost shipment value and opportunities (Reuters, 2008), and the number of stranded passengers was estimated at well over 100,000 (NPR, 2008). The April 2009 protests were reported to have caused a loss of nearly 10 million baht (approximately USD 300,000) in property damage, including 31 damaged and burned buses. The siege of Suvarnabhumi Airport produced a significant increase in the amount of international press coverage on Thailand, with articles about the crisis breaking Thai taboos about public discussion of the role of the monarchy. The Thai government responded harshly to public criticism. In January 2009, an Australian author was arrested while in Bangkok and sentenced to three years in prison for "dishonouring Thailand's royal family in his book (The Economist, 2009). This charge refers to an archaic law, lse-majest that makes it illegal to speak negatively about the royal family. Police actively pursued and prosecuted those who spoke out against the crown. This law became an increasingly tense issue as King Bhumibol, who was esteemed by the public, neared the end of his life, and his heir apparent, who was not liked, prepared to assume the role of King. Additionally, PAD experienced a steady decline in public popularity and support, especially among the Bangkok elite, as the crisis escalated and increasingly affected the economy. Consumer Product Industry in Thailand From 2005 to 2008, Thailand saw a steady incline in consumer food (and wholesale) market demand in Thailand, and then a slight decrease in 2009 amid the economic recession (Table 4). Consumer confidence also weakened as a result of the recession and ongoing political turmoil. Efforts by the Thai government have contributed to increased exports of consumer goods in recent years with total sales increasing in 2011 and a strong recovery between 2016 and 2018 (Trading Economics, 2019b). Moreover, the shortage of skilled labor has not had an adverse effect on the consumer goods manufacturing sector in Thailand. In fact, the overall sector has benefited because of cheap labor and the country's relatively open operating environment, particularly with regard to foreign investment (Economist Intelligence Unit, 2010). According to a leading Thai consumer product company, average operating margins within the industry range between 30% and 60% and net profits are between 3% and 10% (before corporate tax). 2 Publicly traded companies operating in the consumer products sector and selling pan Asian Pacific report anywhere from 1.5-5.5% net profit margins. Table 4. Consumer Products: Market Demand 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 a a a a Clothing (USD m) 3,317 3,882 4,482 5,139 4,987 5,515 5,871 6,319 6,841 7,404 Clothing (% real change) 7.8 5.4 2.8 3.6 -0.8 2.1 3.6 4.1 4.7 4.8 Footwear (USD) 714 903 1,064 1,196 1,148 1,253 1,316 1,396 1,489 1,587 Footwear (% real change) 9.2 14 5 1.6 -1.9 0.8 2.2 2.6 3.2 3.2 Household furniture (USD m) 2,035 2,539 3,082 3,563 3,512 3,919 4,202 4,547 4,943 5,368 Household furniture (% real 17.3 change) 12.4 8.1 4.4 0.8 3.1 1.3 1.6 5.1 5.2 Household textile products (USD m) 10,443 13,150 16,160 18,296 17,675 19,389 20,463 21,816 23,37425,024 Household textile products (% real 1.1 13.5 9.5 2.3 - 1.2 1.3 2.7 3.1 3.6 3.7 change) Soaps and cleaners (USD m) 927 1,138 1,339 1,567 1,503 1,673 1,795 1,954 2.143 2,350 Soaps and cleaners (% real 5.7 change) 10.6 4.8 5.7 -1.9 2.8 4.4 5.3 6.1 6.2 Television sets (stock per 1,000, 253 people) 250 247 245 241 251 262 275 287 300 PCs (units) 5,036 6,450 7,905 9,337 10,539 11,937 13,256 14,585 15,790 17,294 a Economist Intelligence Unit forecasts Source: Economist Intelligence Unit Conclusion Thailand's economically productive years have outnumbered its crisis years by a factor of more than 10:1. While the country has its share of political turmoil and military coups, and is currently on its 17th Constitution, any infighting and domestic discord was largely ignored or under-reported by Western media. In the latter part of 2011, as political turmoil seemed to be receding, Bangkok began to experience massive flooding. Mr. Huang consequently cancelled a business trip owing to the disruption caused by the floods; he had hoped to begin conducting local due diligence on other companies thriving in Thailand. He had learned that Serna-Zonal Public Company Limited (SZC). 