The 5. Dane Ltd is 75% equity-funded and 25% debt funded. Dane Ltd's debt is in the form of bonds with a yield to maturity

The

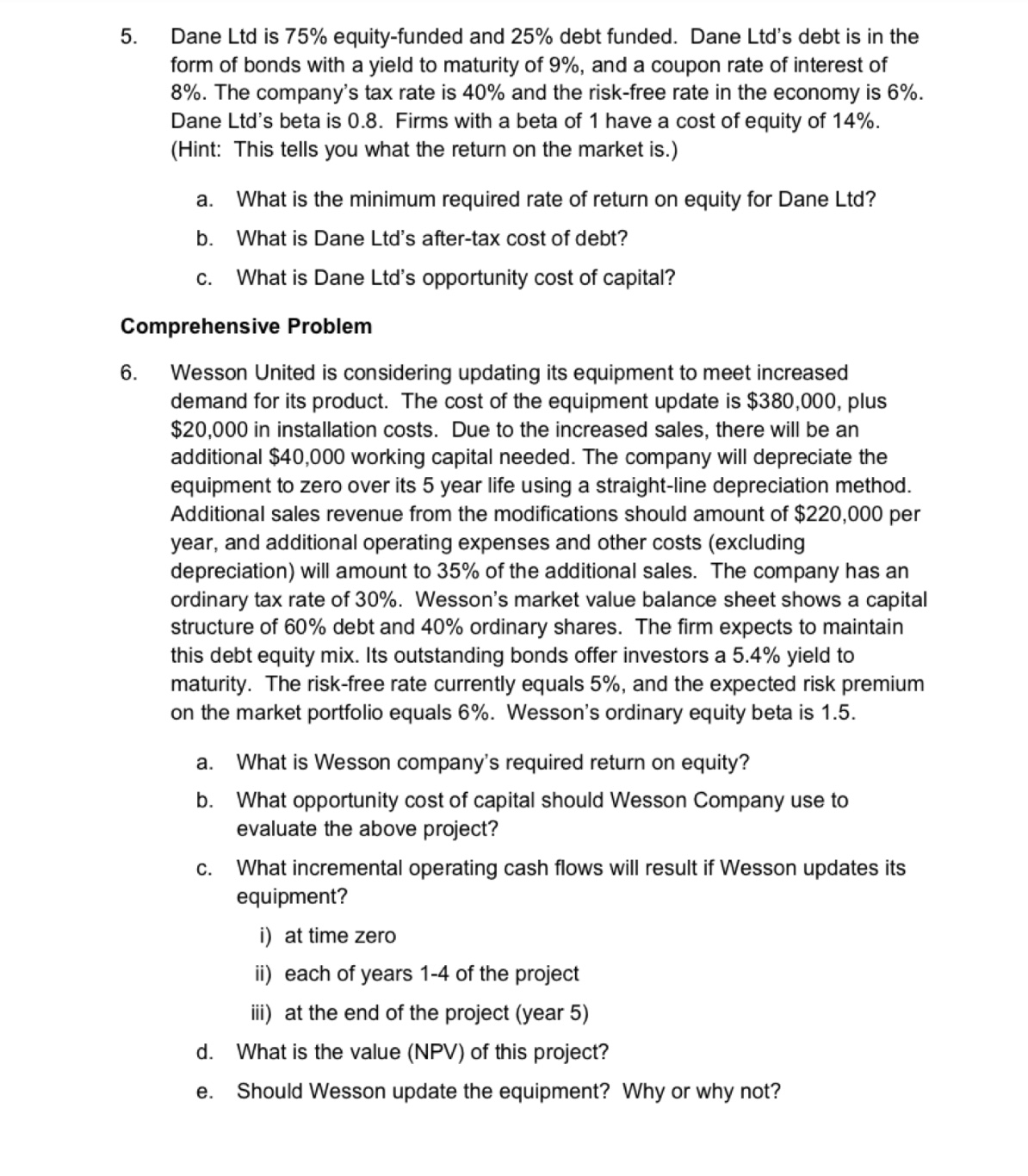

5. Dane Ltd is 75% equity-funded and 25% debt funded. Dane Ltd's debt is in the form of bonds with a yield to maturity of 9%, and a coupon rate of interest of 8%. The company's tax rate is 40% and the risk-free rate in the economy is 6%. Dane Ltd's beta is 0.8. Firms with a beta of 1 have a cost of equity of 14%. (Hint: This tells you what the return on the market is.) a. What is the minimum required rate of return on equity for Dane Ltd? b. What is Dane Ltd's after-tax cost of debt? C. What is Dane Ltd's opportunity cost of capital? Comprehensive Problem 6. Wesson United is considering updating its equipment to meet increased demand for its product. The cost of the equipment update is $380,000, plus $20,000 in installation costs. Due to the increased sales, there will be an additional $40,000 working capital needed. The company will depreciate the equipment to zero over its 5 year life using a straight-line depreciation method. Additional sales revenue from the modifications should amount of $220,000 per year, and additional operating expenses and other costs (excluding depreciation) will amount to 35% of the additional sales. The company has an ordinary tax rate of 30%. Wesson's market value balance sheet shows a capital structure of 60% debt and 40% ordinary shares. The firm expects to maintain this debt equity mix. Its outstanding bonds offer investors a 5.4% yield to maturity. The risk-free rate currently equals 5%, and the expected risk premium on the market portfolio equals 6%. Wesson's ordinary equity beta is 1.5. a. What is Wesson company's required return on equity? b. C. What opportunity cost of capital should Wesson Company use to evaluate the above project? What incremental operating cash flows will result if Wesson updates its equipment? i) at time zero ii) each of years 1-4 of the project ii) at the end of the project (year 5) d. What is the value (NPV) of this project? e. Should Wesson update the equipment? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Stores Ledger Card Understanding the Data We have data on receipts purchases and issues sales of a p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started