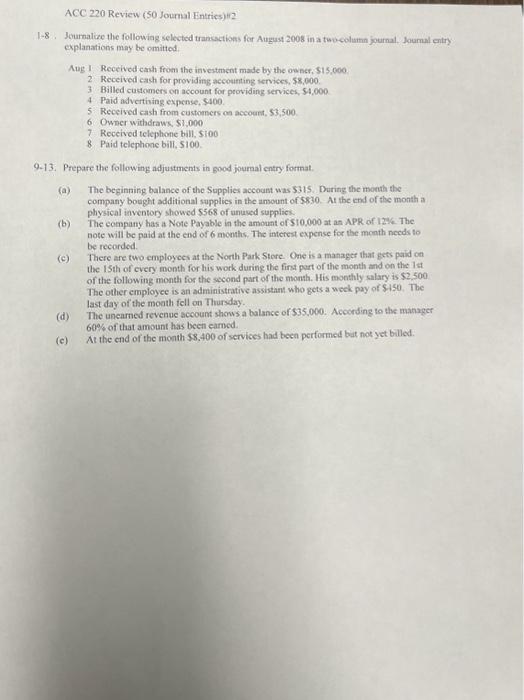

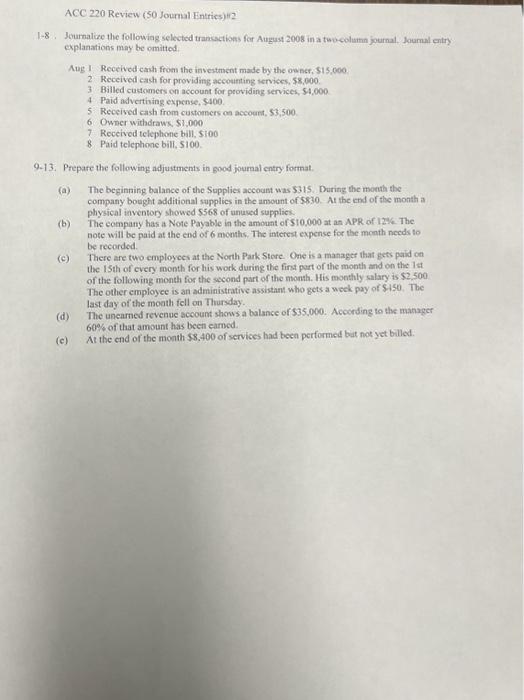

ACC 220 Review (50 Journal Entries)#2 1-8. Journalize the following selected transactions for August 2008 in a two-column journal. Journal entry explanations may be omitted. Aug 1 2 9-13. Prepare the following adjustments in good journal entry format. (a) (b) Received cash from the investment made by the owner, $15,000. Received cash for providing accounting services, $8,000. 3 Billed customers on account for providing services, $4,000. 4 Paid advertising expense, $400. 5 Received cash from customers on account, $3,500. 6 Owner withdraws, $1,000 7 Received telephone bill, $100 8 Paid telephone bill, $100. (c) (d) (e) The beginning balance of the Supplies account was $315. During the month the company bought additional supplies in the amount of $830. At the end of the month a physical inventory showed $568 of unused supplies. The company has a Note Payable in the amount of $10,000 at an APR of 12%. The note will be paid at the end of 6 months. The interest expense for the month needs to be recorded. There are two employees at the North Park Store. One is a manager that gets paid on the 15th of every month for his work during the first part of the month and on the 1st of the following month for the second part of the month. His monthly salary is $2,500. The other employee is an administrative assistant who gets a week pay of $450. The last day of the month fell on Thursday. The unearned revenue account shows a balance of $35,000. According to the manager 60% of that amount has been earned. At the end of the month $8,400 of services had been performed but not yet billed.