3 engaged in the manufacturing, packaging, marketing, and distribution of consumer products primarily in Thailand, had found a business model that remained sustainable throughout Thailand's difficult times (Table 5). After gaining a large market share in Thailand, SZC had expanded to other South East Asian markets, with manufacturing facilities in Vietnam and Malaysia. Neither the political crises in Thailand, nor the floods appeared to have hindered or driven out SZC. Table 5. Serna-Zonal Public Company Limited Financials (USD millions) 2010 2009 Statement of income Revenue 834 679 Cost of sales (626) (515) Gross profit 208 164 Selling, general and administrative expense (138) (115) Other (3) (3) Income before interest and taxes 67 46 Interest expense (7) (5) Income tax expense (10) (9) Net income 50 32 Statement of financial position Assets Current assets Cash and cash equivalents 23 17 Accounts receivables 167 133 Inventories 43 32 Other 137 22 Total current assets 369 204 Non-current assets Property, plant and equipment 15 14 Long-term investments 490 285 Other 9 116 Total non-current assets 514 415 Total assets 883 620 Liabilities Current liabilities Accounts payables 121 96 Short-term debt 131 0 Other 89 67 Total current liabilities 341 163 Non-current liabilities Long-term debt 150 118 Other 8 7 Total non-current liabilities 158 125 Total liabilities 499 289 Equity Share capital 69 62 Retained earnings 315 269 Total equity 384 331 Total equity and liabilities 883 620 Note: These numbers are real, but the name of the company has been changed. Other businesses had experienced similar success in Thailand, such as BB Snacks, Frito-Lay, Berli Jucker PLC, and PM Food Company. According to Euromonitor International, "the sweet and savory snacks category in Thailand is very fragmented, and there are many products offered in different categories. They are presented as alternatives to consumers, and could be said to be substitute products for one another" Euromonitor, 2018). In addition to its success in packaged food products in China, Treslana had found business opportunities by exporting quick-freeze food items to distributors and import/export companies in Japan, Australia, Germany, and the United States. The products were then sold in supermarkets, convenience stores, mass merchandizers such as Wal-Mart, and other retail outlets and stores. Mr. Huang and others on Treslana's management team agreed that the success of their international business could be mirrored in Thailand and, eventually, other ASEAN countries. Furthermore, the possibility of establishing production facilities in these countries would allow for easier access to the consumer. Mr. Huang believed Treslana was financially sound and the time was right to expand further internationally, but he wondered whether Thailand was the right place to start its next business development project. There were other ASEAN markets where Treslana could expand while waiting to see how Thailand's political crisis evolved. However, the success of other consumer product companies in Thailand such as SZC seemed to suggest that the opportunity was economically viable. Moreover, Mir. Huang was concerned that by waiting too long, his products might not beat competitors to the market. Author's Note We have great respect and admiration for the Kingdom of Thailand and love the country and its people. This case/class/discussion is meant to be an academic study supporting investment in the country. No disrespect is meant toward the royal family or the king. Discussion Questions . 1. What are the pros and cons that Mr. Huang and Treslana need to consider when entering Thailand? What are the benefits and disadvantages for Treslana of exporting products to Thailand, as opposed to establishing production facilities in the country? As an investor, assume you have decided to make an equity investment in Treslana. What specific terms and conditions (if any) would you insist upon in order to protect your money? 2. Abstract For Treslana Food Holdings Limited, the decision of whether or not to expand internationally into Thailand is unclear. Political unrest and public demonstrations are disrupting trade. Industries that traditionally thrived in Thailand are losing ground to surrounding countries. However, historically, Thailand had proven more receptive to foreign business than countries such as India. In addition, the cost of doing business could be greatly reduced owing to significantly lower wage rates, and opening a company in Thailand offers an opportunity to gain a foothold in South East Asia. Case Learning Outcomes Through this business case, students will study: how to determine factors in timing a business investment in a developing country; how recent trends and historical, political, and economic struggles affect the investment climate, and various definitions for success over a multi-year investment time frame. Introduction As chief executive officer (CEO) of Treslana Food Holdings Limited (Treslana), 1 Mr. Huang recognized that Thailand could provide an excellent platform to expand his company's reach into new markets. Treslana, which develops, produces, and sells traditional, frozen, ready-to-eat Chinese food, has established itself as a staple of Chinese diet and shopping habits (Tables 1 and 2). While products are offered in various retail outlets in China, the company's only other outpost in Asia is Tokyo, Japan. Table 1. Treslana Food Holdings Limited Overview Company Overview Develops, produces, and sells quick-freeze products Headquartered in Zhengzhou City, Henan Province, People's Republic of China Four manufacturing facilities in China Exports its products to Australia, Japan, Germany, and the United States Voted one of China's Top 500 Most Valuable Brands," for the 7th consecutive year Exclusive supplier of quick-freeze products to the Beijing 2008 Olympic Games Products Savory dumplings Glutinous sweet dumplings Glutinous rice dumplings Pumpkin cakes Traditional Chinese buns Spring rolls 2010 Financial Overview (USD millions) Revenue: USD 378 Net income: USD 23 Cash and cash equivalents: USD 162 Total assets: USD 687 Table 2. Treslana Food Holdings Limited Financials (USD millions) 2010 2009 Statement of Income Revenue 378 357 Cost of sales (285) (263) Gross profit 93 93 Other income 3 2 Selling and distribution expense (52) (45) Administrative expense (16) (12) Other (1) (1) Income before taxes 28 38 Income tax expense (5) (6) Net income 23 32 Statement of financial position Assets Current assets Cash and cash equivalents 162 176 Accounts receivables 125 99 Inventories 29 26 Other 42 42 Total current assets 357 343 Non-current assets Property, plant and equipment 182 129 Land use rights 143 142 Other 4 11 Total non-current assets 329 282 Total assets 687 625 Liabilities Current liabilities Accounts payable 46 27 Other 20 20 Total current liabilities 66 47 Total non-current liabilities 0 0 Total liabilities 66 47 Equity Share capital 28 27 Retained earnings 593 551 Total equity 620 577 687 625 Note: These numbers are real, but the name of the company has been changed. With four production facilities and a distribution network that includes 29 cities in China, Mr. Huang was considering the options of either exporting to Thailand or building facilities in the country to meet local needs and tastes (Table 3). He was even considering customizing the flavors of some of his company's products to suit local tastes. Table 3. Thailand Food Industry 2009 2010 2011 2012 2013 2014 2015 2016 2017 Food consumption (USD billions) 35.9 42 47.6 51.5 55.5 55.9 61.2 63.9 64.8 Per capita food consumption (USD) 530.4615.4 694.6746.7801.9803.9 804.3813.9900.1 Canned food sales (thousands of tons) 93.2 96.9 100.5 103 105.8 106.2 108.8 114.2 116.1 Canned food sales (USD millions) 233.2270.4 305.2 324.8 326 322 384.9386.8401.2 Confectionery sales (thousands of tons) 44.7 46 47.3 48.3 49.9 51.9 56.9 58 60.2 Confectionery sales (USD Millions) 80.7 91.5 101.1 104.9 111.8 114 128 98 129.9 Source: Estimates from a source who has requested anonymity. Culturally, the Thais are generally regarded as being the nicest people in Asia," as reported in 2010 by CNN and Chris Robinson, host of a Canadian radio travel show (Robinson, 2010). This may be due to their Buddhist heritage, which promotes peace and respect for the King, and owing to the nation's moniker as the land of smiles (Hulme, 2017; Quora, 2017). From a business perspective, Thailand had customarily been a fairly stable economy to run a company in. Low wages also keep the costs of doing business down. However, by 2010, political turbulence was changing the dynamic. Political unrest was having an impact on commerce; Mr. Huang had seen public demonstrations blocking streets, forcing airports to shut down, and disrupting shopping centers. Industries such as textiles, which had traditionally thrived in Thailand, were now losing ground to surrounding countries (Department of International Trade Promotion, DITP, 2010). Treslana's History Treslana was founded by two brothers at the end of the Cultural Revolution in China, in the late 1970s. With families having lost so much, including their homes, many people began companies out of necessity rather than for pecuniary gain. The two brothers who founded Treslana began creating ready-to-eat food packages, and then selling them to other villagers. Because the new government paid little attention to anything outside of the larger citiesthe focus being on China's full recovery and in the largest cities like Beijing and Shanghaithe brothers were able to expand relatively quickly. The brothers set up factories in adjoining