Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abstract In early 2 0 1 8 , Diana Mulhall was undertaking a career change that would eliminate the need for frequent business trips to

Abstract

In early Diana Mulhall was undertaking a career change that would eliminate the need for

frequent business trips to Toronto. As a result, she wondered whether she should sell her condo

in the heart of the Canadian city or keep it as a rental property to generate income for herself.

The housing market in Toronto was booming, so Mulhall believed that the condo would fetch top

dollar as a sale. She also thought it would be easy to attract tenants if she kept it as a rental.

She had invested in rental property before but never outside of her hometown of Chicago, so

Mulhall needed to identify the key risks associated with being a landlord in Toronto.

Case

In early Diana Mulhall faced a financial decision that she hadnt anticipated. She had just decided to

leave the consulting firm where she had spent the better part of her career to start her own risk assessment

advisory business in her hometown of Chicago. For the past years, she had climbed the ranks at

management consultancy Accent, finally becoming a partner in the firms risk management division three

years ago. Her major client was the Canadian Imperial Bank of Commerce CIBC She eventually grew tired

of spending four nights a week in a Toronto hotel, so in she purchased a small, onebedroom condo in

Torontos financial district that was within walking distance of the bank. Being able to return in the evenings

to a condo decorated to her own tastes improved her mood during her stays in Toronto. Now that her career

move would put her regular Toronto commute to an end, Mulhalls first instinct was to sell the condo, which

had soared in value in Torontos booming housing market. Perhaps, though, that was a hasty decision, and

she should consider keeping the property as an investment, renting it out to capitalize on its prime location in a

booming city. As part of her portfolio of assets, Mulhall already owned a number of investment properties, but

all of those were located in Chicago. Perhaps the Toronto condo would add useful geographic diversification?

It had certainly been a great investment up to this point. But what about the risks? Fortunately, risk was her

business during all of her years at Accent. She knew all about the quantification of risk. It was time to apply

her skills for her personal benefit.

The Property

The Toronto condominium was located in the story boutique condo building at Nelson St in downtown

Toronto Exhibit It was only about a kilometer from CIBC headquarters in Commerce Court and around

the corner from the ShangriLa Hotel, at which Mulhall had spent over nights in her years commuting to

the city. The building offered luxury, loftstyle condo living, with hour concierge service, exercise facilities,

a rooftop bar, outdoor barbecue, and even its own yoga studio. Mulhalls junior onebedroom unit was located

on the th floor and offered a view of the CN Tower. The living room, kitchen, and powder room were on the

entry level, and then a staircase led to the sleeping area and full bathroom upstairs In total, the

unit was square feet, and Mulhall had purchased the unit in July for $

The Neighborhood

The city of Toronto is divided into neighborhoods. Mulhalls condominium was in neighborhood the

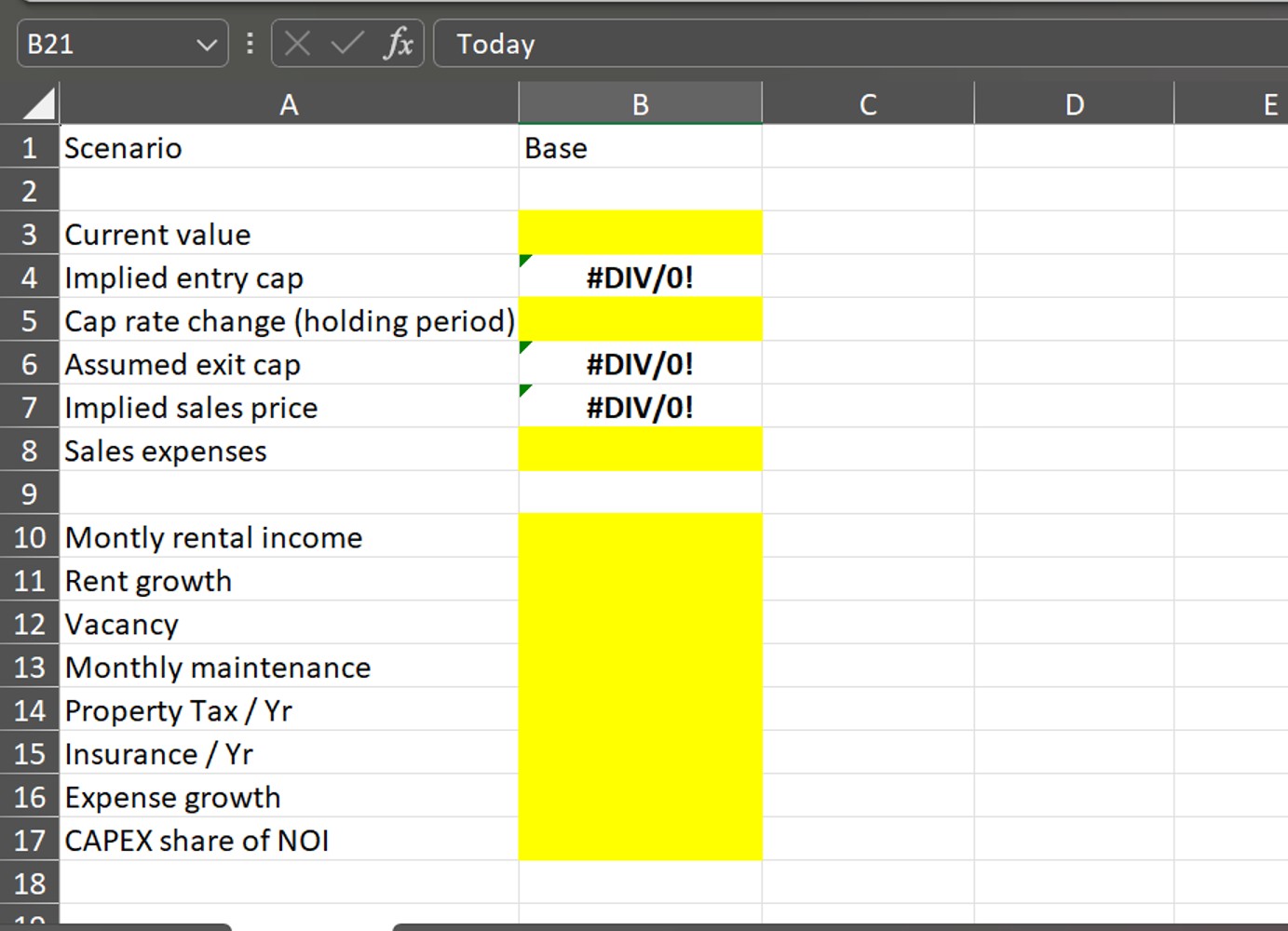

the area had increased between and with of its pCurrent value

Implied entry ca

Cap rate change holdin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started