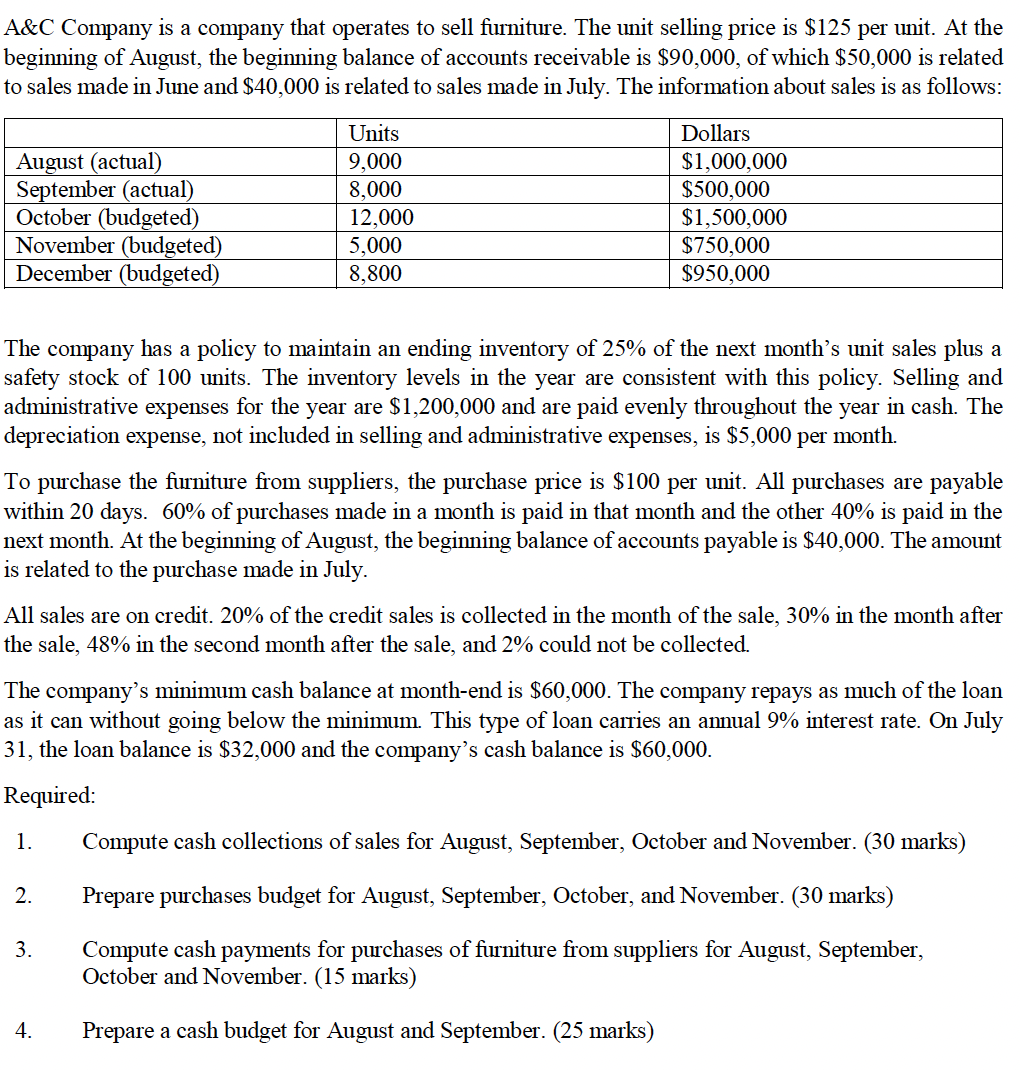

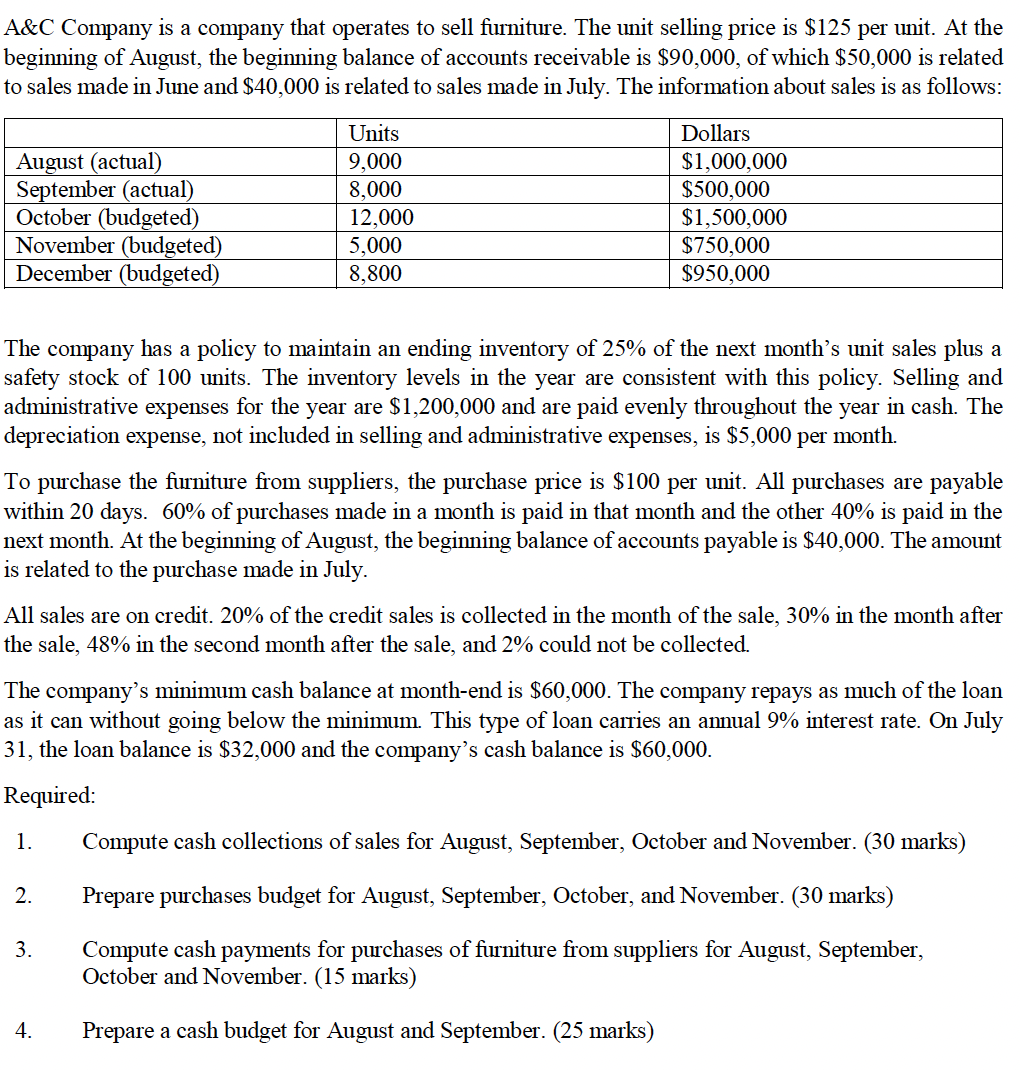

A\&C Company is a company that operates to sell furniture. The unit selling price is $125 per unit. At the beginning of August, the beginning balance of accounts receivable is $90,000, of which $50,000 is related to sales made in June and $40,000 is related to sales made in July. The information about sales is as follows: The company has a policy to maintain an ending inventory of 25% of the next month's unit sales plus a safety stock of 100 units. The inventory levels in the year are consistent with this policy. Selling and administrative expenses for the year are $1,200,000 and are paid evenly throughout the year in cash. The depreciation expense, not included in selling and administrative expenses, is $5,000 per month. To purchase the furniture from suppliers, the purchase price is $100 per unit. All purchases are payable within 20 days. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. At the beginning of August, the beginning balance of accounts payable is $40,000. The amount is related to the purchase made in July. All sales are on credit. 20% of the credit sales is collected in the month of the sale, 30% in the month after the sale, 48% in the second month after the sale, and 2% could not be collected. The company's minimum cash balance at month-end is $60,000. The company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 9% interest rate. On July 31 , the loan balance is $32,000 and the company's cash balance is $60,000. Required: 1. Compute cash collections of sales for August, September, October and November. (30 marks) 2. Prepare purchases budget for August, September, October, and November. (30 marks) 3. Compute cash payments for purchases of furniture from suppliers for August, September, October and November. (15 marks) 4. Prepare a cash budget for August and September. ( 