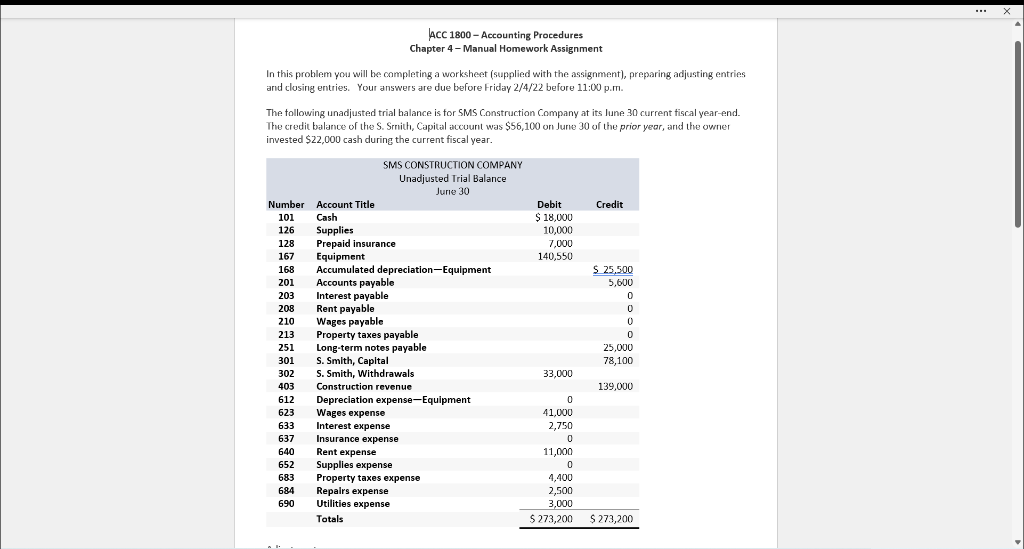

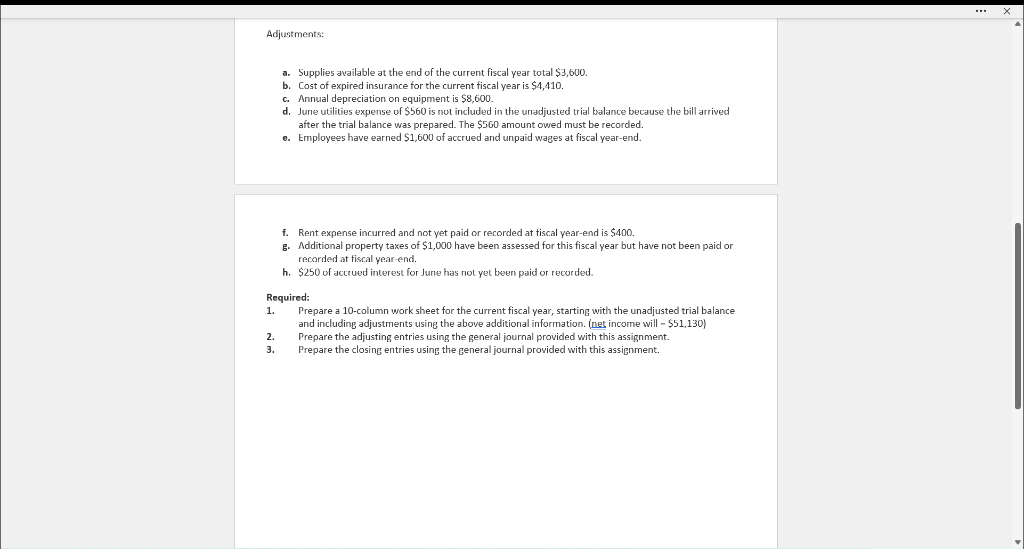

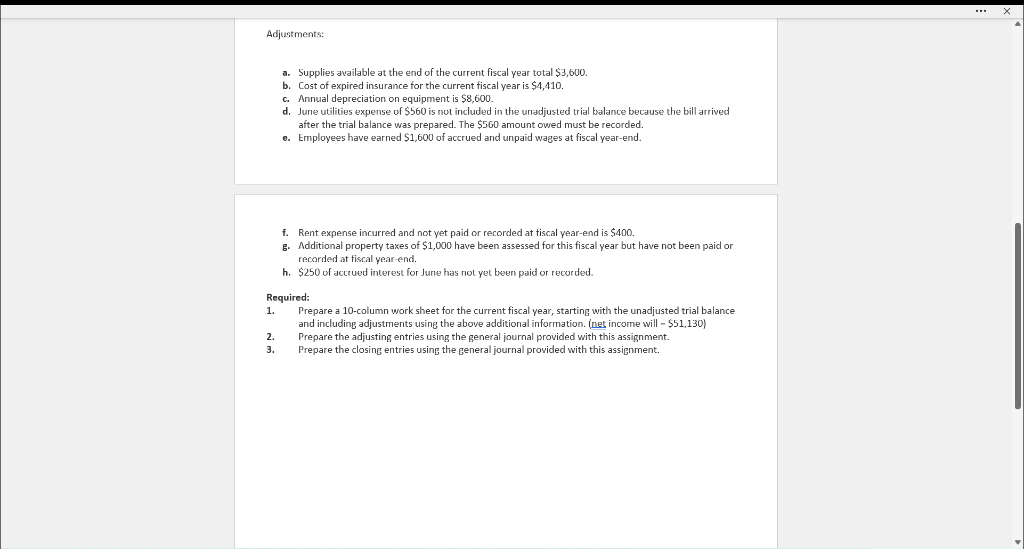

ACC 1800 - Accounting Procedures Chapter 4 - Manual Homework Assignment In this problem you will be completing a worksheet (supplied with the assignment), preparing adjusting entries and closing entries. Your answers are due before Friday 2/4/22 before 11:00p.m. The following unadjusted trial balance is for SMS Construction Company at its lune 30 current fiscal year-end. The credit balance of the S. Srnith, Capital account was $56,100 on June 30 of the prior year, and the owner invested $22,000 cash during the current fiscal year. Credit Debit $ 18,000 10,000 7,000 140,550 SMS CONSTRUCTION COMPANY Unadjusted Trial Balance June 30 Number Account Title 101 Cash 126 Supplies 128 Prepaid insurance Equipment Accumulated depreciation-Equipment Accounts payable Interest payable Rent payable Wages payable Property taxes payable Long-term notes payable S. Smith, Capital S. Smith, Withdrawals Construction revenue Depreciation expense-Equipment Wages expense Interest expense Insurance expense Rent expense Supplies expense Property taxes expense Repairs expense Utilities expense Totals $ 25,500 5.600 0 0 0 0 25,000 78,100 33,000 09001980209820092018 139,000 0 41,000 2,750 0 11,000 0 4,400 2,500 3,000 $ 273,200 $ 273,200 Adjustments: a. Supplies available at the end of the current fiscal year total $3,600. b. Cost of expired insurance for the current fiscal year is $4,410. c. Annual depreciation on equipment is $8,600. d. June utilities expense of $560 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $560 amount owed must be recorded. e. Employees have earned $1,600 of accrued and unpaid wages at fiscal year-end. f. Rent expense incurred and not yet paid or recorded at fiscal year-end is $400. 8. Additional property taxes of $1,000 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end. h. $250 of accrued interest for Jure has not yet been paid or recorded. Required: 1. Prepare a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the above additional information. (net income will - $51,130) 2. Prepare the adjusting entries using the general journal provided with this assignment. Prepare the closing entries using the general journal provided with this assignment 3