cities. The next problem they encountered was villagers from their labor pool opting to move to the larger cities, figuring on higher wage rates and greater stability. This quickly led to a lack of available skilled labor, so many factories across the People's Republic also began migrating toward more developed areas, which also meant access to better machinery and clean water. The formerly modest food operation blossomed into a multi-city corporation employing people from all over central and eastern China. Treslana still provided ready-to-eat food packages but now concentrated on frozen stock. With so much development, materials costs also dramatically increased. Treslana, in its third generation of ownership, began seriously considering a move to Thailand to reduce expenses and continue innovating. Thai Economy The year 1997 put Thailand on the world stage, when a rapid devaluation of the baht, the Thai currency, set off a financial crisis that spread across Asia. Dubbed "the Asian Flu" by the news media, the crisis revealed weaknesses in the economic structure of Thailand, and forced the goverment to focus its attention on several sectors of the economy. Although Thailand had begun to recover from this crisis by the start of the 21st century, the emergence of new Thai economic policies became the subject of fierce debate among the public. Uncertainties about the Thai economy resurfaced after a bloodless coup in 2006. By imposing various restrictions on foreign investment, the interim government supported the King's philosophy of a "sufficiency economy," an ideal emphasizing self-reliance and moderation in consumption, without rejecting capitalist investment (DITP, 2010). Benefits of Doing Business in Thailand From providing access to Asia, to a solid and improving infrastructure, to a supportive government and an educated, inexpensive workforce, Thailand offers resources that make doing business relatively painless for foreign companies, compared with other countries in South East Asia. It is consistently rated as an attractive investment location. In early 2010, the World Bank's Ease of Doing Business report ranked Thailand as the 12th easiest country in which to conduct business (Thailand Board of Investment, BOI, 2017). Strategic Location Thailand is in a prime location to serve as a gateway to Asia, China, India, and the other countries of the Association of Southeast Asian Nations (ASEAN), which represent fast-growing economic markets. As one of the founders of ASEAN and a country that was influential in the recent formation of the ASEAN Free Trade Agreement (AFTA), Thailand has good relations with its neighbors, and has been able to reduce import duties to zero with the five other original members (Singapore, Malaysia, Indonesia, the Philippines, and Brunei), with Cambodia, Laos, Myanmar, and Vietnam planning to follow suit in 2015 (BOI, 2017). This means that businesses in Thailand have direct access to countries that are home to more than half a billion people, have a gross domestic product (GDP) in excess of USD 1.5 trillion, and a total trade of well over USD 1 trillion per year (BOI, 2017). Infrastructure The Thai government has made significant improvements over the past two decades by building new roads and widening existing ones, increasing the number of airports, and providing easier access to the seaboard. With 28 commercial airports, all regions can be reached in an hour or less. The extensive highway network allows commercial vehicles to reach 98.5% of the country, and a rail system that intersects Bangkok offers transportation from the Malaysian border to northernmost provinces and Kanchanaburi in the west. With 122 ports, wharves, and jetties able to accommodate seagoing vessels engaging in international trade, the seaboard serves as a critical part of Thailand's commercial infrastructure. Labor The labor pool in Thailand is relatively well educated and technically skilled, and employers pay significantly lower wages than in Japan, China, and South Korea, and certainly lower than in the United States. Daily wages vary depending on region, but they averaged 325 baht per day in 2018, which is the equivalent of about USD 9 (Trading Economics, 2019a). By comparison, wages in India can run as high as USD 11.31 a day (Wage Indicator.org., 2019). Additionally, the Thai government is hands-off in its approach to how employers handle their employees. There is no "first in, last out" requirement in Thailand, thus employers have the ability to keep only those employees that perform the best. However, although the wages are lower in Thailand, so is the number of hours that employees are allowed to work by