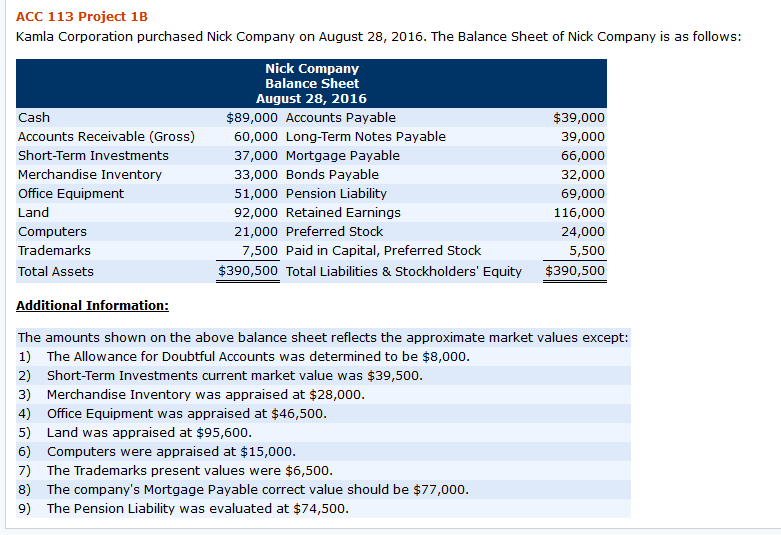

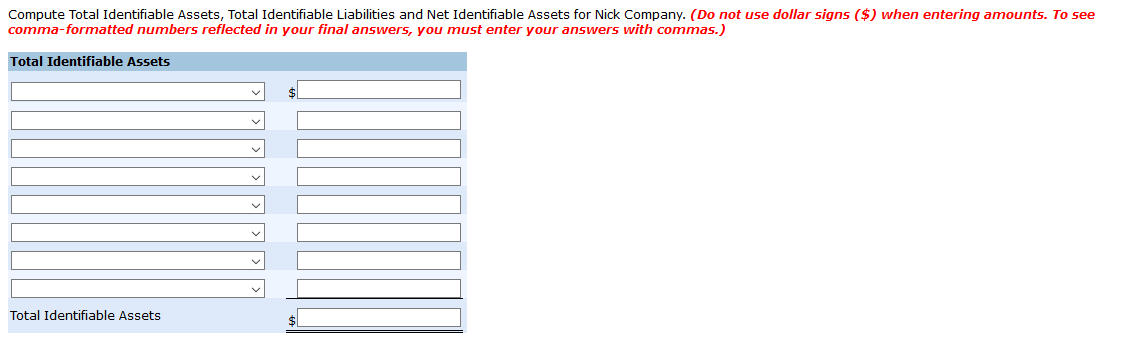

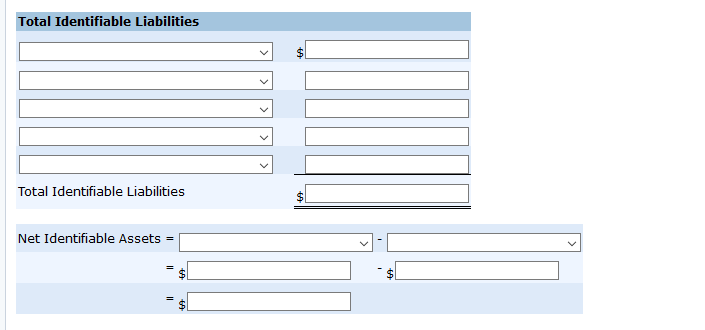

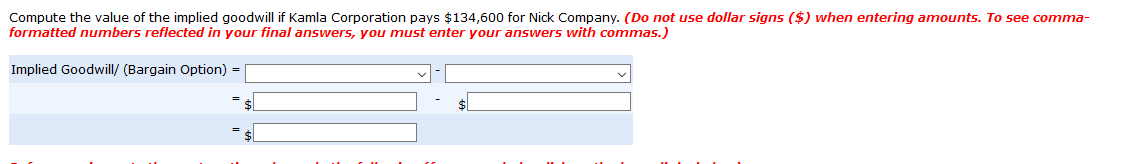

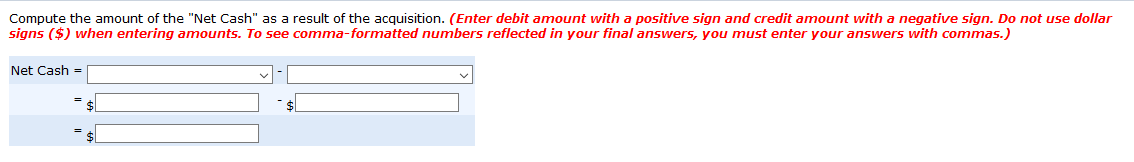

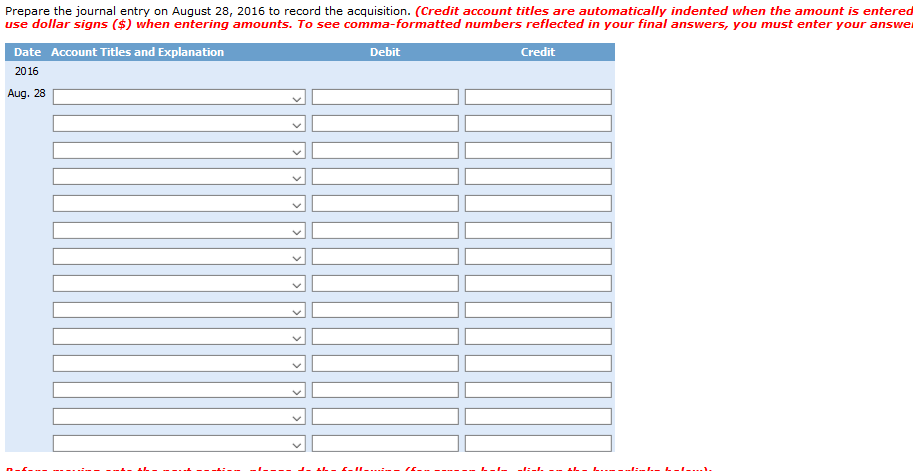

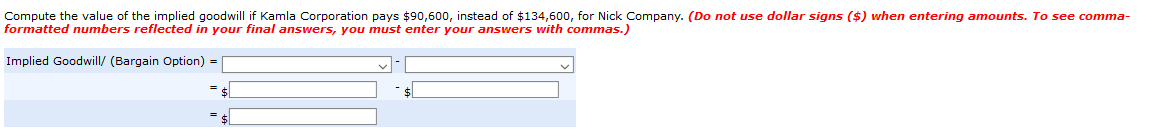

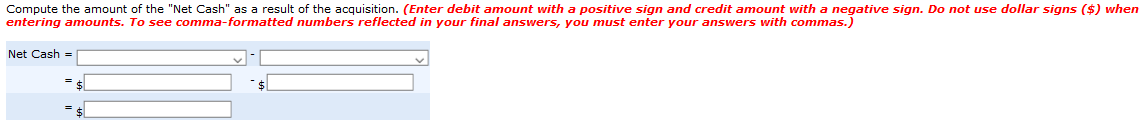

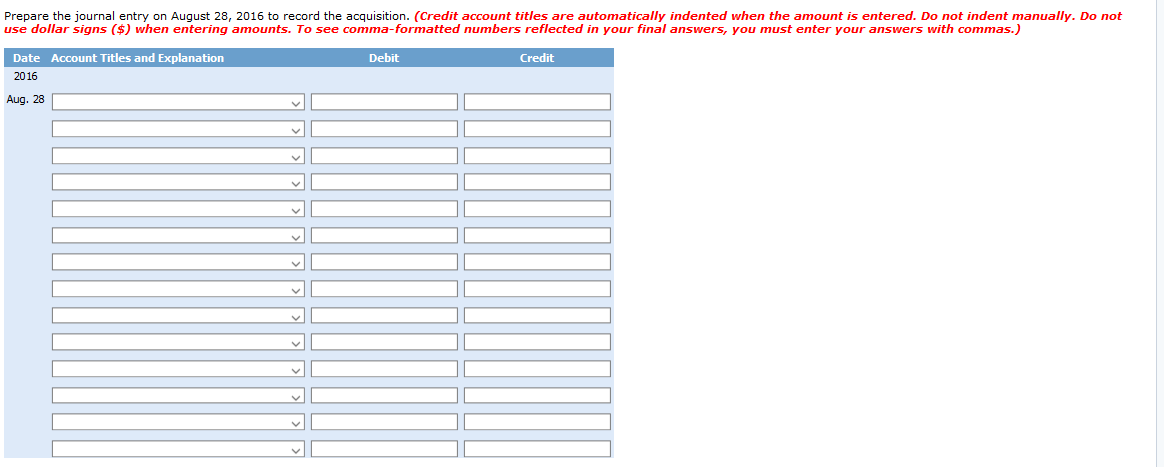

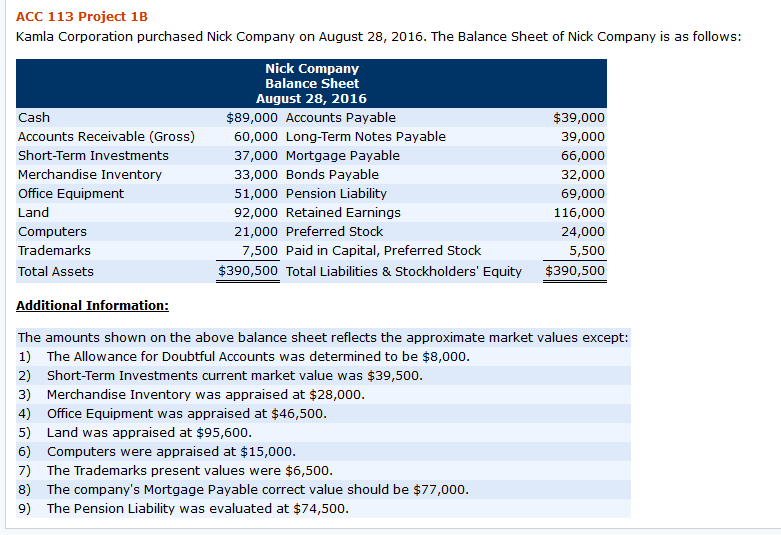

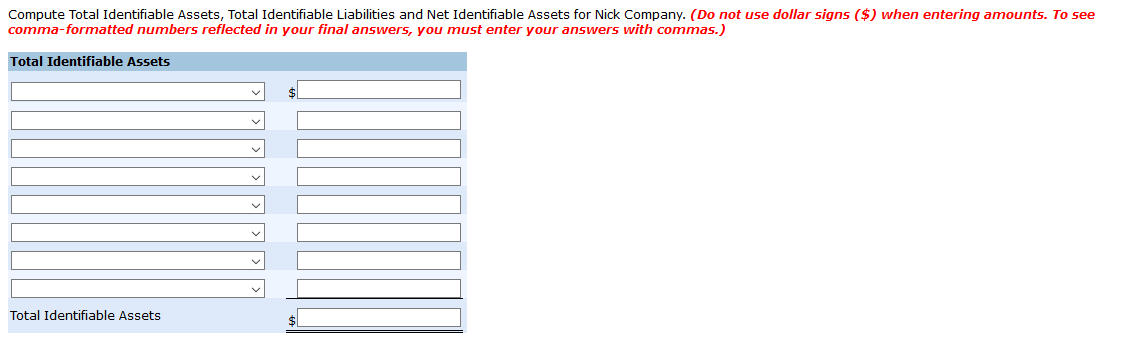

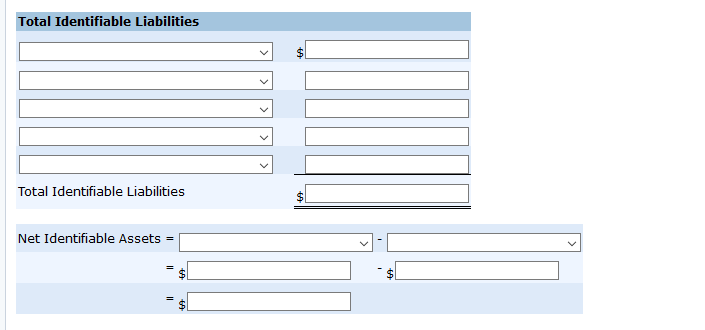

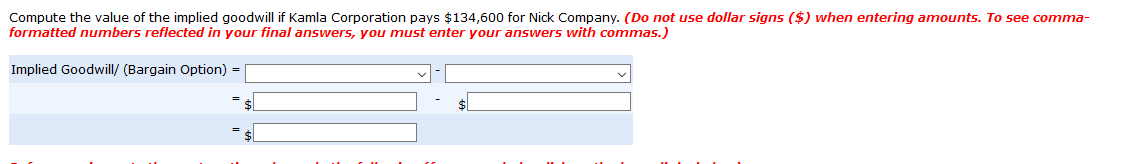

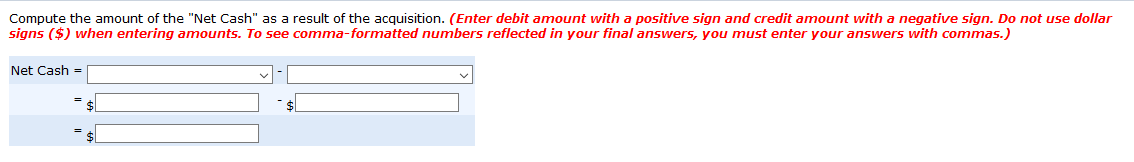

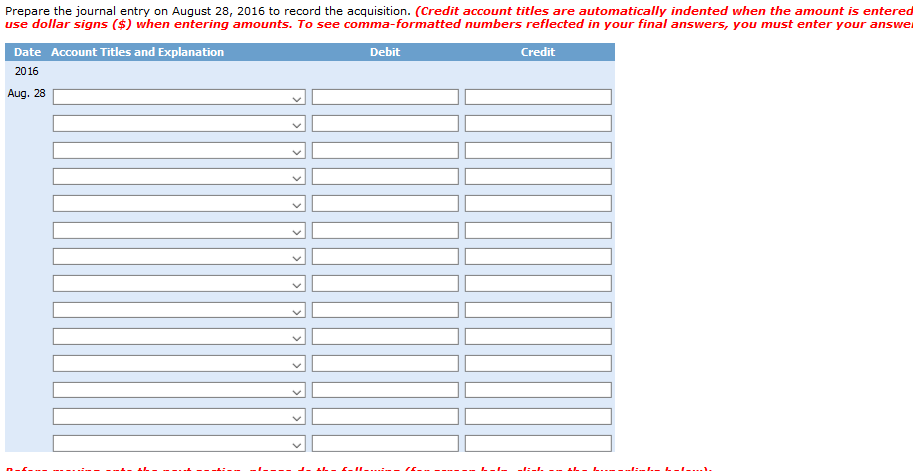

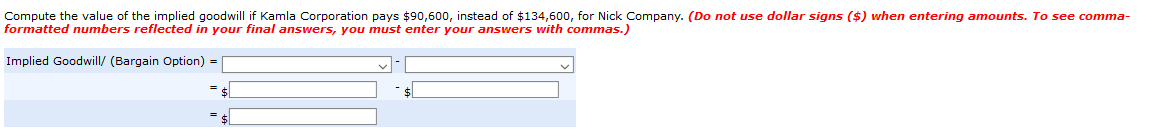

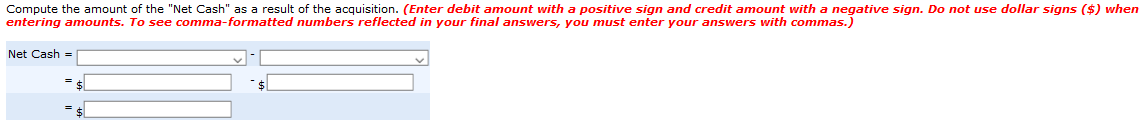

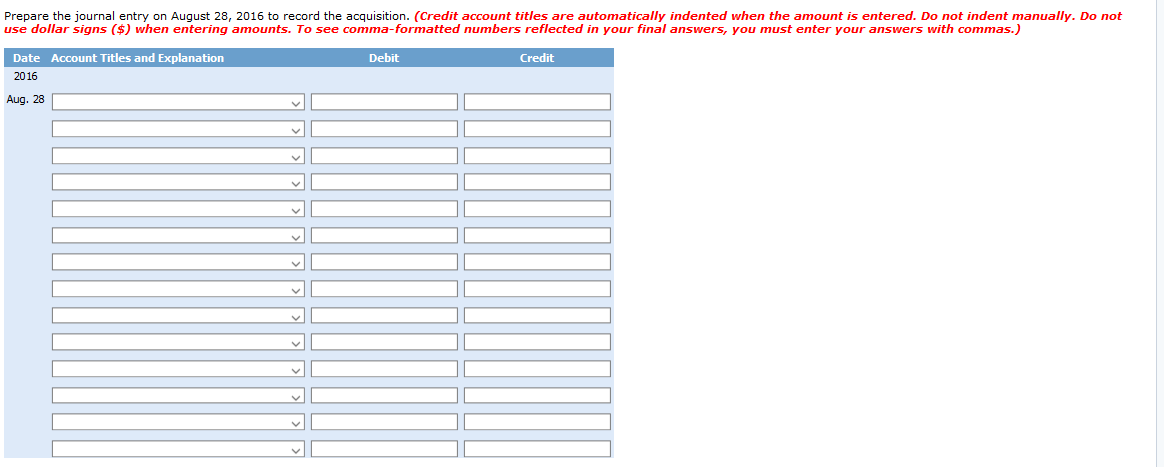