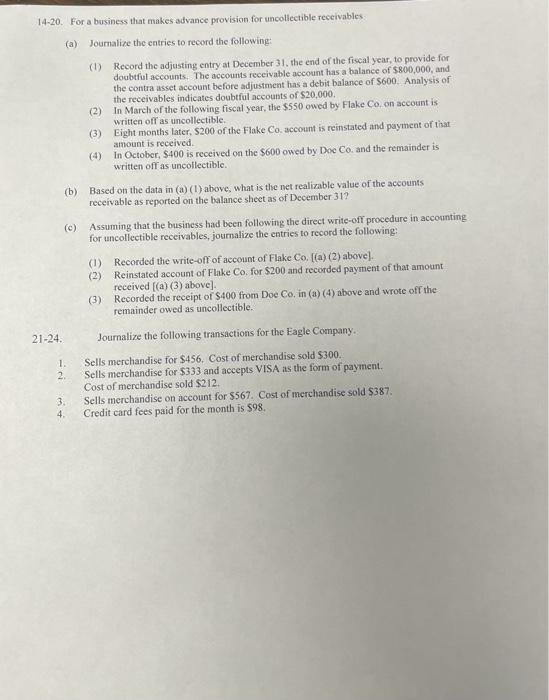

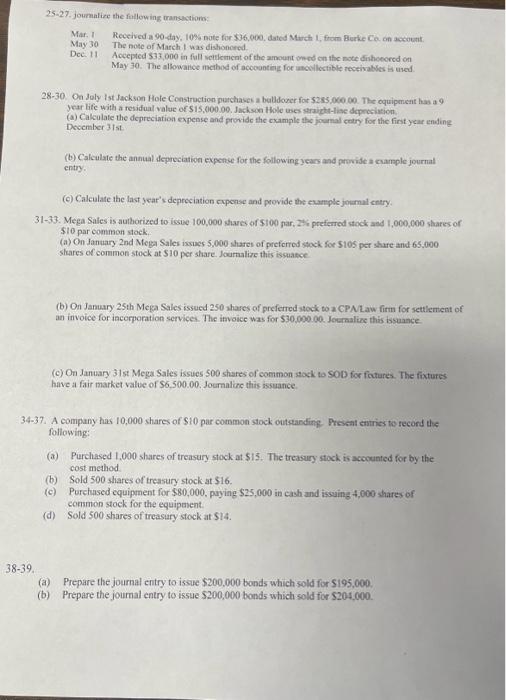

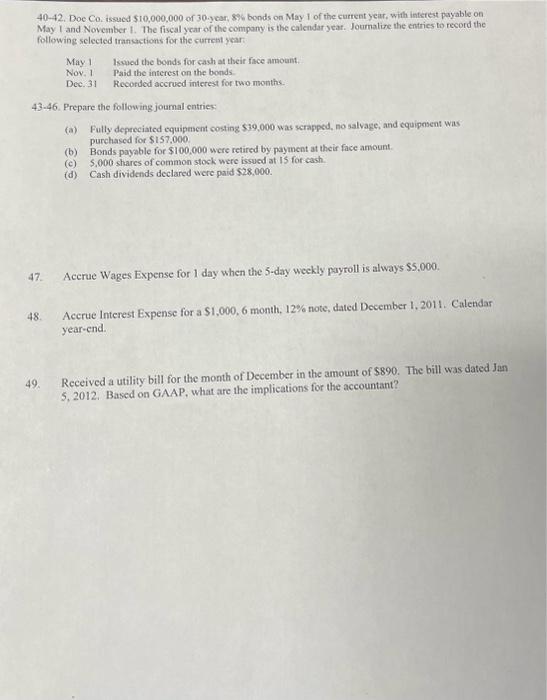

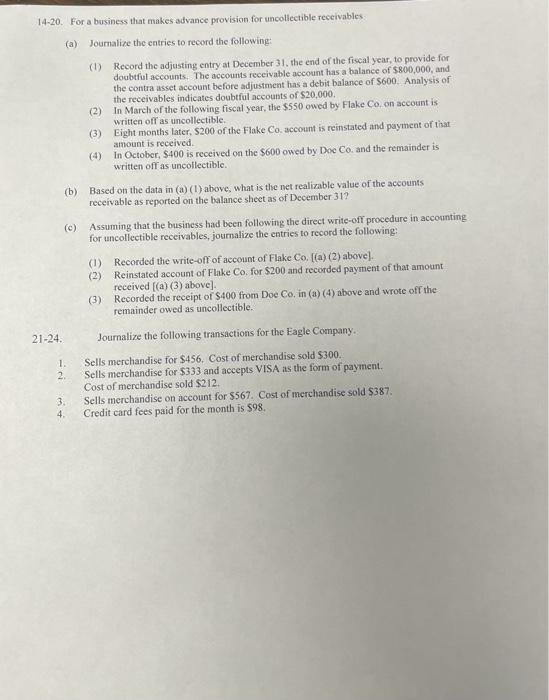

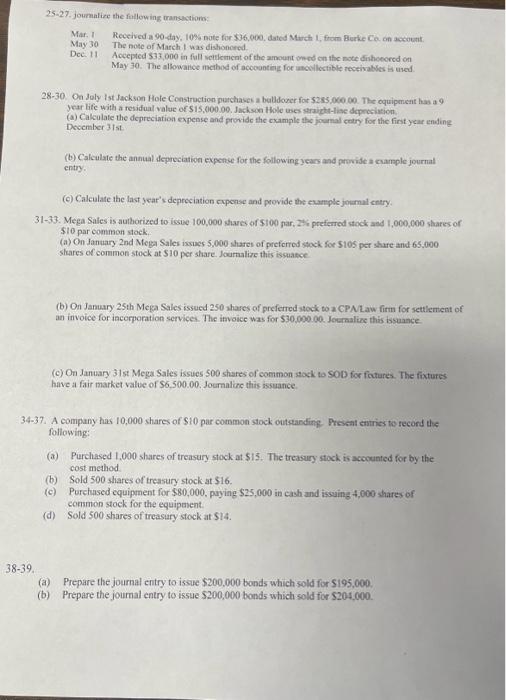

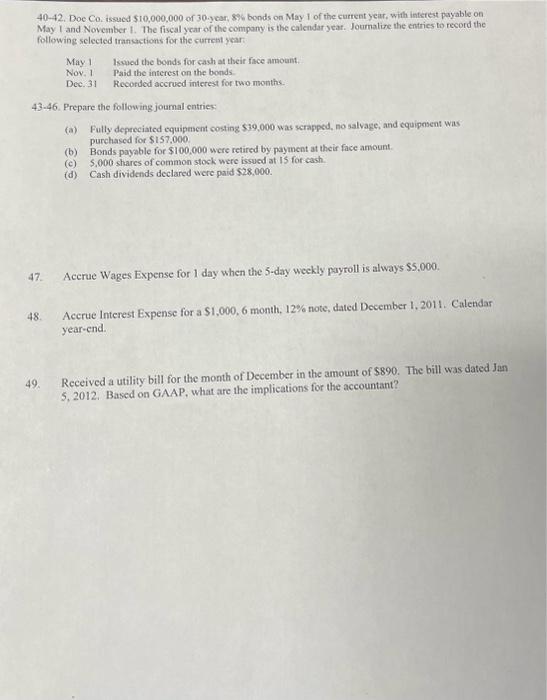

1-8. Journalice the followiag selected transactions for August 2008 in a two column journal, Joumal entry explanations may be omitted. Aug I Received cash from the investment made by the owner, $15,000. 2 Received cash for providing accourting iervices, 58,000 . 3 Billed castcomers on account for peoviding services, 54,000 4 Paid advertioing expense, $400. 5 Received cash from customers on accourt, 53,500 6 Owner withdraws, $1,000 7 Received telephone bill, 5700 8 Paid telephone bill, 5100. 9.13. Prepare the following adjustments in pood joumal entry format. (a) The beginaing balance of the Supplies account was 5315 . During the month the company bought additional supplics in the umount of 5830 . At the end of the month a physical inventory showed 5568 of unued supplies. (b) The company has a Note Payable in the amount of 510.000 at an APR of 12%. The note will be paid at the end of 6 months. The interest expense for the month necds to be recorded. (c) There are two employees at the North Park Stere. One is a manager that gets paid cen the ISth of every month for his work during the fint port of the month and on the lat of the following month for the second part of the month. His monthly salary is $2,500 The other employee is an administrative assistant who gets a week pay of $150. The last day of the moath fell on Thursday. (d) The uncarned revenue account shows a balance of $35,000. According to the manager 60% of that amount has been earnod. (c) At the end of the month 58,400 of services had been performed bat not yet billed: 14-20. For a business that makes advance provision for uncollectible receivables (a) Joumalize the entries to record the following: (1) Record the adjusting entry at December 31. the end of the fiscal year, to provide for doubtful accounts. The accounts receivable account has a balance of $800,000, and the contra asset account before adjustment has a debit balance of $600. Analysis of the receivables indicates doubtful accounts