Question

Abstract In your opening paragraph, summarize the overall story of profitability and liquidity for your company. In other words, highlight the most important aspects of

Abstract

In your opening paragraph, summarize the overall story of profitability and liquidity for your company. In other words, highlight the most important aspects of your report, including your major conclusions.

Paragraph One: Computations

In your first body paragraph, complete the computations portion of your report: Identify and describe your computations from the Financial Analysis tab of your workbook. Be sure to format your key results in table or graphical format, as appropriate. Explain why each cited figure was included in your report in terms of its importance for the organization.

Comparison Ratios:

|

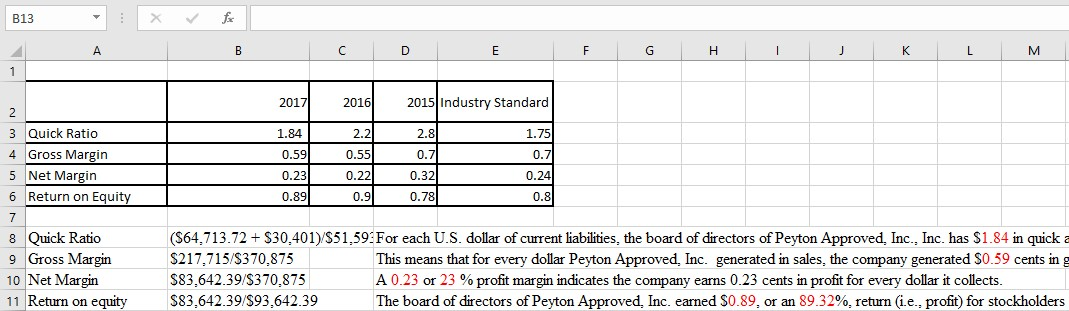

| 2017 | 2016 | 2015 | Industry Standard |

| Quick Ratio |

|

|

|

|

| Gross Margin |

|

|

|

|

| Net Margin |

|

|

|

|

| Return on Equity |

|

|

|

|

Paragraph Two: Comparison

In your second body paragraph, complete the comparison portion of your report: Evaluate the financials of the company by comparing ratios to both historical and industry-average ratios. Clearly identify all unexpected or aberrant figures.

Paragraph Three: Conclusions

In your third body paragraph, draw informed conclusions based on your computations and comparisons in the previous paragraphs. Be sure to justify your claims with specific evidence and examples.

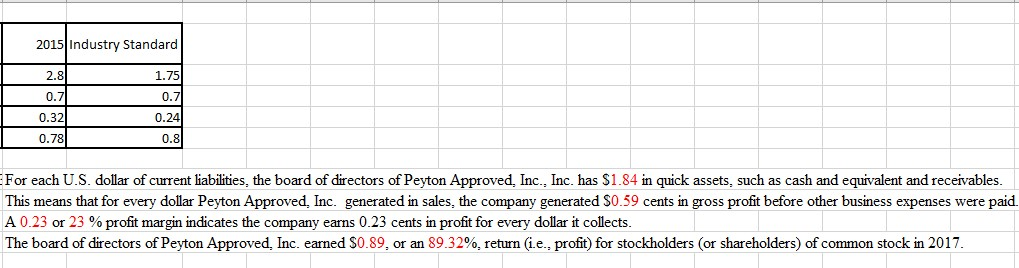

B13 B C D E F G H K L - 1 2017 2016 2015 Industry Standard 1.84 2.81 1.75 0.7 0.59 0.23 2.21 0.55 0.22 0.9 0.7 0.32 0.24 0.89 0.78 0.8 2 3 Quick Ratio Gross Margin 5 Net Margin 6 Return on Equity 7 8 Quick Ratio 9 Gross Margin 10 Net Margin 11 Return on equity ($64.713.72 + $30,401)/$51.59:For each U.S. dollar of current liabilities, the board of directors of Peyton Approved. Inc., Inc. has $1.84 in quick a $217,715/$370.875 This means that for every dollar Peyton Approved. Inc. generated in sales, the company generated $0.59 cents ing $83,642.39/$370.875 A 0.23 or 23 % profit margin indicates the company earns 0.23 cents in profit for every dollar it collects. $83,642.39/$93.642.39 The board of directors of Peyton Approved., Inc. earned $0.89, or an 89.32%, return (i.e., profit) for stockholders 2015 Industry Standard 2.8 0.7 0.321 0.78) 1.75 0.7 0.24 0.8 For each U.S. dollar of current liabilities, the board of directors of Peyton Approved. Inc., Inc. has $1.84 in quick assets, such as cash and equivalent and receivables. This means that for every dollar Peyton Approved, Inc. generated in sales, the company generated $0.59 cents in gross profit before other business expenses were paid A 0.23 or 23 % profit margin indicates the company earns 0.23 cents in profit for every dollar it collects. The board of directors of Peyton Approved, Inc. earned $0.89, or an 89.32%, return (i.e., profit) for stockholders (or shareholders) of common stock in 2017. B13 B C D E F G H K L - 1 2017 2016 2015 Industry Standard 1.84 2.81 1.75 0.7 0.59 0.23 2.21 0.55 0.22 0.9 0.7 0.32 0.24 0.89 0.78 0.8 2 3 Quick Ratio Gross Margin 5 Net Margin 6 Return on Equity 7 8 Quick Ratio 9 Gross Margin 10 Net Margin 11 Return on equity ($64.713.72 + $30,401)/$51.59:For each U.S. dollar of current liabilities, the board of directors of Peyton Approved. Inc., Inc. has $1.84 in quick a $217,715/$370.875 This means that for every dollar Peyton Approved. Inc. generated in sales, the company generated $0.59 cents ing $83,642.39/$370.875 A 0.23 or 23 % profit margin indicates the company earns 0.23 cents in profit for every dollar it collects. $83,642.39/$93.642.39 The board of directors of Peyton Approved., Inc. earned $0.89, or an 89.32%, return (i.e., profit) for stockholders 2015 Industry Standard 2.8 0.7 0.321 0.78) 1.75 0.7 0.24 0.8 For each U.S. dollar of current liabilities, the board of directors of Peyton Approved. Inc., Inc. has $1.84 in quick assets, such as cash and equivalent and receivables. This means that for every dollar Peyton Approved, Inc. generated in sales, the company generated $0.59 cents in gross profit before other business expenses were paid A 0.23 or 23 % profit margin indicates the company earns 0.23 cents in profit for every dollar it collects. The board of directors of Peyton Approved, Inc. earned $0.89, or an 89.32%, return (i.e., profit) for stockholders (or shareholders) of common stock in 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started