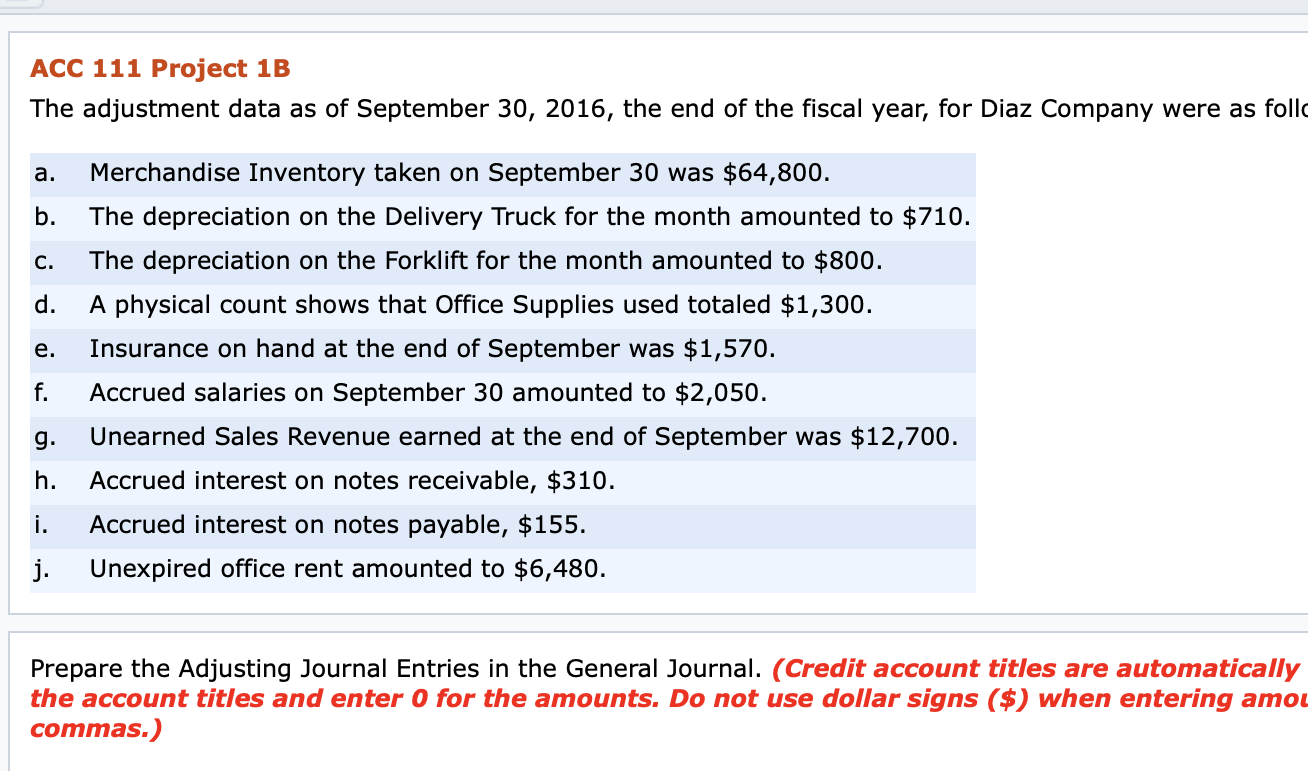

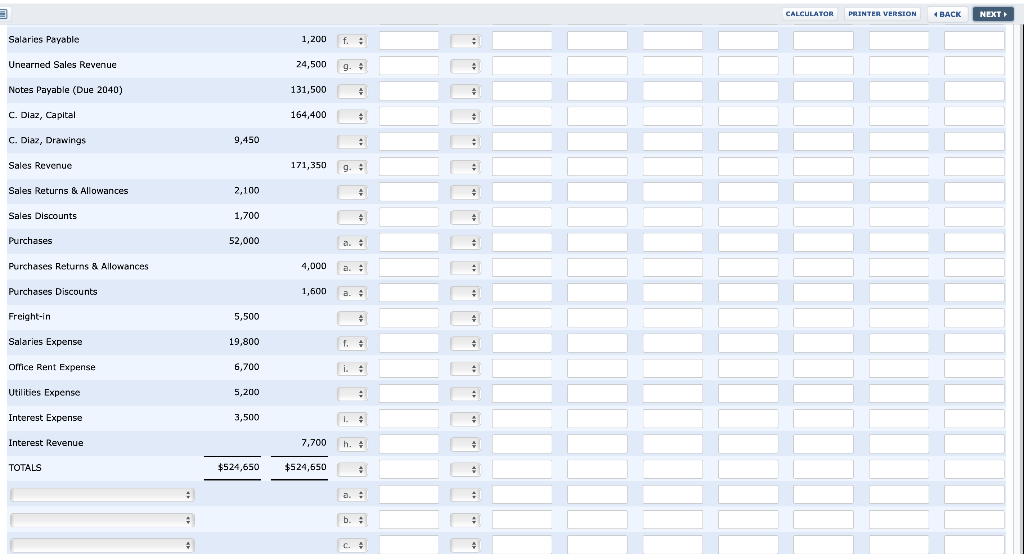

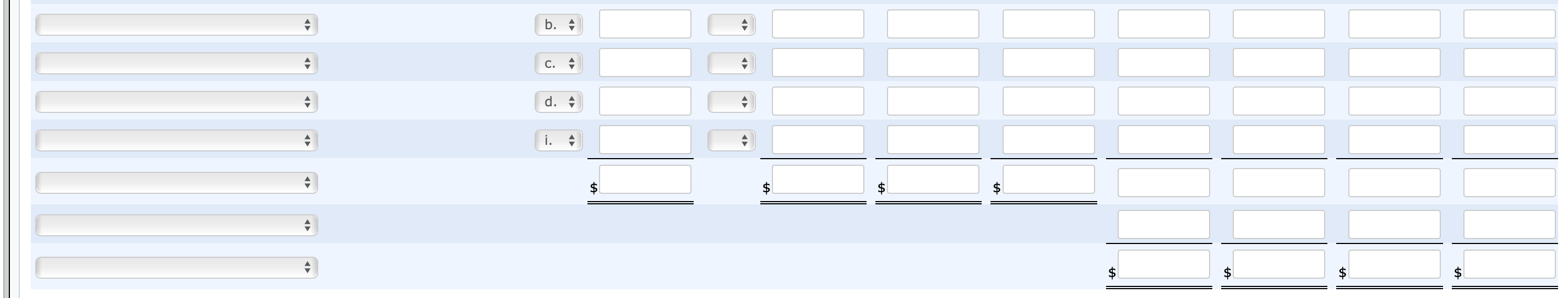

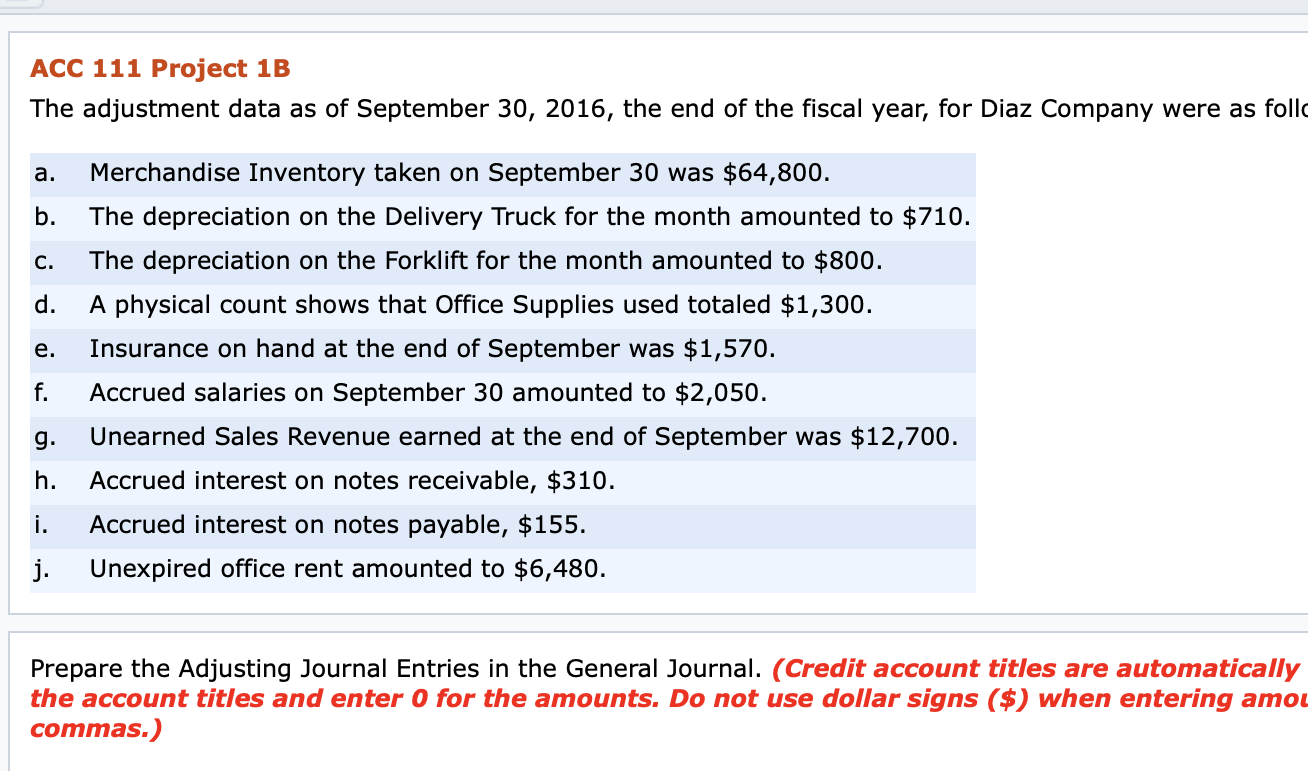

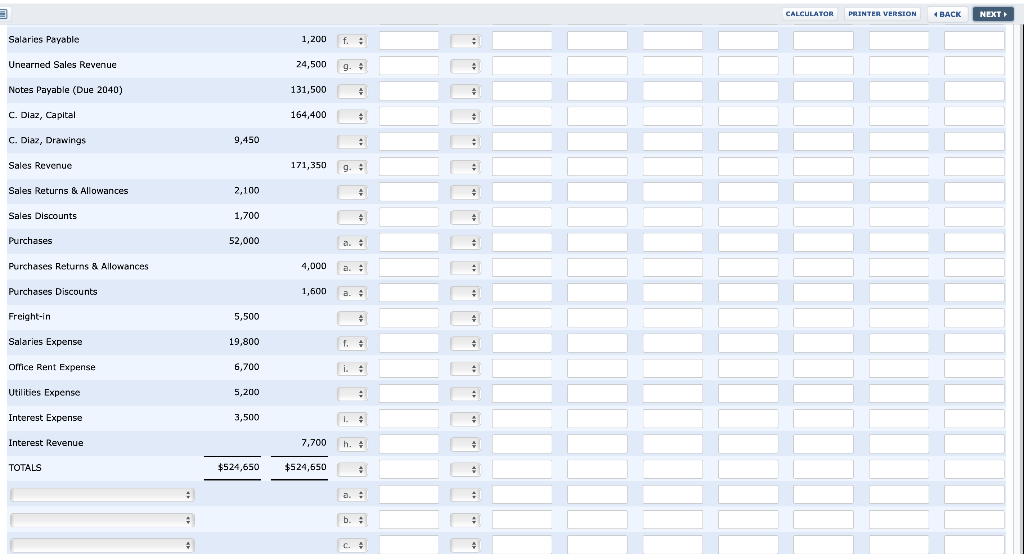

ACC 111 Project 1B The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follo a. b. C. d. e. Merchandise Inventory taken on September 30 was $64,800. The depreciation on the Delivery Truck for the month amounted to $710. The depreciation on the Forklift for the month amounted to $800. A physical count shows that Office Supplies used totaled $1,300. Insurance on hand at the end of September was $1,570. Accrued salaries on September 30 amounted to $2,050. Unearned Sales Revenue earned at the end of September was $12,700. Accrued interest on notes