25 marks) A\&C Company is a company that operates to sell furniture. The unit selling price is $125 per unit. At the beginning of August, the beginning balance of accounts receivable is $90,000, of which $50,000 is related to sales made in June and $40,000 is related to sales made in July. The information about sales is as follows: The company has a policy to maintain an ending inventory of 25% of the next month's unit sales plus a safety stock of 100 units. The inventory levels in the year are consistent with this policy. Selling and administrative expenses for the year are $1,200,000 and are paid evenly throughout the year in cash. The depreciation expense, not included in selling and administrative expenses, is $5,000 per month. To purchase the furniture from suppliers, the purchase price is $100 per unit. All purchases are payable within 20 days. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. At the beginning of August, the beginning balance of accounts payable is $40,000. The amount is related to the purchase made in July. All sales are on credit. 20% of the credit sales is collected in the month of the sale, 30% in the month after the sale, 48% in the second month after the sale, and 2% could not be collected. The company's minimum cash balance at month-end is $60,000. The company repays as much of the loan as it can without going below the minimum. This type of loan carries an annual 9% interest rate. On July 31 , the loan balance is $32,000 and the company's cash balance is $60,000. Required: 1. Compute cash collections of sales for August, September, October and November. (30 marks) 2. Prepare purchases budget for August, September, October, and November. (30 marks) 3. Compute cash payments for purchases of furniture from suppliers for August, September, October and November. (15 marks) 4. Prepare a cash budget for August and September. ( 25 marks)