ACC 113 Project 1B Kamla Corporation purchased Nick Company on August 28, 2016. The Balance Sheet of Nick Company is as follows: Cash Accounts Receivable (Gross) Short-Term Investments Merchandise Inventory Office Equipment Land Computers Trademarks Total Assets Nick Company Balance Sheet August 28, 2016 $89,000 Accounts Payable 60,000 Long-Term Notes Payable 37,000 Mortgage Payable 33,000 Bonds Payable 51,000 Pension Liability 92,000 Retained Earnings 21,000 Preferred Stock 7,500 Paid in Capital, Preferred Stock $390,500 Total Liabilities & Stockholders' Equity $39,000 39,000 66,000 32,000 69,000 116,000 24,000 5,500 $390,500 Additional Information: The amounts shown on the above balance sheet reflects the approximate market values except: 1) The Allowance for Doubtful Accounts was determined to be $8,000. 2) Short-Term Investments current market value was $39,500. 3) Merchandise Inventory was appraised at $28,000. 4) Office Equipment was appraised at $46,500. 5) Land was appraised at $95,600. 6) Computers were appraised at $15,000. 7) The Trademarks present values were $6,500. 8) The company's Mortgage Payable correct value should be $77,000. 9) The Pension Liability was evaluated at $74,500. Compute Total Identifiable Assets, Total Identifiable Liabilities and Net Identifiable Assets for Nick Company. (Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) Total Identifiable Assets Total Identifiable Assets Total Identifiable Liabilities Total Identifiable Liabilities Net Identifiable Assets = 6 67 Compute the value of the implied goodwill if Kamla Corporation pays $134,600 for Nick Company. (Do not use dollar signs ($) when entering amounts. To see comma- formatted numbers reflected in your final answers, you must enter your answers with commas.) Implied Goodwill/ (Bargain Option) = 4 6 Compute the amount of the "Net Cash" as a result of the acquisition. (Enter debit amount with a positive sign and credit amount with a negative sign. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) Net Cash = 6 69 Prepare the journal entry on August 28, 2016 to record the acquisition. (Credit account titles are automatically indented when the amount is entered use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answer Date Account Titles and Explanation Debit Credit 2016 Aug. 28 Compute the value of the implied goodwill if Kamla Corporation pays $90,600, instead of $134,600, for Nick Company. (Do not use dollar signs ($) when entering amounts. To see comma- formatted numbers reflected in your final answers, you must enter your answers with commas.) Implied Goodwill/ (Bargain Option) = $ Compute the amount of the "Net Cash" as a result of the acquisition. (Enter debit amount with a positive sign and credit amount with a negative sign. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) Net Cash = Prepare the journal entry on August 28, 2016 to record the acquisition. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.) Debit Credit Date Account Titles and Explanation 2016 Aug. 28