of $20,000. (2) In March of the following fiscal year, the $550 owed by Flake C0, on account is written off as uncollectible. (3) Eight months later, $200 of the Flake Co. account is reinstated and payment of that amount is received. (4) In October, $400 is received on the $600 owed by Doc CO and the remainder is written off as uncollectible. (b) Based on the data in (a) (1) above, what is the net realizable value of the accounts receivable as reported on the balance sheet as of December 31 ? (c) Assuming that the business bad been following the direct write-off procedure in accounting for uncollectible receivables, journalize the entries to record the following: (1) Recorded the write-off of account of Flake Co. [(a) (2) above] (2) Reinstated account of Flake Co. for $200 and recorded payment of that amount received [(a) (3) above]. (3) Recorded the receipt of $400 from Doe Co, in (a) (4) above and wrote off the remainder owed as uncollectible. 21-24. Journalize the following transactions for the Eagle Company. 1. Sells merchandise for $456. Cost of merchandise sold $300. 2. Sells merchandise for $333 and accepts VISA ats the form of payment. Cost of merchandise sold $212. 3. Sells merchandise on account for \$567. Cost of merchandise sold $387. 4. Credit card fees paid for the month is $98. 2527, joumalier the finllowing transuctions: Mar, 1 Received a 90-day, 109 sote for $36,000, dated Murch 1 , from Burke Ca on accoutit. May 30 The note of March I was dishonored. Dec. 11 Accepted 533,000 in full weitiement of the amount oned en the note disheecerd on 28-30. On Joly ist Jackson Hole Construction purchases a buldower for $285,060.00. The oquipment has a 9 year bife with a residual value of $15,000,00. Jackson Hole uses straight-lise depresiation. (a) Cakulate the depreciatioa expense and provide the coample the journal cetry for the first year ending December 31 st. (b) Calculate the annual depreciation expense for the following years and provise a cuample journal entry. (c) Calculate the last year's depreciation cupense and peovide the erample joumal entry. 