AC309 Unit 3: Application Assignment Individual Deduction

| Description | 2018 Expense Amount | Source Document | Additional Details |

| Gambling losses | 5,150 | Casino account summary | Bob reported $4,750 of gambling winnings on his 2018 Schedule 1, Line 21 |

| Woodworking expenses | 3,330 | Store receipts | Bob whittles animals out of wood as a hobby and sells them to friends & family; in 2018 he reported $5,100 of woodworking income on his 2018 Schedule 1, Line 21 |

| Unreimbursed qualified medical expenses | 19,980 | Hospital invoices | Bob underwent a costly life-saving surgery in 2018 this amount represents his out-of-pocket costs that were not reimbursed through insurance |

| Mortgage interest | 11,875 | Form 1098 | Mortgage is secured by Bobs principal residence |

| Home Equity Line of Credit (HELOC) interest | 2,385 | Bank statement | Bobs principal residence was used to secure the loan; loan proceeds were used to pay off credit card debt |

| Home Equity Line of Credit (HELOC) interest | 4,625 | Bank statement | Bobs principal residence was used to secure the loan; loan proceeds were used to purchase a new roof for Bobs principal residence |

| State income taxes | 8,185 | State tax return | |

| State sales taxes | 2,240 | Receipts | |

| Real estate taxes | 2,650 | Bank statement | |

| Personal property taxes | 470 | Car registration | |

| Tax preparation fees | 300 | Receipts | |

| Union dues | 1,500 | Paystubs | |

| Cash gifts to charity | 750 | 501(c)(3) receipts | |

