AC313

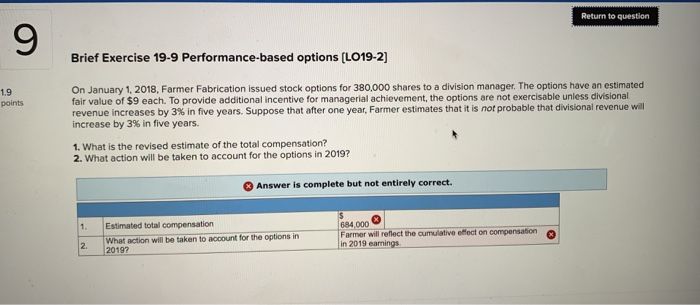

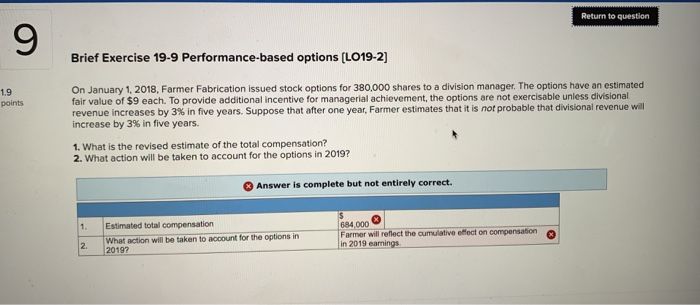

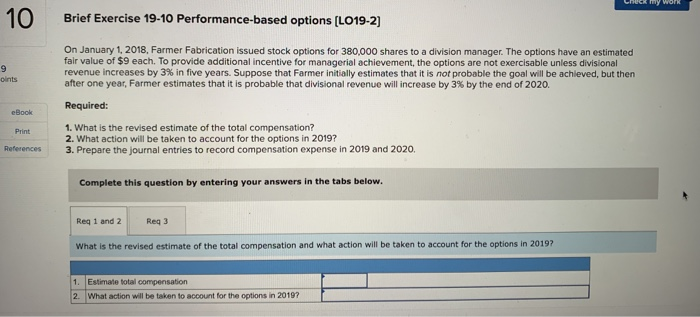

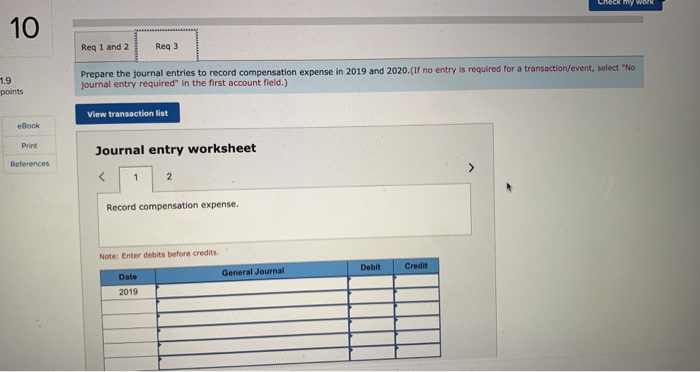

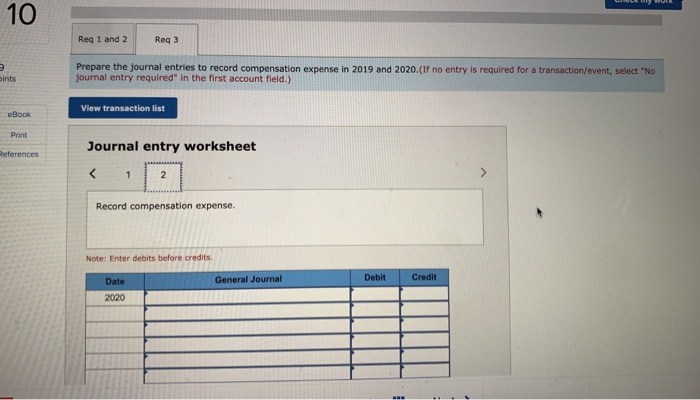

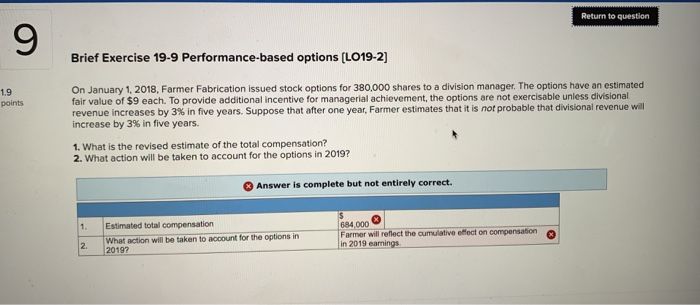

Return to question Brief Exercise 19-9 Performance-based options (LO19-2] 1.9 points On January 1, 2018, Farmer Fabrication issued stock options for 380,000 shares to a division manager. The options have an estimated fair value of $9 each. To provide additional incentive for managerial achievement, the options are not exercisable unless divisional revenue increases by 3% in five years. Suppose that after one year, Farmer estimates that it is not probable that divisional revenue will increase by 3% in five years. 1. What is the revised estimate of the total compensation? 2. What action will be taken to account for the options in 2019? Answer is complete but not entirely correct. 684.000 Estimated total compensation What action will be taken to account for the options in 20197 Farmer will reflect the cumulative effect on compensation in 2019 earnings 10 Brief Exercise 19-10 Performance-based options (LO19-2] On January 1, 2018, Farmer Fabrication issued stock options for 380,000 shares to a division manager. The options have an estimated fair value of $9 each. To provide additional incentive for managerial achievement, the options are not exercisable unless divisional revenue increases by 3% in five years. Suppose that Farmer initially estimates that it is not probable the goal will be achieved, but then after one year, Farmer estimates that it is probable that divisional revenue will increase by 3% by the end of 2020. oints Required: eBook 1. What is the revised estimate of the total compensation? 2. What action will be taken to account for the options in 2019? 3. Prepare the journal entries to record compensation expense in 2019 and 2020 References Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 What is the revised estimate of the total compensation and what action will be taken to account for the options in 2019? 1. Estimate total compensation 2. What action will be taken to account for the options in 2019? CHECK MY WORK 10 Reg 1 and 2 Reg 3 1.9 points Prepare the journal entries to record compensation expense in 2019 and 2020.(If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet References Record compensation expense. Note: Enter debits before credits Credit Debit General Journal Date 2019 10 Req 1 and 2 Reg 3 ints Prepare the journal entries to record compensation expense in 2019 and 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list eBook Print Journal entry worksheet References Record compensation expense. Note: Enter debits before credits General Journal Debit Credit Date 2020