Answered step by step

Verified Expert Solution

Question

1 Approved Answer

acc 1800- accounting procedures Name ACC 1800- Accounting Procedures Winter 2018-Comprehensive Problem in Highland Canoe Company is a service-based business that rents canoes for use

acc 1800- accounting procedures

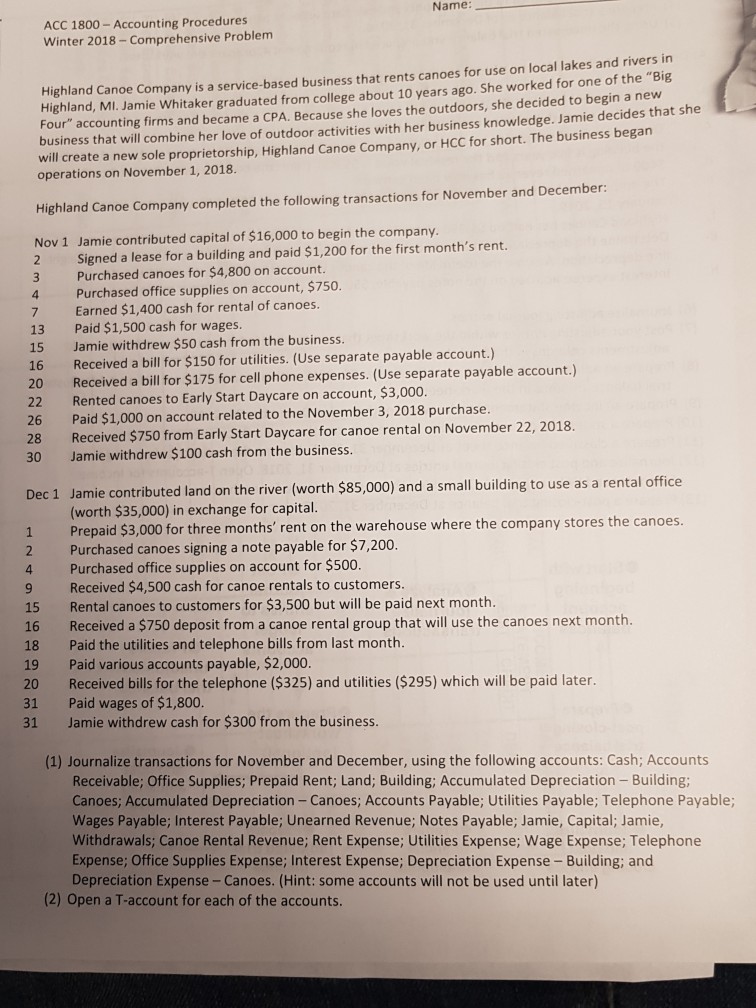

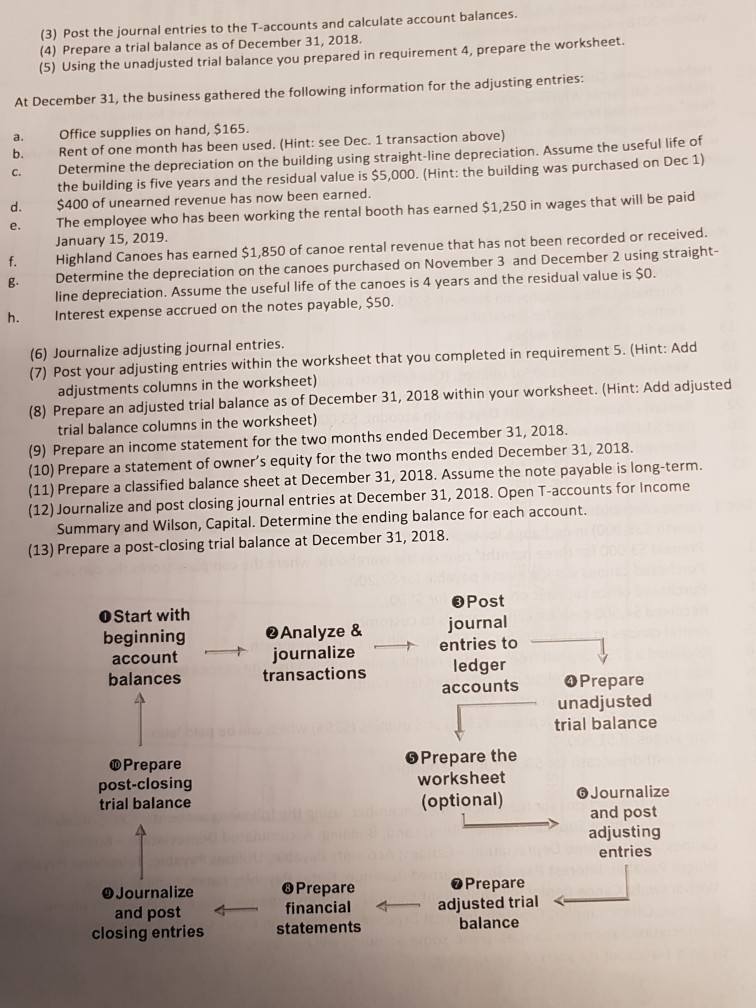

Name ACC 1800- Accounting Procedures Winter 2018-Comprehensive Problem in Highland Canoe Company is a service-based business that rents canoes for use on local lakes and rivers Highland, MI. Jamie Whitaker graduated from college about 10 years ago. She worked for one of the "Big Four" accounting firms and became a CPA. Because she loves the outdoors, she decided to begin a new business that will combine her love of outdoor activities with her business knowledge. Jamie decides that she will create a new sole proprietorship, Highland Canoe Company, or HCC for short. The business began operations on November 1, 2018 Highland Canoe Company completed the following transactions for November and December: Nov 1 Jamie contributed capital of $16,000 to begin the company. Signed a lease for a building and paid $1,200 for the first month's rent Purchased canoes for $4,800 on account Purchased office supplies on account, $750 Earned $1,400 cash for rental of canoes. Paid $1,500 cash for wages. Jamie withdrew $50 cash from the business Received a bill for $150 for utilities. (Use separate payable account.) Received a bill for $175 for cell phone expenses. (Use separate payable account.) Rented canoes to Early Start Daycare on account, $3,000 Paid $1,000 on account related to the November 3, 2018 purchase