| Cash gifts to local homeless man | 1,040 | Personal records | |

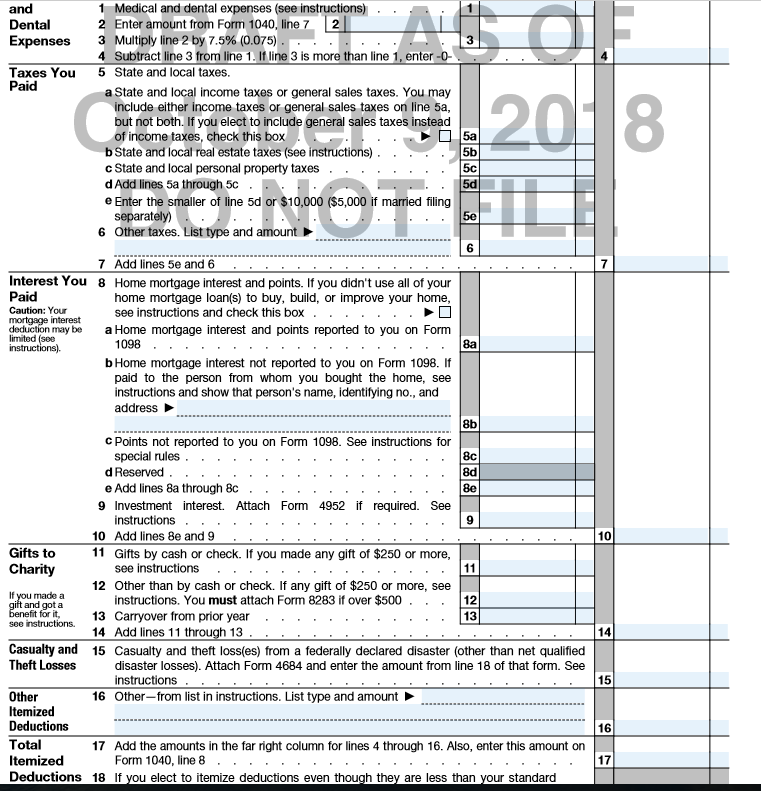

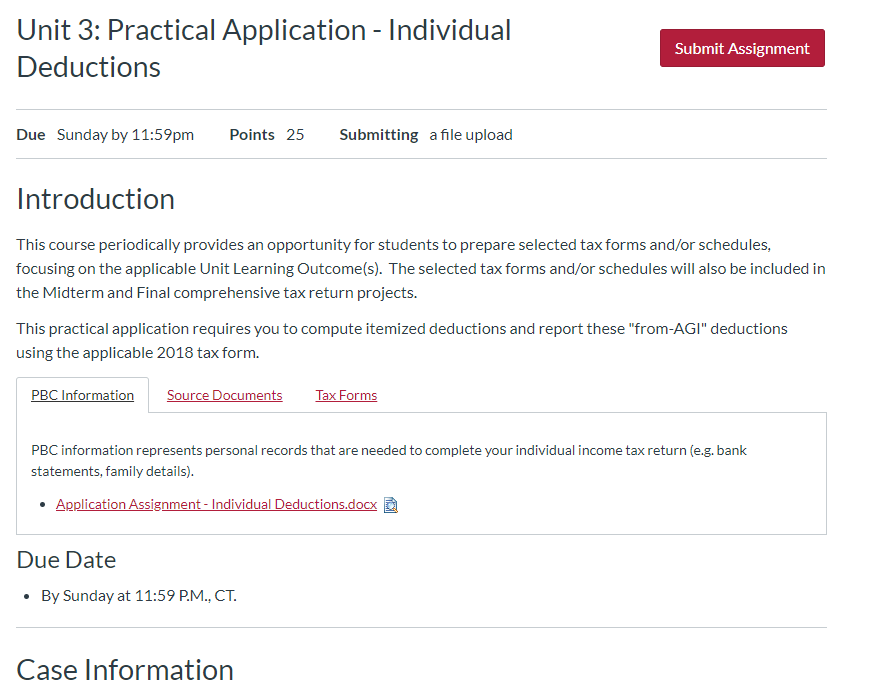

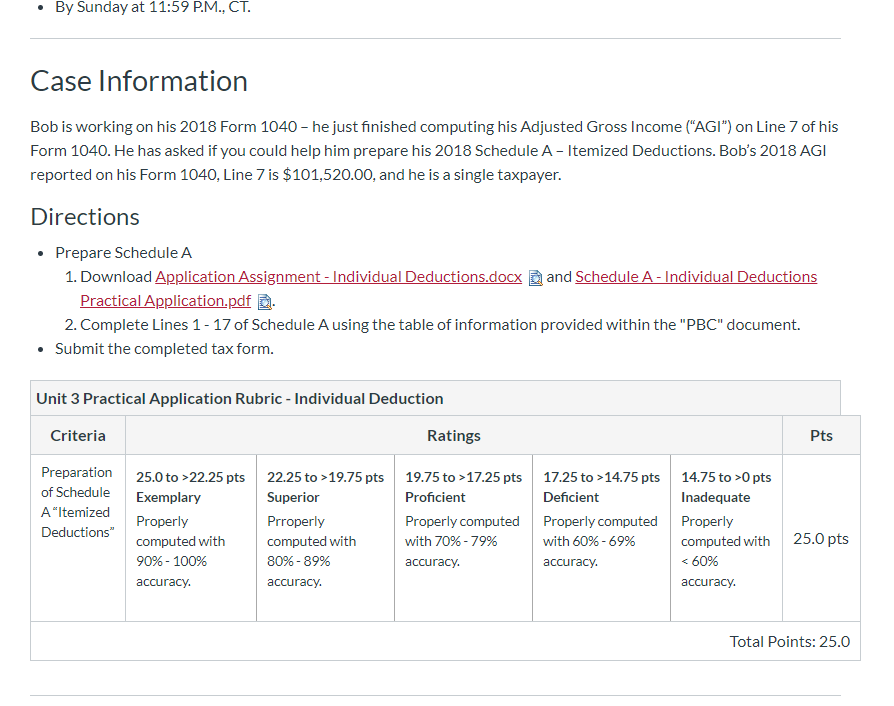

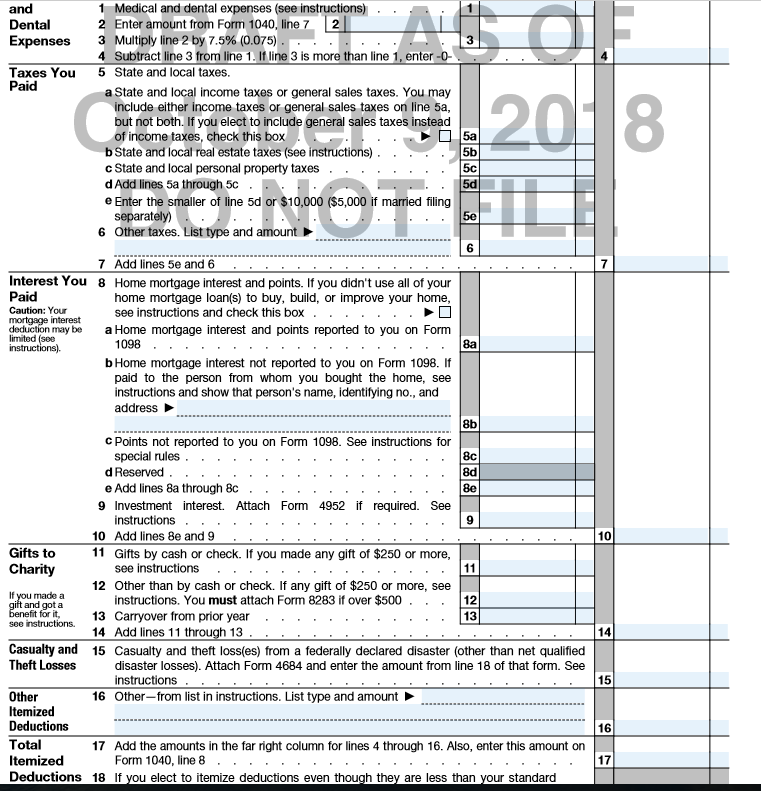

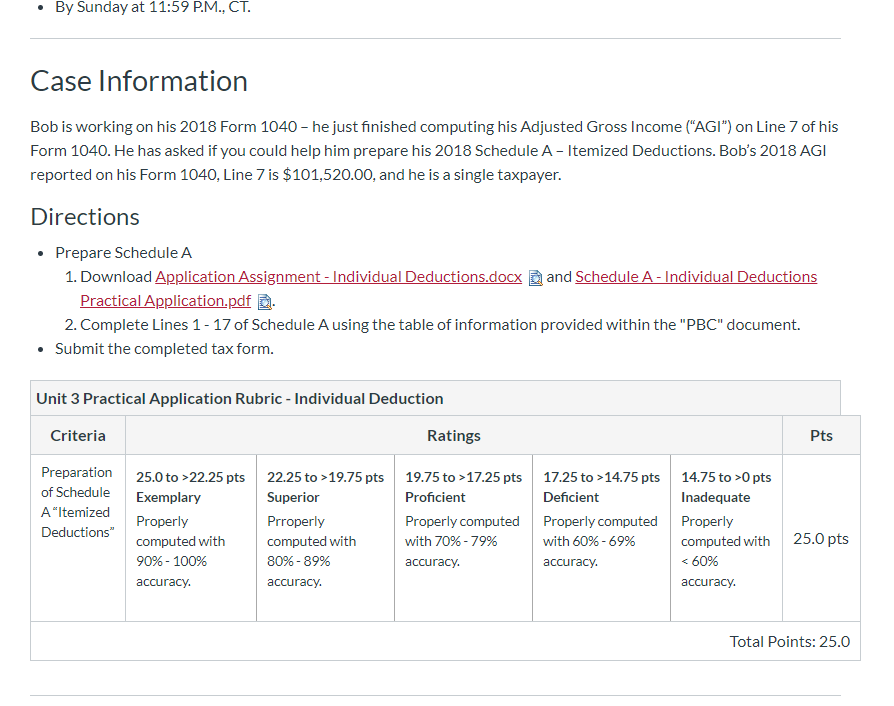

and Dental Expenses Taxes You Paid 1 Medical and dental expenses (see instructions) 2 Enter amount from Form 1040, line 7 2 3 Multiply line 2 by 7.5% (0.075). .......... 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-0- 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) .. .. c State and local personal property taxes....... d Add lines 5a through 5C.. . . e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) . . . . . 6 Other taxes. List type and amount 2018 7 Add lines 5e and 6 . . . . . . . . Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid home mortgage loan(s) to buy, build, or improve your home, Caution: Your see instructions and check this box. . . . . . . U mortgage interest deduction may be a Home mortgage interest and points reported to you on Form limited (see instructions) 1098 . . . . . . . . . . . . . . . . . . . b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8d 8e 10 12 c Points not reported to you on Form 1098. See instructions for special rules. . . . . . 8C . . . d Reserved. . . . . . . . . . . . . . . . . . e Add lines 8a through 8C . . . . . . . . . . . . . 9 Investment interest. Attach Form 4952 if required. See instructions . . . . . . . . . . . . . . . . 10 Add lines 8e and 9 . . . . Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions . . . . . . . . . . . . . . . 12 Other than by cash or check. If any gift of $250 or more, see If you made a gilt and got a instructions. You must attach Form 8283 if over $500. .. benefit for it. 13 Carryover from prior year . . . . . . . . . . . . 131 see instructions. 14 Add lines 11 through 13. . Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions . . . . . . . . . . . . . . . . . . . . . . . Other 16 Other-from list in instructions. List type and amount ............. Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040, line 8 . . . . . . . . . . . . . . . . . . . . . . . Deductions 18 If you elect to itemize deductions even though they are less than your standard I 15 Unit 3: Practical Application - Individual Deductions Submit Assignment Due Sunday by 11:59pm Points 25 Submitting a file upload Introduction This course periodically provides an opportunity for students to prepare selected tax forms and/or schedules, focusing on the applicable Unit Learning Outcome(s). The selected tax forms and/or schedules will also be included in the Midterm and Final comprehensive tax return projects. This practical application requires you to compute itemized deductions and report these "from-AGI" deductions using the applicable 2018 tax form. PBC Information Source Documents Tax Forms PBC information represents personal records that are needed to complete your individual income tax return (e.g. bank statements, family details). Application Assignment - Individual Deductions.docx Due Date By Sunday at 11:59 P.M., CT. Case Information By Sunday at 11:59 P.M., CT. Case Information Bob is working on his 2018 Form 1040 - he just finished computing his Adjusted Gross Income ("AGI") on Line 7 of his Form 1040. He has asked if you could help him prepare his 2018 Schedule A-Itemized Deductions. Bob's 2018 AGI reported on his Form 1040, Line 7 is $101,520.00, and he is a single taxpayer. Directions Prepare Schedule A 1. Download Application Assignment - Individual Deductions.docx and Schedule A - Individual Deductions Practical Application.pdf . 2. Complete Lines 1 - 17 of Schedule A using the table of information provided within the "PBC" document. Submit the completed tax form. Unit 3 Practical Application Rubric - Individual Deduction Criteria Ratings Pts Preparation of Schedule A "Itemized Deductions" 25.0 to >22.25 pts Exemplary Properly computed with 90% - 100% accuracy. 22.25 to >19.75 pts Superior Prroperly computed with 80% - 89% accuracy. 19.75 to >17.25 pts Proficient Properly computed with 70% -79% accuracy. 17.25 to > 14.75 pts Deficient Properly computed with 60% -69% accuracy. 14.75 to >0 pts Inadequate Properly computed with 22.25 pts Exemplary Properly computed with 90% - 100% accuracy. 22.25 to >19.75 pts Superior Prroperly computed with 80% - 89% accuracy. 19.75 to >17.25 pts Proficient Properly computed with 70% -79% accuracy. 17.25 to > 14.75 pts Deficient Properly computed with 60% -69% accuracy. 14.75 to >0 pts Inadequate Properly computed with