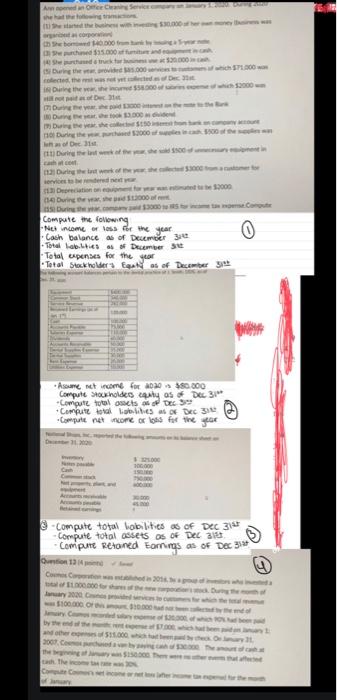

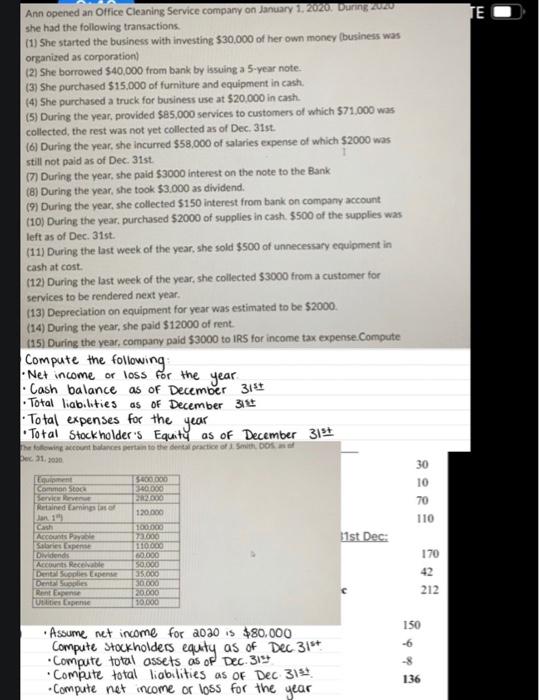

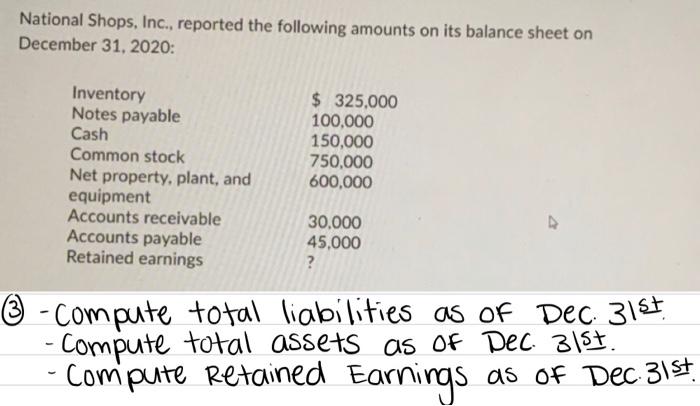

AC Service theologico ed95.000 these During the who558.000 53000 wobec During h00 no During the 2000 vided During the Compute the following Ne income or loss de the year Cash balance as of December 36 Total los. December Total expenses for the cor Total Stockholders as of December 31 TH Asume not come for 20 $80.000 Compute to holdes equy OS DEL 3* Compute walks De Compute to be as of Dec 30 Compute net one or for the year DO . 10000 -Compute totul lollities as of Dec 3145 Compute total assets os Of DEC 313 Compute Retoned forrings as of Dec 31 Onion by the end 150.000 TE Ann opened an Office Cleaning Service company on January 1, 2020 2020 she had the following transactions (1) She started the business with investing 530,000 of her own money business was organized as corporation) (2) She borrowed $40,000 from bank by issuing a 5-year note. (3) She purchased $15.000 of furniture and equipment in cash. (4) She purchased a truck for business use at $20,000 in cash (5) During the year, provided $85,000 services to customers of which $71.000 was collected, the rest was not yet collected as of Dec. 31st. (6) During the year, she incurred $58,000 of salaries expense of which $2000 was still not paid as of Dec. 31st. (7) During the year, she paid $3000 interest on the note to the Bank (8) During the year, she took $3,000 as dividend. (9) During the year, she collected $150 interest from bank on company account (10) During the year, purchased $2000 of supplies in cash. $500 of the supplies was left as of Dec. 31st. (11) During the last week of the year, she sold $500 of unnecessary equipment in cash at cost. (12) During the last week of the year, she collected $3000 from a customer for services to be rendered next year. (13) Depreciation on equipment for year was estimated to be $2000 (14) During the year, she paid $12000 of rent (15) During the year, company paid $3000 to IRS for income tax expense.Compute Compute the following -Net income or loss for the year Cash balance as of December 31st Total liabilities as of December 314 Total expenses for the year Total Stock holder's Equit as of December 3151 The following contest to the departs of S DOS . Dec 31,300 500 000 2003 Common Stoc Eervice Retained comings at 30 10 70 110 11st Dec: cash Accounts Payable Screen Didends Account Recovable DentScopes pense Dents Suplies 120.000 Toto 737600 11110730 60.000 50.000 stood 306800 201000 TOO 170 212 LULE 150 Assume net income for a 20 is $80.000 .Computer Stockholders equty as of Dec 31** Compute total liabilities as of Dec 312 Compute net income or loss for the year 136 National Shops, Inc., reported the following amounts on its balance sheet on December 31, 2020: Inventory Notes payable Cash Common stock Net property, plant, and equipment Accounts receivable Accounts payable Retained earnings $ 325,000 100,000 150,000 750,000 600,000 30,000 45,000 ? - compute total liabilities as of Dec 31st. - compute total