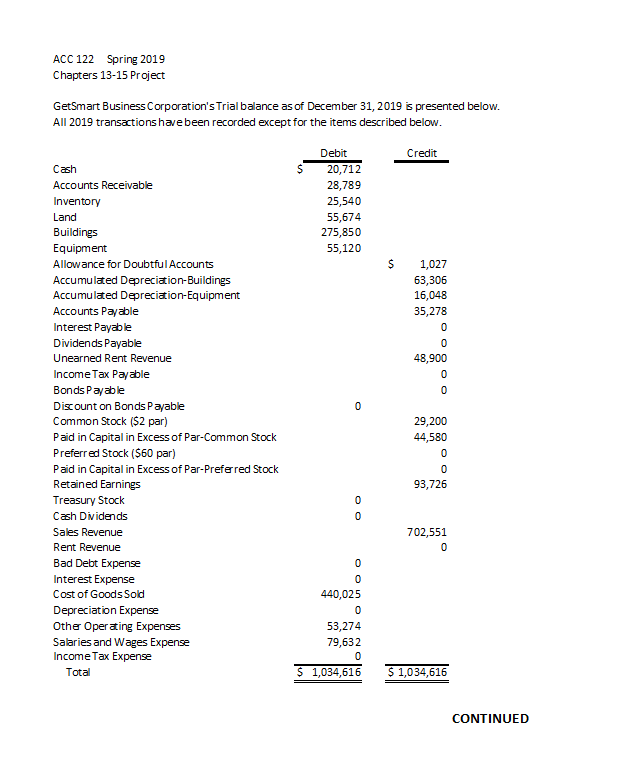

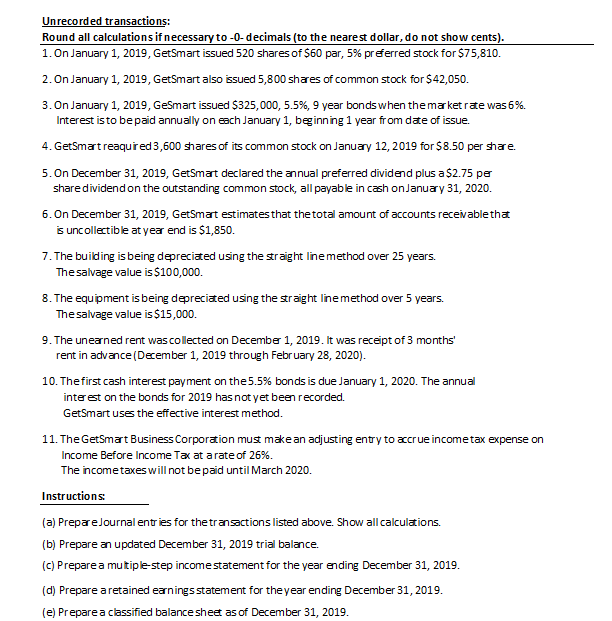

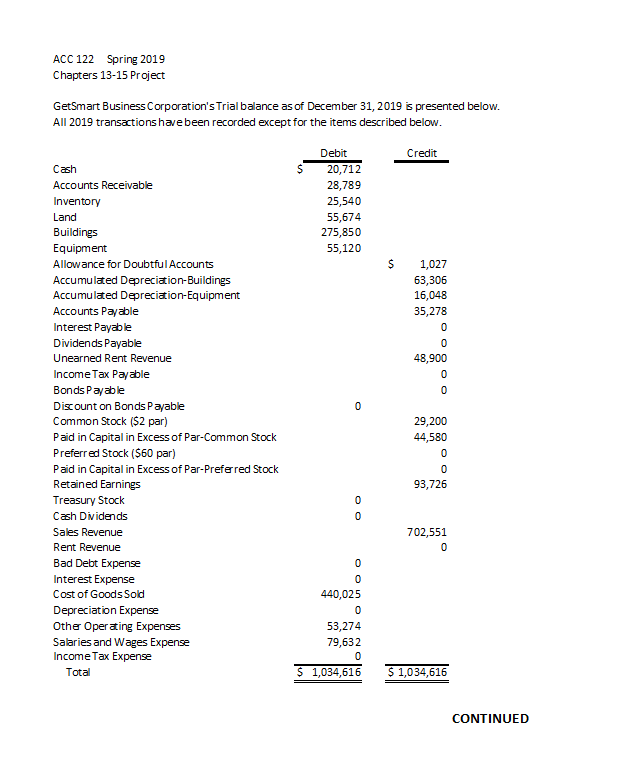

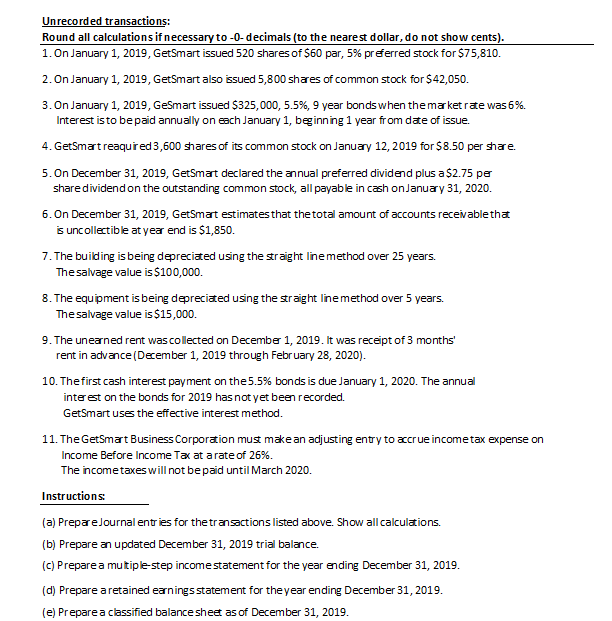

ACC 122 Spring 2019 Chapters 13-15 Project GetSmart Business Corporation's Trial balance as of December 31, 2019 is presented below. All 2019 transactions havebeen recorded exceptfor the items described below Debit Credit $ 20,712 28,789 25,540 55,674 275,850 55,120 Cash Accounts Receivable Inventory Buildings Equipment Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue IncomeTax Payable Bonds Payable Discount on Bonds Payable Common Stock ($2 par) Paid in Capital in Excess of Par-Common Stock Preferred Stock (560 par) Paid in Capital in Excess of Par-Prefered Stock Retained Earnings Treasury Stock Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses Saaries and Wages Expense Income Tax Expense 1,027 63,306 16,048 35,278 48,900 29,200 44,580 93,726 702,551 440,025 53,274 79,632 S 1,034,616 1,034,616 Total CONTINUED nrecorded transactions: Round all calculations if ne 1. On January 1, 2019, GetSmart issued 520 shares of S60 par, 5% preferred stock for $75,810. to -0-decimals (to the nearest dollar, do not show cents) 2.On January 1, 2019, GetSmart also issued 5,800 shares of common stock for $42,050. 3. On January 1, 2019, GeSm art issued $325,000, 5.5%, 9 year bonds when the m a ketre was 6%. Interest isto bepaid annually on each January 1, beginning 1 year from date of issue. 4. GetSmartreaqured3,600 shares of its common stock on January 12, 2019 for $8.50 per share. 5.On December 31, 2019, GetSmart declared the annual preferred dividend plus a$2.75 pe share dividendon the outstanding common stock, all payable in cash onJanuary 31, 2020. 6.On December 31, 2019, GetSmat estimates that thetotal amount of accounts recevablethat s uncollectible at year end is $1,850. 7. The building is being depreciated using the straight linemethod over 25 years. The salvage value is $100,000. 8. The equipment is being depreciated using the straight lnemethod over 5 years. The salvage value is $15,000. 9. The unearned rent wascolected on December 1, 2019. It was receipt of 3 months' rent in advance (December 1, 2019 through February 28, 2020) 10. The first cash interest payment on the 5.5% bonds is due January 1, 2020. The annual interest on the bonds for 2019 hasnot yet been recorded. GetSmart uses the effective interest method. 11. TheGetSmart Business Corporation must make an adjusting entry to accrue income tax expense on Income Before Income Tax at a rate of 26%. The income taxeswill not bepaid until March 2020. Instructions: (a) PrepareJournal enties for thetransactions listed above. Show all calculations. (b) Prepare an updated December 31, 2019 trial balance. (c) Preparea mutiple-step incomestatement for the year ending December 31, 2019 (d) Prepare aretained earnings statement for theyear ending December 31, 2019 (e) Prepare a classified balancesheet as of December 31, 2019 ACC 122 Spring 2019 Chapters 13-15 Project GetSmart Business Corporation's Trial balance as of December 31, 2019 is presented below. All 2019 transactions havebeen recorded exceptfor the items described below Debit Credit $ 20,712 28,789 25,540 55,674 275,850 55,120 Cash Accounts Receivable Inventory Buildings Equipment Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue IncomeTax Payable Bonds Payable Discount on Bonds Payable Common Stock ($2 par) Paid in Capital in Excess of Par-Common Stock Preferred Stock (560 par) Paid in Capital in Excess of Par-Prefered Stock Retained Earnings Treasury Stock Cash Dividends Sales Revenue Rent Revenue Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses Saaries and Wages Expense Income Tax Expense 1,027 63,306 16,048 35,278 48,900 29,200 44,580 93,726 702,551 440,025 53,274 79,632 S 1,034,616 1,034,616 Total CONTINUED nrecorded transactions: Round all calculations if ne 1. On January 1, 2019, GetSmart issued 520 shares of S60 par, 5% preferred stock for $75,810. to -0-decimals (to the nearest dollar, do not show cents) 2.On January 1, 2019, GetSmart also issued 5,800 shares of common stock for $42,050. 3. On January 1, 2019, GeSm art issued $325,000, 5.5%, 9 year bonds when the m a ketre was 6%. Interest isto bepaid annually on each January 1, beginning 1 year from date of issue. 4. GetSmartreaqured3,600 shares of its common stock on January 12, 2019 for $8.50 per share. 5.On December 31, 2019, GetSmart declared the annual preferred dividend plus a$2.75 pe share dividendon the outstanding common stock, all payable in cash onJanuary 31, 2020. 6.On December 31, 2019, GetSmat estimates that thetotal amount of accounts recevablethat s uncollectible at year end is $1,850. 7. The building is being depreciated using the straight linemethod over 25 years. The salvage value is $100,000. 8. The equipment is being depreciated using the straight lnemethod over 5 years. The salvage value is $15,000. 9. The unearned rent wascolected on December 1, 2019. It was receipt of 3 months' rent in advance (December 1, 2019 through February 28, 2020) 10. The first cash interest payment on the 5.5% bonds is due January 1, 2020. The annual interest on the bonds for 2019 hasnot yet been recorded. GetSmart uses the effective interest method. 11. TheGetSmart Business Corporation must make an adjusting entry to accrue income tax expense on Income Before Income Tax at a rate of 26%. The income taxeswill not bepaid until March 2020. Instructions: (a) PrepareJournal enties for thetransactions listed above. Show all calculations. (b) Prepare an updated December 31, 2019 trial balance. (c) Preparea mutiple-step incomestatement for the year ending December 31, 2019 (d) Prepare aretained earnings statement for theyear ending December 31, 2019 (e) Prepare a classified balancesheet as of December 31, 2019