Received $750 from Early Start Daycare for canoe rental on November 22, 2018 Jamie withdrew $100 cash from the business 2 3 4 7 13 15 16 20 22 26 28 30 Dec 1 Jamie contributed land on the river (worth $85,000) and a small bu uilding to use as a rental office 1 2 4 9 15 16 18 19 20 31 31 (worth $35,000) in exchange for capital Prepaid $3,000 for three months' rent on the warehouse where the company stores the canoes Purchased canoes signing a note payable for $7,200 Purchased office supplies on account for $500 Received $4,500 cash for canoe rentals to customers Rental canoes to customers for $3,500 but will be paid next month Received a $750 deposit from a canoe rental group that will use the canoes next month Paid the utilities and telephone bills from last month Paid various accounts payable, $2,000 Received bills for the telephone ($325) and utilities ($295) which will be paid later Paid wages of $1,800 Jamie withdrew cash for $300 from the business. (1) Journalize transactions for November and December, using the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Rent; Land; Building; Accumulated Depreciation - Building; Canoes; Accumulated Depreciation - Canoes; Accounts Payable; Utilities Payable; Telephone Payable; Wages Payable; Interest Payable; Unearned Revenue; Notes Payable; Jamie, Capital; Jamie thdrawals; Canoe Rental Revenue; Rent Expense; Utilities Expense; Wage Expense; Telephone Expense; Office Supplies Expense; Interest Expense; Depreciation Expense - Building; and Depreciation Expense- Canoes. (Hint: some accounts will not be used until later) (2) Open a T-account for each of the accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started