law each week. The maximum number of hours for those in non-hazardous work is eight hours per day, or 48 hours per week. Conducting Business in Thailand Although the government welcomes foreign businesses, they must conform to the Foreign Business Act of 1999 (FBA). The FBA divides businesses into three categories, each with its own limitations. Businesses in Category 1 are prohibited from being run by foreigners unless there is an exception through a special law or treaty, and include such industries as rice and animal farming, television stations and newspapers (Wage Indicator.org., 2019). Category 2 comprises businesses such as manufacturing that were in existence prior to the FBA and that may apply to the appropriate minister for a special license to continue operating. These businesses would otherwise be prohibited to foreigners. For Category 3 businesses, the director general and a government committee vote on each application for a license (Wage Indicator.org., 2019). (For a more comprehensive list of the category breakdowns, see the Appendix.) The most popular type of business among foreign investors is the private limited company, which is similar to a Western corporation. Shareholders have limited liability, limited to the remaining unpaid amount, if any, of the par value of their shares. A board of directors manages the company in accordance with the agreed upon by-laws and charter. Both common and preferred stock may be issued, all shareholders have voting rights, and a minimum of three shareholders who have an ownership interest are required at all times. Foreigners may wholly own a private limited company, unless it is an activity that is reserved for Thai nationals, in which case foreigners may only own up to 49% of the company. A private limited company requires a minimum of seven promoters. The promoters "must be individuals (not juristic persons) who are 20 years of age or older, and they must be available to sign documentation during the registration process." Each promoter must hold at least one share of the company upon registration, however, they may transfer the share(s) freely after registration is complete. In addition to registering with the Ministry of Commerce, private limited companies are required to follow further guidelines to maintain their status in Thailand. These businesses are required to obtain a company income tax identification card, as well as convene a statutory meeting, during which the articles of incorporation and by-laws are approved, the board of directors is elected, and an auditor is appointed. They must follow accounting procedures specified in the Civil and Commercial Code, Revenue Code, and the Accounts Act. The business must prepare a balance sheet once a year and file with the Department of Revenue and Commercial Registration, for companies with at least 10 employees, companies must withhold income tax from all salaries. Political Crisis 2008-2010 Politics and business are closely intertwined in Thailand. The Thai political crisis in 2008 centered on an ongoing conflict between the People's Alliance for Democracy (PAD) and two other groups: the People's Power Party and the National United Front of Democracy Against Dictatorship (UDD). The unrest stemmed from a 2006 coup d'tat staged by the Royal Thai Army to remove Prime Minister Thaksin Shinawatra, who had been accused of corruption. In August 2008, PAD supporters seized Government House and three ministries by force and a state of emergency was declared in Bangkok that lasted until September 14. On April 8, 2009, UDD and Thaksin Shinawatra supporters formed a mass protest, comprising more than 100,000 demonstrators who congregated outside Government House and the Royal Plaza (Reuters, 2009). Political turmoil escalated again in 2010, bringing increased violence in the streets. The uprising had a substantial negative impact on business in Bangkok, and devastated the tourism industry in Thailand by reducing the visitor count by an estimated 1-2 million (Thaiwebsites.com., 2018); tourism historically accounts for 6% of the economy (at over USD 70 billion annually) (Thaiwebsites.com., 2018; VOA News, 2017). The protests and rallies spread into the major expressways, blocking traffic heading north and restricting access to one of Thailand's major airports. These demonstrations caused significant trade and industry disruptions, enough to force the Ministry of Finance to revise its forecasted GDP growth from 4.5% to 3.5% (Setthasiriphaiboon, 2010). In addition, economic ministers approved a relief package for the businesses and workers affected by the political unrest in 2010. The package allowed for delayed payments of