Answered step by step

Verified Expert Solution

Question

1 Approved Answer

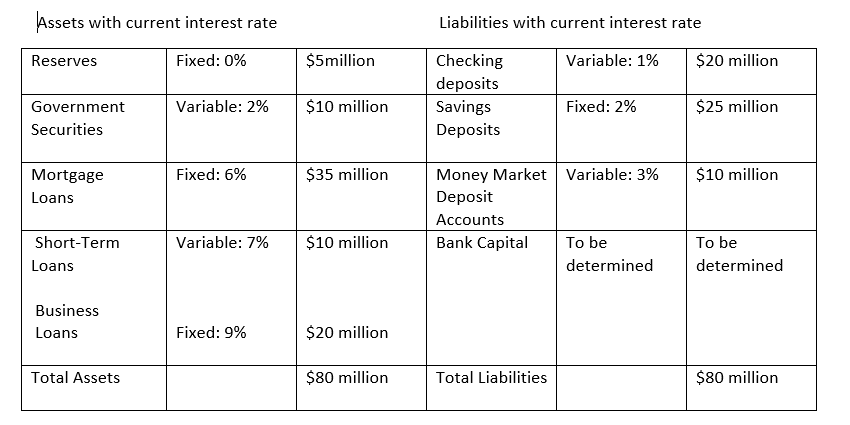

a.Calculate the banks annual interest income and interest expense b.If the bank has $1 million from off balance sheet activities income and $0.5 million of

a.Calculate the banks annual interest income and interest expense b.If the bank has $1 million from off balance sheet activities income and $0.5 million of non-interest expense, calculate your banks annual profit ( interest income interest expense)

c.Assuming no taxes, calculate the banks ROA and ROE. Which of the two are better measure of the return to the banks owners?

d.If $5 million of the bank mortgage loans default, what risk is your bank facing? What will happen to the value of the bank capital?

Assets with current interest rate Liabilities with current interest rate | $20 million Checking deposits SavingS Deposits Reserves Fixed: 0% $5million Variable: 1% Government Variable: 2% | $10 million Fixed: 2% $25 million Securities $35 million Money Market | Variable: 3% Deposit Accounts Bank Capital Fixed: 6% | $10 million Mortgage Loans Short-Term Loans | $10 million To be determined Variable: 7% To be determined Business Loans Fixed: 9% $20 million Total Assets $80 million Total Liabilities $80 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started