31-33. Mega Sales is authorized to issive 100,000 shares of $100 par, 2% preferred stock and 1,000,000 shares of $10 par common stock. (a) On Jantary 2nd Mega Sales issues 5,000 shares of preferred stock foe 5105 per share and 65.000 shares of conmon stock at $10 per share. Joumalize this issuatce. (b) On January 25th Mega Sales issued 250 ahares of preferred stock to a CPN Law firm for settlement of an invoice for incorporation services. The invoice was for $30,000,00. Jecrnalize this issuance. (c) On January 31 st Mega Sales issues $00 shares of common sock to 500 for fotures. The fixtures have a fair market value of $6,500.00. Joumalize this ssuance. 34-37. A company has 10,000 shares of $10 par common stock outstanding. Present entrics to fecord the following: (a) Purchased 1,000 shares of treasury stock at \$15. The treasury stock is accounted for by the cost method. (b) Sold 500 shiares of treasury stock at $16. (c) Purchused equipment for $80,000, paying $25,000 in cash and issuing 4,000 shares of cormon stock for the equipanent. (d) Sold 500 shares of treasury stock at $14. 3839. (a) Prepare the journal entry to issue $200,000 bonds which sold for $195,000. (b) Prepare the joumal entry to issue $200,000 bonds which sold for $204,000. 40-42. Doe Co. issued $10,000,000 of 30-year, 8%6 bonds on May 1 of the current year, with interest payable on May 1 and November I. The fiscal year of the company is the calendar year. Joumalize the entries to record the following selected irancactions for the current year: May 1 Issued the bonds for cash at their face amount. Nov, 1 Paid the interest on the bonds. Dec.31 Recorded accrued interest for two months. 43-46. Prepare the following joumal entries: (a) Fully depreciated equipenent costing $39,000 was scrapped, no salvage, and equiponent was purchased for $157,000 (b) Bonds payable for $100,000 were retired by payment at their face amount (c) 5,000 shares of common stock were issued at is for cash. (d) Cash dividends declared were paid $28,000. 47. Accrue Wages Expense for 1 day when the 5 -day weckly payroll is always $5,000. 48. Accrue Interest Expense for a $1,000,6 month, 12\% note, dated December 1, 2011. Calendar year-end. 49. Received a utility bill for the month of December in the amount of $890. The bill was dated Jan 5, 2012. Based on GAAP, what are the implications for the accountant