Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AC Limited (hereafter AC) is a manufacturing company situated in Auckland Park, Johannesburg. On 19 June 2021, the management signed a purchase contract to

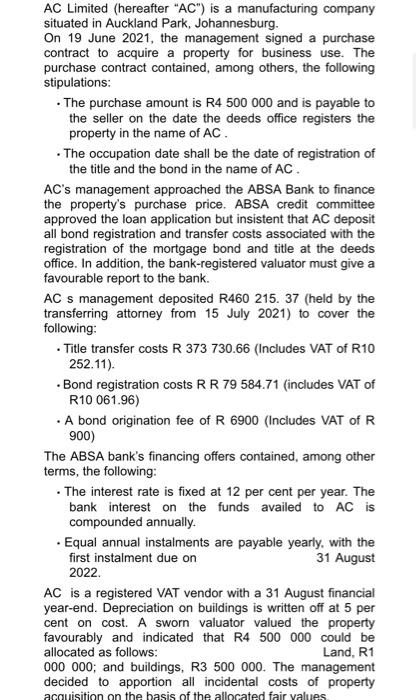

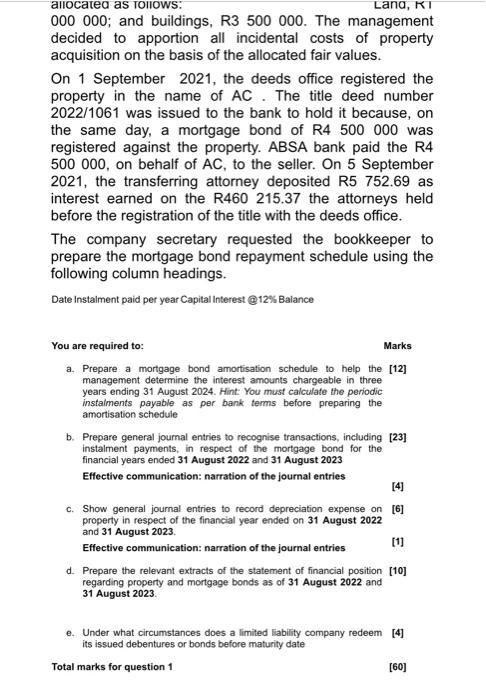

AC Limited (hereafter "AC") is a manufacturing company situated in Auckland Park, Johannesburg. On 19 June 2021, the management signed a purchase contract to acquire a property for business use. The purchase contract contained, among others, the following stipulations: . The purchase amount is R4 500 000 and is payable to the seller on the date the deeds office registers the property in the name of AC. The occupation date shall be the date of registration of the title and the bond in the name of AC. AC's management approached the ABSA Bank to finance the property's purchase price. ABSA credit committee approved the loan application but insistent that AC deposit all bond registration and transfer costs associated with the registration of the mortgage bond and title at the deeds office. In addition, the bank-registered valuator must give a favourable report to the bank. AC s management deposited R460 215. 37 (held by the transferring attorney from 15 July 2021) to cover the following: Title transfer costs R 373 730.66 (Includes VAT of R10 252.11). Bond registration costs R R 79 584.71 (includes VAT of R10 061.96) A bond origination fee of R 6900 (Includes VAT of R 900) The ABSA bank's financing offers contained, among other terms, the following: . The interest rate is fixed at 12 per cent per year. The bank interest on the funds availed to AC is compounded annually. Equal annual instalments are payable yearly, with the first instalment due on 31 August 2022. AC is a registered VAT vendor with a 31 August financial year-end. Depreciation on buildings is written off at 5 per cent on cost. A sworn valuator valued the property favourably and indicated that R4 500 000 could be allocated as follows: Land, R1 000 000; and buildings, R3 500 000. The management decided to apportion all incidental costs of property acquisition on the basis of the allocated fair values allocated as follows: Land, KT 000 000; and buildings, R3 500 000. The management decided to apportion all incidental costs of property acquisition on the basis of the allocated fair values. On 1 September 2021, the deeds office registered the property in the name of AC. The title deed number 2022/1061 was issued to the bank to hold it because, on the same day, a mortgage bond of R4 500 000 was registered against the property. ABSA bank paid the R4 500 000, on behalf of AC, to the seller. On 5 September 2021, the transferring attorney deposited R5 752.69 as interest earned on the R460 215.37 the attorneys held before the registration of the title with the deeds office. The company secretary requested the bookkeeper to prepare the mortgage bond repayment schedule using the following column headings. Date Instalment paid per year Capital Interest @ 12% Balance You are required to: Marks a. Prepare a mortgage bond amortisation schedule to help the [12] management determine the interest amounts chargeable in three years ending 31 August 2024. Hint: You must calculate the periodic instalments payable as per bank terms before preparing the amortisation schedule b. Prepare general journal entries to recognise transactions, including [23] instalment payments, in respect of the mortgage bond for the financial years ended 31 August 2022 and 31 August 2023 Effective communication: narration of the journal entries [4] c. Show general journal entries to record depreciation expense on [6] property in respect of the financial year ended on 31 August 2022 and 31 August 2023. Effective communication: narration of the journal entries [1] d. Prepare the relevant extracts of the statement of financial position [10] regarding property and mortgage bonds as of 31 August 2022 and 31 August 2023. e. Under what circumstances does a limited liability company redeem [4] its issued debentures or bonds before maturity date Total marks for question 1 [60]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provided shows a real estate scenario involving a company named AC Limited that is purchasing a property and requires a mortgage bond amortisation schedule and journal entries for financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started