corporate income tax, withholding tax and utilities, and contributions to social security for up to 180 days. However, this assistance was withdrawn if officials determined that a business operator had taken part in the protests (Setthasiriphaiboon, 2010). Economic and Political Effects The final economic consequences of the political unrest still remain to be seen as of 2018, as the crisis is, to an extent, still ongoing. After the fall 2008 state of emergency, the Stock Exchange of Thailand reached its lowest point since January 2007 at 655.62 baht; it had fallen 24.7% since the beginning of the PAD demonstrations in May 2008. The Thai baht hit a one-year low of 34.52 per U.S. dollar, prompting the Bank of Thailand to intervene. In 2018 the value was 32.96 baht. PAD's seizure of the Suvarnabhumi International Airport was estimated to have cost the Thai economy at least three billion baht a day (approximately USD 100 million) in lost shipment value and opportunities (Reuters, 2008), and the number of stranded passengers was estimated at well over 100,000 (NPR, 2008). The April 2009 protests were reported to have caused a loss of nearly 10 million baht (approximately USD 300,000) in property damage, including 31 damaged and burned buses. The siege of Suvarnabhumi Airport produced a significant increase in the amount of international press coverage on Thailand, with articles about the crisis breaking Thai taboos about public discussion of the role of the monarchy. The Thai government responded harshly to public criticism. In January 2009, an Australian author was arrested while in Bangkok and sentenced to three years in prison for "dishonouring Thailand's royal family in his book (The Economist, 2009). This charge refers to an archaic law, lse-majest that makes it illegal to speak negatively about the royal family. Police actively pursued and prosecuted those who spoke out against the crown. This law became an increasingly tense issue as King Bhumibol, who was esteemed by the public, neared the end of his life, and his heir apparent, who was not liked, prepared to assume the role of King. Additionally, PAD experienced a steady decline in public popularity and support, especially among the Bangkok elite, as the crisis escalated and increasingly affected the economy. Consumer Product Industry in Thailand From 2005 to 2008, Thailand saw a steady incline in consumer food (and wholesale) market demand in Thailand, and then a slight decrease in 2009 amid the economic recession (Table 4). Consumer confidence also weakened as a result of the recession and ongoing political turmoil. Efforts by the Thai government have contributed to increased exports of consumer goods in recent years with total sales increasing in 2011 and a strong recovery between 2016 and 2018 (Trading Economics, 2019b). Moreover, the shortage of skilled labor has not had an adverse effect on the consumer goods manufacturing sector in Thailand. In fact, the overall sector has benefited because of cheap labor and the country's relatively open operating environment, particularly with regard to foreign investment (Economist Intelligence Unit, 2010). According to a leading Thai consumer product company, average operating margins within the industry range between 30% and 60% and net profits are between 3% and 10% (before corporate tax). 2 Publicly traded companies operating in the consumer products sector and selling pan Asian Pacific report anywhere from 1.5-5.5% net profit margins. Table 4. Consumer Products: Market Demand 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 a a a a Clothing (USD m) 3,317 3,882 4,482 5,139 4,987 5,515 5,871 6,319 6,841 7,404 Clothing (% real change) 7.8 5.4 2.8 3.6 -0.8 2.1 3.6 4.1 4.7 4.8 Footwear (USD) 714 903 1,064 1,196 1,148 1,253 1,316 1,396 1,489 1,587 Footwear (% real change) 9.2 14 5 1.6 -1.9 0.8 2.2 2.6 3.2 3.2 Household furniture (USD m) 2,035 2,539 3,082 3,563 3,512 3,919 4,202 4,547 4,943 5,368 Household furniture (% real 17.3 change) 12.4 8.1 4.4 0.8 3.1 1.3 1.6 5.1 5.2 Household textile products (USD m) 10,443 13,150 16,160 18,296 17,675 19,389 20,463 21,816 23,37425,024 Household textile products (% real 1.1 13.5 9.5 2.3 - 1.2 1.3 2.7 3.1 3.6 3.7 change) Soaps and cleaners (USD m) 927 1,138 1,339 1,567 1,503 1,673 1,795 1,954 2.143 2,350 Soaps and cleaners (% real 5.7 change) 10.6 4.8 5.7 -1.9 2.8 4.4 5.3 6.1 6.2 Television sets (stock per 1,000, 253 people) 250 247 245 241 251 262 275 287 300 PCs (units) 5,036 6,450 7,905 9,337 10,539 11,937 13,256 14,585 15,790 17,294 a Economist Intelligence Unit forecasts Source: Economist Intelligence Unit Conclusion Thailand's economically productive years have outnumbered its crisis years by a factor of more than 10:1. While the country has its share of political turmoil and military coups, and is currently on its 17th Constitution, any infighting and domestic discord was largely ignored or under-reported by Western media. In the latter part of 2011, as political turmoil seemed to be receding, Bangkok began to experience massive flooding. Mr. Huang consequently cancelled a business trip owing to the disruption caused by the floods; he had hoped to begin conducting local due diligence on other companies thriving in Thailand. He had learned that Serna-Zonal Public Company Limited (SZC). 