receivable, $310. Accrued interest on notes payable, $155. Unexpired office rent amounted to $6,480. ." g. h. i. j. Prepare the Adjusting Journal Entries in the General Journal. (Credit account titles are automatically the account titles and enter 0 for the amounts. Do not use dollar signs ($) when entering amo commas.) amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) Unadjusted Trial Balance Debit Credit Adjustments Debit Adjusted Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit ACCOUNT NAME Credit Cash $8,000 $ $ s 160,000 . Notes Receivable Accounts Receivable 16,100 4 + Interest Receivable 2,800 h. Merchandise Inventory, 9/30/15 54,800 a a. Prepaid Insurance 3,800 Prepaid Office Rent 16,900 i. Office Supplies 2,800 d. Land 90,000 Forklift 24,000 Accumulated Depreciation, Forklift $2,600 + Delivery Truck 39,500 . Accumulated Depreciation, Delivery Truck 4,900 b. Accounts Payable 10,900 Salaries Payable 1,200 f .. Uneamed Sales Revenue 24,500 9. CALCULATOR PRINTER VERSION 1 BACK NEXT Salaries Payable 1,200 Unearned Sales Revenue 24,500 . Notes Payable (Due 2040) 131,500 + C. Dlaz, Capital 164,400 + C. Diaz, Drawings 9,450 - . Sales Revenue 171,350 . . Sales Returns & Allowances 2,100 + Sales Discounts 1,700 - + Purchases 52,000 + Purchases Returns & Allowances 4,000 : Purchases Discounts 1,600 a. Freight-in 5,500 + Salaries Expense 19,800 + Office Rent Expense 6,700 Utilities Expense 5,200 . . Interest Expense 3,500 + Interest Revenue 7,700 h. + TOTALS $524,650 $524,650 + a.. . . b. + . + b. C. - d. i. $ $