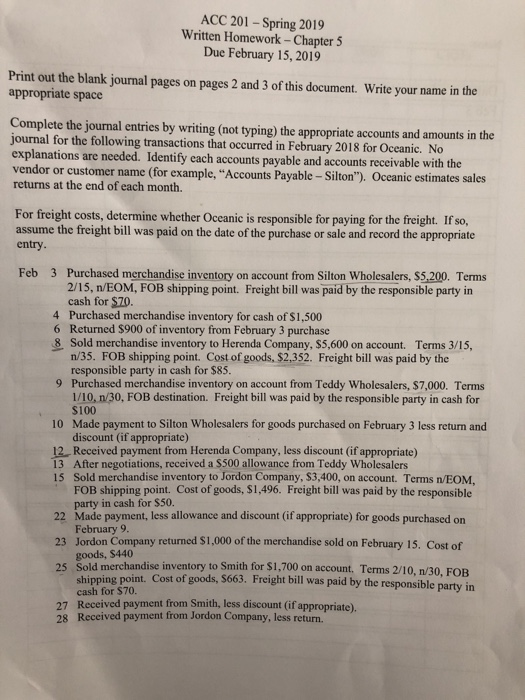

ACC 201 - Spring 2019 Written Homework - Chapter 5 Due February 15, 2019 Print out the blank journal pages on pages 2 and 3 of this document. Write your name in the appropriate space Complete the journal entries by writing (not typing) the appropriate accounts and amounts in the journal for the following transactions that occurred in February 2018 for Oceanic. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name (for example, "Accounts Payable - Silton"). Oceanic estimates sales returns at the end of each month. For freight costs, determine whether Oceanic is responsible for paying for the freight. If so, assume the freight bill was paid on the date of the purchase or sale and record the appropriate entry Feb 3 Purchased merchandise inventory on account from Silton Wholesalers, $5,200. Terms 2/15, n/EOM, FOB shipping point. Freight bill was paid by the responsible party in cash for $70. 4 Purchased merchandise inventory for cash of $1,500 6 Returned $900 of inventory from February 3 purchase 8 Sold merchandise inventory to Herenda Company. S5,600 on account. Terms 315, n/35. FOB shipping point. Cost of goods, $2,352. Freight bill was paid by the responsible party in cash for $85. Purchased merchandise inventory on account from Teddy Wholesalers, $7,000. Terms 1/10,n30, FOB destination. $100 Made payment to Silton Wholesalers for goods purchased on February 3 less return and discount (if appropriate) 9 Freight bill was paid by the responsible party in cash for 10 12 Received payment from Herenda Company, less discount (if appropriate) 13 After negotiations, received a S500 allowance from Teddy Wholesalers 15 Sold merchandise inventory to Jordon Company, S3,400, on account. Terms n/EOM, FOB shipping point. party in cash for $50 Made payment, less allowance and discount (if appropriate) for goods purchased on February 9 Cost of goods, $1,496. Freight bill was paid by the responsible 22 23 Jordon Company returned S1,000 of the merchandise sold on February 15. Cost of 25 Sold merchandise inventory to Smith for S1,700 on account. Terms 2/10, n/30, FOB 27 Received payment from Smith, less discount (if appropriate). goods, $440 shipping point. Cost of goods, 5663. cash for $70. Freight bill was paid by the responsible party in 28 Received payment from Jordon Company, less return. ACC 201 - Spring 2019 Written Homework - Chapter 5 Due February 15, 2019 Print out the blank journal pages on pages 2 and 3 of this document. Write your name in the appropriate space Complete the journal entries by writing (not typing) the appropriate accounts and amounts in the journal for the following transactions that occurred in February 2018 for Oceanic. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name (for example, "Accounts Payable - Silton"). Oceanic estimates sales returns at the end of each month. For freight costs, determine whether Oceanic is responsible for paying for the freight. If so, assume the freight bill was paid on the date of the purchase or sale and record the appropriate entry Feb 3 Purchased merchandise inventory on account from Silton Wholesalers, $5,200. Terms 2/15, n/EOM, FOB shipping point. Freight bill was paid by the responsible party in cash for $70. 4 Purchased merchandise inventory for cash of $1,500 6 Returned $900 of inventory from February 3 purchase 8 Sold merchandise inventory to Herenda Company. S5,600 on account. Terms 315, n/35. FOB shipping point. Cost of goods, $2,352. Freight bill was paid by the responsible party in cash for $85. Purchased merchandise inventory on account from Teddy Wholesalers, $7,000. Terms 1/10,n30, FOB destination. $100 Made payment to Silton Wholesalers for goods purchased on February 3 less return and discount (if appropriate) 9 Freight bill was paid by the responsible party in cash for 10 12 Received payment from Herenda Company, less discount (if appropriate) 13 After negotiations, received a S500 allowance from Teddy Wholesalers 15 Sold merchandise inventory to Jordon Company, S3,400, on account. Terms n/EOM, FOB shipping point. party in cash for $50 Made payment, less allowance and discount (if appropriate) for goods purchased on February 9 Cost of goods, $1,496. Freight bill was paid by the responsible 22 23 Jordon Company returned S1,000 of the merchandise sold on February 15. Cost of 25 Sold merchandise inventory to Smith for S1,700 on account. Terms 2/10, n/30, FOB 27 Received payment from Smith, less discount (if appropriate). goods, $440 shipping point. Cost of goods, 5663. cash for $70. Freight bill was paid by the responsible party in 28 Received payment from Jordon Company, less return