3 engaged in the manufacturing, packaging, marketing, and distribution of consumer products primarily in Thailand, had found a business model that remained sustainable throughout Thailand's difficult times (Table 5). After gaining a large market share in Thailand, SZC had expanded to other South East Asian markets, with manufacturing facilities in Vietnam and Malaysia. Neither the political crises in Thailand, nor the floods appeared to have hindered or driven out SZC. Table 5. Serna-Zonal Public Company Limited Financials (USD millions) 2010 2009 Statement of income Revenue 834 679 Cost of sales (626) (515) Gross profit 208 164 Selling, general and administrative expense (138) (115) Other (3) (3) Income before interest and taxes 67 46 Interest expense (7) (5) Income tax expense (10) (9) Net income 50 32 Statement of financial position Assets Current assets Cash and cash equivalents 23 17 Accounts receivables 167 133 Inventories 43 32 Other 137 22 Total current assets 369 204 Non-current assets Property, plant and equipment 15 14 Long-term investments 490 285 Other 9 116 Total non-current assets 514 415 Total assets 883 620 Liabilities Current liabilities Accounts payables 121 96 Short-term debt 131 0 Other 89 67 Total current liabilities 341 163 Non-current liabilities Long-term debt 150 118 Other 8 7 Total non-current liabilities 158 125 Total liabilities 499 289 Equity Share capital 69 62 Retained earnings 315 269 Total equity 384 331 Total equity and liabilities 883 620 Note: These numbers are real, but the name of the company has been changed. Other businesses had experienced similar success in Thailand, such as BB Snacks, Frito-Lay, Berli Jucker PLC, and PM Food Company. According to Euromonitor International, "the sweet and savory snacks category in Thailand is very fragmented, and there are many products offered in different categories. They are presented as alternatives to consumers, and could be said to be substitute products for one another" Euromonitor, 2018). In addition to its success in packaged food products in China, Treslana had found business opportunities by exporting quick-freeze food items to distributors and import/export companies in Japan, Australia, Germany, and the United States. The products were then sold in supermarkets, convenience stores, mass merchandizers such as Wal-Mart, and other retail outlets and stores. Mr. Huang and others on Treslana's management team agreed that the success of their international business could be mirrored in Thailand and, eventually, other ASEAN countries. Furthermore, the possibility of establishing production facilities in these countries would allow for easier access to the consumer. Mr. Huang believed Treslana was financially sound and the time was right to expand further internationally, but he wondered whether Thailand was the right place to start its next business development project. There were other ASEAN markets where Treslana could expand while waiting to see how Thailand's political crisis evolved. However, the success of other consumer product companies in Thailand such as SZC seemed to suggest that the opportunity was economically viable. Moreover, Mir. Huang was concerned that by waiting too long, his products might not beat competitors to the market. Author's Note We have great respect and admiration for the Kingdom of Thailand and love the country and its people. This case/class/discussion is meant to be an academic study supporting investment in the country. No disrespect is meant toward the royal family or the king. Discussion Questions . 1. What are the pros and cons that Mr. Huang and Treslana need to consider when entering Thailand? What are the benefits and disadvantages for Treslana of exporting products to Thailand, as opposed to establishing production facilities in the country? As an investor, assume you have decided to make an equity investment in Treslana. What specific terms and conditions (if any) would you insist upon in order to protect your money? 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started