assets as of Dec. 3157. Compute Retained Earnings as of Dec 31st, AC Service theologico ed95.000 these During the who558.000 53000 wobec During h00 no During the 2000 vided During the Compute the following Ne income or loss de the year Cash balance as of December 36 Total los. December Total expenses for the cor Total Stockholders as of December 31 TH Asume not come for 20 $80.000 Compute to holdes equy OS DEL 3* Compute walks De Compute to be as of Dec 30 Compute net one or for the year DO . 10000 -Compute totul lollities as of Dec 3145 Compute total assets os Of DEC 313 Compute Retoned forrings as of Dec 31 Onion by the end 150.000 TE Ann opened an Office Cleaning Service company on January 1, 2020 2020 she had the following transactions (1) She started the business with investing 530,000 of her own money business was organized as corporation) (2) She borrowed $40,000 from bank by issuing a 5-year note. (3) She purchased $15.000 of furniture and equipment in cash. (4) She purchased a truck for business use at $20,000 in cash (5) During the year, provided $85,000 services to customers of which $71.000 was collected, the rest was not yet collected as of Dec. 31st. (6) During the year, she incurred $58,000 of salaries expense of which $2000 was still not paid as of Dec. 31st. (7) During the year, she paid $3000 interest on the note to the Bank (8) During the year, she took $3,000 as dividend. (9) During the year, she collected $150 interest from bank on company account (10) During the year, purchased $2000 of supplies in cash. $500 of the supplies was left as of Dec. 31st. (11) During the last week of the year, she sold $500 of unnecessary equipment in cash at cost. (12) During the last week of the year, she collected $3000 from a customer for services to be rendered next year. (13) Depreciation on equipment for year was estimated to be $2000 (14) During the year, she paid $12000 of rent (15) During the year, company paid $3000 to IRS for income tax expense.Compute Compute the following -Net income or loss for the year Cash balance as of December 31st Total liabilities as of December 314 Total expenses for the year Total Stock holder's Equit as of December 3151 The following contest to the departs of S DOS . Dec 31,300 500 000 2003 Common Stoc Eervice Retained comings at 30 10 70 110 11st Dec: cash Accounts Payable Screen Didends Account Recovable DentScopes pense Dents Suplies 120.000 Toto 737600 11110730 60.000 50.000 stood 306800 201000 TOO 170 212 LULE 150 Assume net income for a 20 is $80.000 .Computer Stockholders equty as of Dec 31** Compute total liabilities as of Dec 312 Compute net income or loss for the year 136 National Shops, Inc., reported the following amounts on its balance sheet on December 31, 2020: Inventory Notes payable Cash Common stock Net property, plant, and equipment Accounts receivable Accounts payable Retained earnings $ 325,000 100,000 150,000 750,000 600,000 30,000 45,000 ? - compute total liabilities as of Dec 31st. - compute total assets as of Dec. 3157. Compute Retained Earnings as of Dec 31st